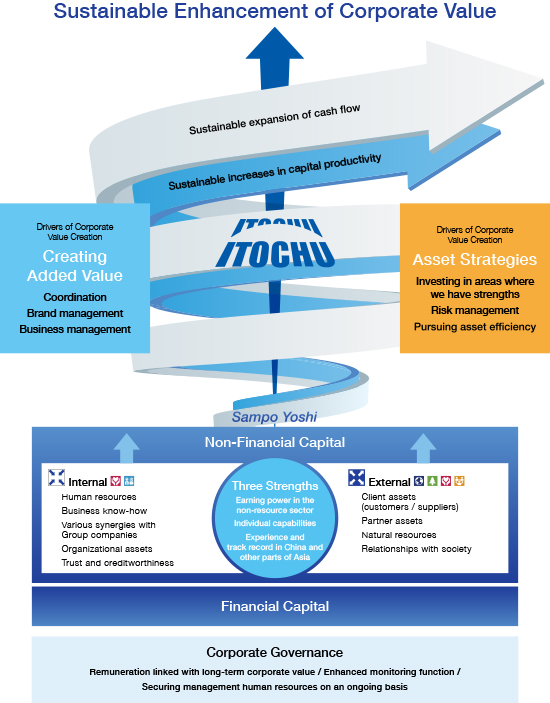

A Business Model for Achieving Sustainable Increases in Corporate Value

“Creating Added Value” and “Asset Strategies” Working in Tandem

Since the time of our founding, we have pursued “creating added value” that we alone were capable of providing. Honed through the ongoing transformations that took place in the 2000s, we developed a second driver of value creation: “asset strategies,” referring to making investments in areas of strength and pursuing asset efficiency. These two factors, working in tandem, constitute our business model.

Two Drivers of Corporate Value Creation

Coordination

Leveraging its client assets and partnerships with leading companies, ITOCHU works to cultivate sales channels and suppliers and takes steps to foster the creation of new businesses, such as large-scale project structuring.

Brand Management

Through integrated management, including of sales channels and product development, ITOCHU strives to increase brand value and take the initiative in business activities.

Business Management

By providing the various functions and management knowhow we have accumulated as a general trading company, we provide support to enhance the corporate value of operating companies.

Investing in Areas Where We Have Strengths

Our fundamental principle is to invest in areas where we have strengths, such as the non-resource sector, centered on consumer-related businesses, in China and Asia, and where Division Companies have strengths. On this basis, we are working to further reinforce our competitive edge.

Risk Management

ITOCHU is implementing comprehensive management of risk through risk assets, risk management on a project-by-project basis through evaluation of investments using a hurdle rate based on the cost of capital, and analysis and control of a wide range of risk factors that affect business.

Pursuing of Asset Efficiency

We exit from investments that are determined to be lowefficiency assets from such perspectives as scale of earnings, investment efficiency, and strategic significance. In this way, we are working to increase asset efficiency and to maximize free cash flow under strengthened cash flow management.

01. Sources of Sustainability

Cash Flow Stability(→CFO Interview)

ITOCHU’s steady cash flow stems from its earning power in the stable non-resource sector, an area of strength for the Company and where volatility is controlled. Going forward, we will continue working to create cash flow in a sustainable manner—a shareholder focus.

02. Sources of Sustainability

Three Unique Strengths(“Earning Power in the Non-Resource Sector,” “Individual Capabilities,” and “Experience and Track Record in China and Other Parts of Asia”)

We have unleashed the potential of these three unique strengths over the years since FYE 2012. These strengths are difficult to imitate, and thus a source of competitive advantage, and lead to the sustainable creation of corporate value.

03. Sources of Sustainability

Strong Non-Financial Capital

ITOCHU has a deep stock of non-financial capital whose potential as corporate value has not yet been tapped. This capital includes ESG factors, helps lower the cost of capital, and ensures sustainability of the business model.

Internal Management Resources

Internal Management Resources

Human Resources

It is human resources that are the driving force behind the functioning of ITOCHU’s business models. We are working to develop industry professionals who have high levels of expertise in specific areas. In addition, we are working consistently to strengthen human resource productivity through working-style reforms.(→Human Resources Strategy)![]()

Business Know-How

ITOCHU is developing businesses in a broad array of industries spanned by its seven Division Companies, and has accumulated a wide range of business know-how. This know-how is an indispensable intangible asset in creating new businesses and in advancing into new business fields.

Various Synergies with Group Companies

The ITOCHU Group comprises 207 subsidiaries and 101 affiliated companies (as of March 31, 2017). The combination of their functions with those of ITOCHU expands the potential scope for added value creation.

Organizational Assets

In addition to rapid decision-making systems, ITOCHU also has functional organizations that possess high levels of expertise in such fields as legal affairs, risk management, accounting, taxation, finance, and more. These organizations provide strong backup for ITOCHU’s ability to earn profit from a front-line perspective.

Trust and Creditworthiness

The trust and creditworthiness we have cultivated as a general trading company underpin our earning power throughout the value chain, including customers and investees.

External Management Resources

External Management Resources

Client Assets (Customers / Suppliers)

Maintaining relationships with customers and suppliers is indispensable in securing continued trade opportunities. In addition, ITOCHU can control risk in investments precisely because it can draw on these client assets.

Partner Assets

From the viewpoints of rapidly advancing into new business areas and increasing the probability of business success, ITOCHU emphasizes win–win relationships with partners. Over many years, ITOCHU has built excellent relationships with many leading companies.

Natural Resources

In order to maintain and enhance our strengths in the non-resource sector, the ability to steadily procure limited natural resources, particularly forestry resources, impacts our business sustainability.

Relationships with Society

As we expand our businesses around the world, maintaining and developing relationships with various countries’ governments and local communities has a major impact on the sustainability of our business activities.

Relationship with Materialities(→Sustainability)

Consideration for the environment

Consideration for the environment

Sustainable use of resources

Sustainable use of resources

Respect and consideration for human rights

Respect and consideration for human rights

Contribution to local communities

Contribution to local communities

Improving labor conditions

Improving labor conditions

04. Sources of Sustainability

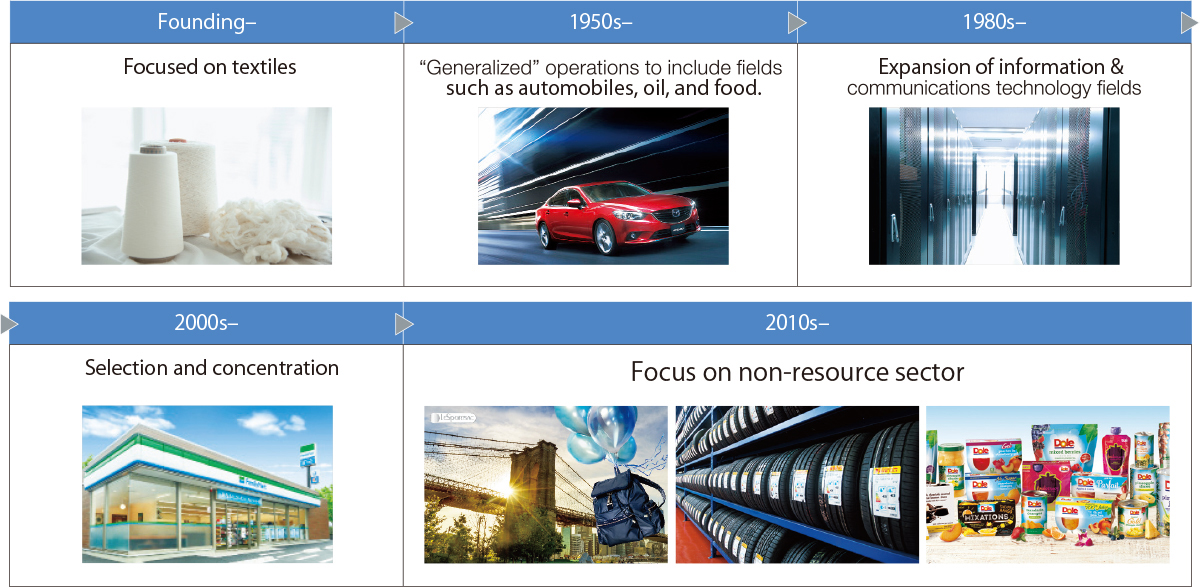

Adaptability to the Changing Times

Portfolio Distribution across Spans of Time and Industries

Transforming our business portfolio flexibly in response to changes in the industrial structure has enabled us to develop our business sustainably. By looking ahead to future economic cycles, we are allocating personnel and certain other management resources to rapidly expand growth businesses and launch new businesses.

Spreading into Multifaceted Business Domains

Reweighting in Response to the Changing Industrial Structure

Vertical Expansion

In building value chains, we aim to maximize business value by leveraging our strengths in domains where we have knowledge and collaborating with partners in other domains, thereby increasing the efficiency of invested capital and reducing risk.(→The Merchants Creating Synergies Indefinitely)

How ITOCHU Differs from a General Private Equity Fund

As we consider business investment one of our major options, our business model is often compared to that of a private equity fund. There are certain similarities, such as the desire to contribute proactively to management and maximize the corporate value of investees. We view as different, however, the facts that we are also aiming to increase our own corporate value, we focus on generating synergy with existing businesses, and we enjoy returns (cash) centered on trading profits and dividends.

| Investee liquidity | Investee ownership ratio | Investee ownership period | Business synergies | Returns (cash) | |

|---|---|---|---|---|---|

|

General private equity fund |

In principle, unlisted |

In principle, majority stake to 100% |

Buy and hold having an exit strategy |

In principle, none |

Capital gains and dividends |

|

ITOCHU |

Either listed or unlisted |

Decided individually, based on business conditions and market environment |

Buy and hold |

Create synergies with existing businesses |

In principle, trading profit and dividends |

05. Sources of Sustainability

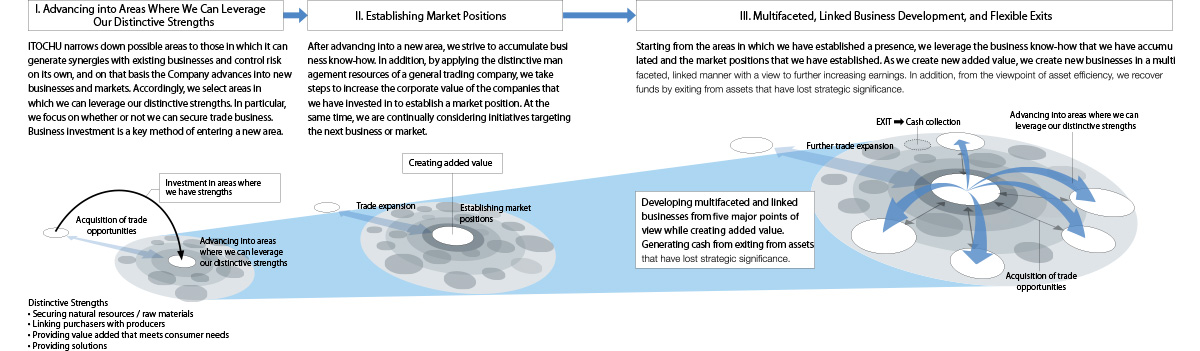

Generating Business in Unlimited Directions

Leveraging Our Distinctive Strengths to Expand Multifaceted Initiatives in a Linked Manner

Five Major Points of View in Multifaceted Business Development

Targeting a stable supply of food, ITOCHU is establishing and expanding grain handling and supply bases. (Photo: CGB grain export facility in North America)

1.Expanding and Diversifying Sources of Supply

In procurement, ITOCHU works to diversify and expand its sources of supply. In this way, we disperse risks, such as geopolitical and exchange rate risks; increase buying power; and strengthen our competitiveness by increasing the amounts supplied.

We are reinforcing our position as the global No. 1 pulp trader by participating in the pulp production business. (Photo: Celulose Nipo-Brasileira S.A.)

2.Participating in Production Activities

We participate in upstream production activities with the objectives of developing and procuring competitive products, taking the initiative on the supply side, and generating earnings.

In the brand business, licensing business and business development in China is leading to growth in source of earnings. (Photo: OUTDOOR PRODUCTS)

3.Expanding the Range of Success Models

We aim to create businesses efficiently and rapidly by extending models of success with certain products and regions to other products and regions.

We increased our competitiveness through the management integration of FamilyMart Co., Ltd., and UNY Group Holdings Co., Ltd.

4.Pursuing Economies of Scale

We are working to increase our operational efficiency and strengthen competitiveness by expanding our scale through mergers, etc.

Information obtained by FamilyMart, which is a point of contact with customers, is increasing added value throughout the entire value chain.

5.Obtaining Contact with Consumers

We are aiming to achieve synergistic earnings growth by obtaining contact with consumers, feeding information back to midstream and upstream businesses, and optimizing the supply chain.

Cash Collection from Exits

Based on our view of the long-term business environment, we implement exits from existing businesses and reinvest in new strategic fields using the cash generated from exits. In this way, we are working to create new businesses.