CFO Interview

Amid the uncertain business environment, we will continue to further enhance the quality of management and ensure the replicability of highly effective management by firmly maintaining our financial and capital strategies to balance three factors.

Member of the Board, Executive Vice President, CFO

Tsuyoshi Hachimura

Q1. What is your overall assessment of the financial and capital strategies in FYE 2022?

A1. We accelerated the expansion of our financial and capital foundations, which will underpin our growth strategies going forward.

Every year, when I write this message, I get the urge to sit up even straighter, in part because this is where I am called to report the results of the commitments I made, whether it was in the previous year’s annual report or during dialogue with market participants. This year, though, I feel a sense of relief because we steadfastly achieved our commitments. In FYE 2022, the economy was expected to recover from the COVID-19 pandemic, and a somewhat optimistic mood began circulating in the market. However, we did not actually find a way out of the prolonged pandemic, and, by the end of the fiscal year, geopolitical risks shot to the fore following the Russian invasion of Ukraine. Due mainly to these factors, the fiscal year ended with persistent uncertainty for the future. During the year, we were called on to take more timely and appropriate action on offense and defense while monitoring trends in COVID-19 case numbers and commodity prices. Amid that kind of business environment, I would first like to highlight that I worked hard on consistent financial and capital strategies as the CFO and that we were able to accelerate the expansion of our financial and capital foundations, which will underpin our growth strategies going forward.

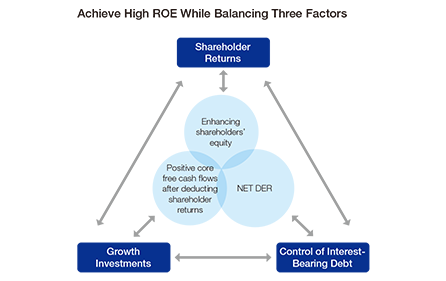

Since becoming CFO in FYE 2016, I have committed to the “Policy to achieve high ROE while balancing three factors (shareholder returns, growth investments, and control of interest-bearing debt)” and continued implementing strategic balance sheet management.

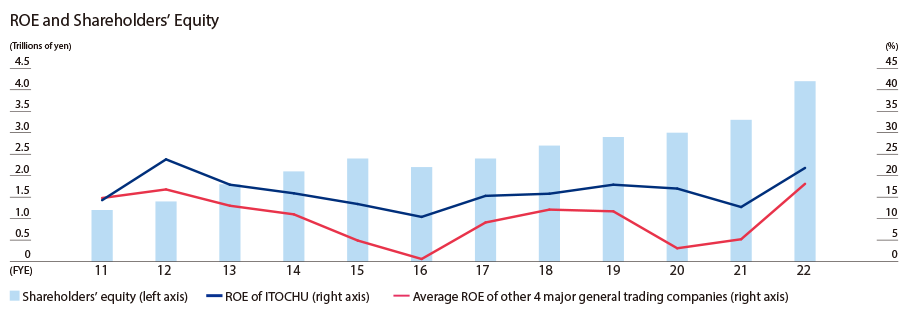

Over the last seven years, shareholders’ equity, which is an important indicator of the Company’s resilience to risk, increased by ¥1.8 trillion to ¥4.2 trillion, and the ratio of shareholders’ equity to total assets improved by 6.1 points to 34.6% as of March 31, 2022, with both recording historical highs.

In addition, regarding growth investments, we are working to carefully select projects in regions and fields where we have expertise while being careful to avoid accumulating goodwill that accompanies overly high-priced acquisitions. We promote proactive asset replacement for low-efficiency assets or those that have peaked out. We have managed large-scale investments within the scope of cash flow generated each fiscal year or the span of the each medium-term management plan. Through this kind of control, over the past seven years, total assets have increased by ¥3.6 trillion to ¥12.2 trillion, but net interest-bearing debt has held steady at ¥2.3 trillion (down ¥0.1 trillion). We also set our best record for net debt-to-shareholders’ equity ratio (NET DER) with 0.54 times (an improvement of 0.43 points). Taken together with the aforementioned shareholders’ equity and the ratio of shareholders’ equity to total assets, ITOCHU’s financial soundness and stability have drastically improved in a very visible way.

Moreover, from the perspective of cash-generating power, over the past seven years, core operating cash flows more than doubled to approximately ¥790.0 billion (up approximately ¥404.0 billion). We steadily disposed of assets with concerns, while conducting asset replacement, both in the non-resource sector and the resource sector. Our ardent efforts to improve asset quality have borne fruit.

Lastly, regarding ROE, since I first stepped into the CFO role, ITOCHU has outlined a policy of maintaining an ROE level of 13% or more over the medium- to long-term. This level is in line with a global standard and also significantly exceeds ITOCHU’s cost of capital of 8%. ROE in FYE 2022 soared to 21.8%, which could be construed as too good, but my overall evaluation is that we have a track record of generally achieving a level exceeding our policy. (→ Business Results for FYE 2022)![]()

Q2. What led you to the decision on the New Dividend Policy announced in FYE 2022?

A2. The decision was made by incorporating opinions from the market into the Company’s strong will on management.

As previously mentioned, the Company is steadily enhancing its cash-generating power. We are always conscious of growth investments moving forward and the level of shareholders’ equity as a risk buffer that enables those investments. At the same time, we are striving to expand shareholder returns.

As previously mentioned, the Company is steadily enhancing its cash-generating power. We are always conscious of growth investments moving forward and the level of shareholders’ equity as a risk buffer that enables those investments. At the same time, we are striving to expand shareholder returns.

Under the medium-term management plan “Brand-new Deal 2023,” which was released in May 2021, we announced a policy with a minimum dividend per share (DPS) of ¥94 in FYE 2022 and an aim to reach ¥100 with a progressive dividend policy every fiscal year during the plan. We had announced a share buyback up to ¥70.0 billion, but only executed ¥13.5 billion of them before announcing a reset in June 2021, which created a significant gap between the Company’s shareholder returns policy and market expectations. While, with these announcements, we also laid out our policy to actively and continuously execute share buybacks and dividend increases if and when there is an upward revision to our consolidated net profit plan, which had initially been set conservatively during the pandemic, it is true that this was a policy that was somewhat hard to understand and lacking in strength, looking at it from ITOCHU’s defining and distinctive commitment-based management perspective.

Through dialogue with investors and shareholders, we thoroughly considered market expectations and carefully analyzed the consolidated net profit target during the medium-term management plan. Afterward, we swiftly re-announced a “new dividend policy” for the plan at the end of the second quarter of FYE 2022.

Rather than a dividend payout ratio that causes a decrease in dividends if profit declines, we have prioritized, with a strong emphasis, a progressive dividend wherein actual dividend amounts are guaranteed to increase from the previous fiscal year. We have maintained this focus since FYE 2016. On the other hand, we have heard opinions from the market that if we do not present a dividend payout ratio, which serves as a reference point, it would be difficult for investors to make decisions from a fund / portfolio management standpoint, so the Company presented a new dividend policy which aims to fulfill both: a progressive dividend and enhancement of the dividend payout ratio.

Specifically, we will maintain our progressive dividend policy, setting minimum DPS at ¥110 for FYE 2022, ¥120 for FYE 2023, and ¥130 for FYE 2024, the last year of the plan. We also commit to achieving a dividend payout ratio of 30% by FYE 2024.

The reason DPS in FYE 2024 will be higher than FYE 2023 is not solely because of the progressive dividend. Even if persistently high resource prices come back down, leading to a decline in profit in the resource sector, the Company will expand profit in the non-resource sector, which is ITOCHU’s strength. I want to emphasize that the Company is confident of achieving an increase in consolidated net profit.

We announced this at the end of the second quarter of FYE 2022 as a “new dividend policy,” but not as a “new shareholder returns policy,” because we had already assumed the possibility of a share buyback with a maximum limit of ¥60.0 billion, which we did announce a couple months later in January 2022. We never forgot our original promise, although the resumption of buybacks was taken as a positive surprise by market participants. After carefully assessing progress on growth investments in FYE 2022, we determined the timing to be right and successfully completed the share buyback totaling ¥60.0 billion during FYE 2022.

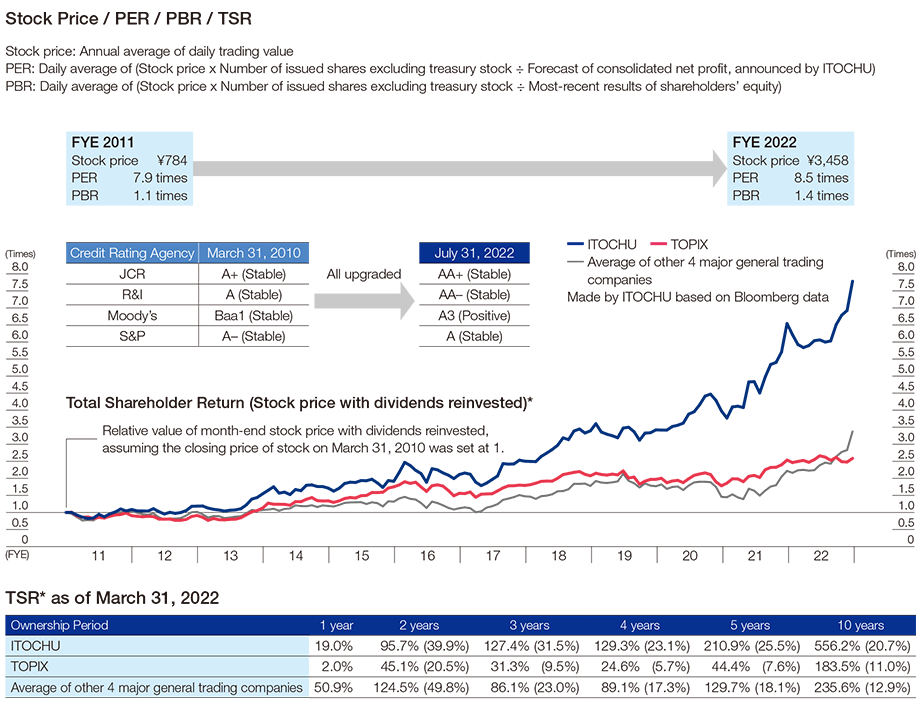

Since presenting this series of shareholder return measures, our share price in FYE 2022 reached record highs 19 times, garnering some acclaim from investors and shareholders.

When announcing the management plan for FYE 2023, the forecast for consolidated net profit increased from assumptions at the end of the second quarter of FYE 2022, and we, therefore, considered again expanding shareholder returns in FYE 2023. We took into consideration our total payout ratio in FYE 2022, commitments for FYE 2024, and other factors, in addition to discussions of whether dividend increases or share buybacks would be more appropriate. We ultimately announced an increase of our planned minimum DPS for FYE 2023 from ¥120 to ¥130, effectively pulling forward the DPS target originally planned for FYE 2024. At the same time, we also announced our plan to maintain the progressive dividend in FYE 2024. Regarding our shareholder returns policy from FYE 2023 onward, we will not change our stance of determining ideal shareholder returns based upon accumulating consolidated net profit, progress on growth investments, the market environment, etc., while remaining attentive to market feedback.(→ FYE 2023 Management Plan)![]()

Q3. As the CFO, based on the business environment, what do you need to pay attention to in FYE 2023?

A3. It is important to implement consistent financial and capital strategies of “Balancing Three Factors.”

There are countless points that need attention when you review the business environment in FYE 2023, but some examples include the chaos-inducing the Russia–Ukraine situation, repeated surges in COVID-19 cases, rising inflation, increasing interest rates (mainly in Europe and the United States), protracted yen depreciation, and volatile share prices. (→ PEST Analysis (Macroenvironmental Factors through 2030))

There are countless points that need attention when you review the business environment in FYE 2023, but some examples include the chaos-inducing the Russia–Ukraine situation, repeated surges in COVID-19 cases, rising inflation, increasing interest rates (mainly in Europe and the United States), protracted yen depreciation, and volatile share prices. (→ PEST Analysis (Macroenvironmental Factors through 2030))

After increasing with unusual rapidity, commodity prices are showing signs of moderation for now, but the price outlook remains unclear. As of this moment, it goes without saying that it is virtually impossible to forecast the business environment for the next few years with any accuracy. Thus, being overly biased toward any particular direction will be a risk. Therefore, amid this kind of volatility, it will be important in FYE 2023 to continue “balancing three factors,” while continuing financial and capital strategies that maintain highly efficient management (high ROE) and achieve sustainable growth in earnings per share (EPS).

The accomplishments of the Company’s financial and capital strategies are evident in assessment of credit rating agencies. Moody’s changed its outlook to positive in January 2022. In July, Japan Credit Rating Agency (JCR) announced an upgrade while Rating & Investment Information (R&I) is conducting a review based on the improvement in the Company’s underlying financial capabilities (as of July 31). The current trend of interest rate hikes to rein in inflation will ultimately result in a higher cost of funding. For corporate management, this is not necessarily a positive development, but we think that this will provide more stages to demonstrate the effectiveness of the preparations we have been making to improve ratings in consideration of the possibility of future interest rate hikes.

Upon the aforementioned preparations, our discussions for analysis of investment projects focus not only on profitability but also on various angles. This is why it is significant that the CFO has served as chair of the Investment Consultative Committee for five consecutive years. I intend to continue leading effective discussions while taking a bird’s-eye view, with an objective and conservative perspective of the business environment.

Lastly, regarding FYE 2023, I would like to “promise” that I will spearhead constructive dialogue and continue promoting proactive IR activities. I am not just listening to opinions from the market. Nor am I merely conveying the ideas of ITOCHU’s management. My mission is to hold dialogues that are fruitful for both the market and ITOCHU. By promoting IR activities that the market deems highly trustworthy, I will work to reduce the cost of capital and thereby help enhance corporate value sustainably. (→ A Positive Cycle of Dialogue and Corporate Value Enhancement)

* Total Shareholder Return (TSR): Return on investment assuming that dividends are reinvested. The chart above shows relative value of month-end stock price with dividends reinvested, assuming the closing price of stock on March 31, 2010 was set at 1. The table above indicates returns on investment during each period of holdings preceding from March 31, 2022. (Figures in brackets are rate of returns converted to the annual average by the geometric mean.)