Corporate Governance

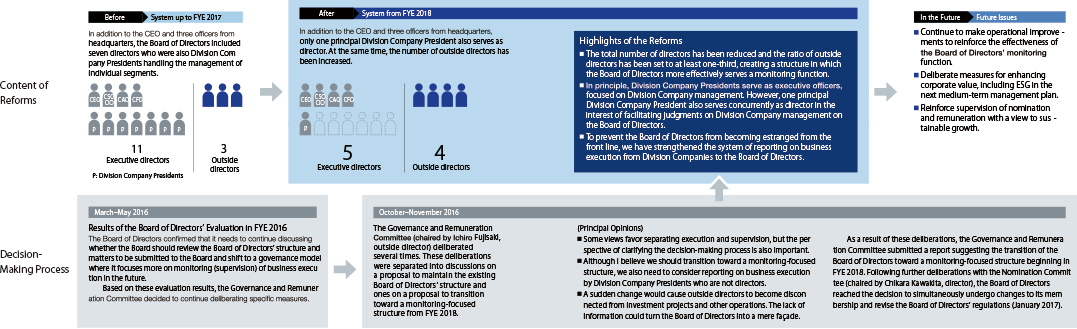

Board of Directors’ Reforms: Our Structure from FYE 2018

Participating in Deliberations on Board of Directors’ Reforms

Atsuko Muraki

To enhance governance, ITOCHU also considered increasing the percentage of outside directors on the Board of Directors and the need to strengthen the function of monitoring execution.

Considering the appropriate size of the Board of Directors in order to facilitate effective discussion, the point at issue was whether removing Division Company Presidents as directors and creating a Board of Directors centered on officers from headquarters would strengthen the monitoring function.

There were two concerns. First, removing Division Company Presidents could mean that Board of Directors’ discussions would become estranged from issues on the front lines, making these discussions lopsided. Also, removing Division Company Presidents, who play the important role of execution, could cause them to lose opportunities to oversee decision-making from a higher perspective.

To address this concern, we decided to have Division Company Presidents in Board of Directors’ meetings, providing them a platform to communicate information and opinions from the front lines. We also decided to increase the number of opportunities for outside directors to get in touch with front-line operations through internal opinion exchanges and site visits.

Reviewing the composition of the Board of Directors itself was not difficult. However, getting the monitoring to operate in the intended fashion could be difficult. For this reason, we consider this fiscal year as the “year for Board of Directors’ reforms,” and we aim to make it a year for enhancing effectiveness.

Promoting Further Advances on the Board of Directors

Harufumi Mochizuki

During my three years as Audit & Supervisory Board Member of ITOCHU, I have taken part in governance reforms on a variety of fronts. During this period, calls for Board of Directors’ reforms have become more pronounced throughout Japan. As ITOCHU is a key company in Japan, I have worked to ensure appropriate reforms were carried out here.

In my current position as an outside director, I aim to contribute to management from a new perspective. I was involved in industrial policy during my career as a government official, and thereafter gained experience and expertise through direct involvement in corporate management. I aim to make use of this experience at ITOCHU, particularly by effectively exercising the monitoring function of the Board of Directors. In this manner, I hope to contribute to sustainable increases in ITOCHU’s corporate value.

Along with strengthening governance, the Company needs to have in place a framework that enables it to remain vigilant and preempt any internal control or compliance infractions, as the manifestation of such risks can threaten a company’s very survival. At the same time, it is important to cultivate a free-spirited corporate culture that contributes to increases in corporate value.

By fulfilling my own mission as an outside director, I intend to promote further advances on ITOCHU’s Board of Directors.

Characteristics of Corporate Governance at ITOCHU

Executive Remuneration

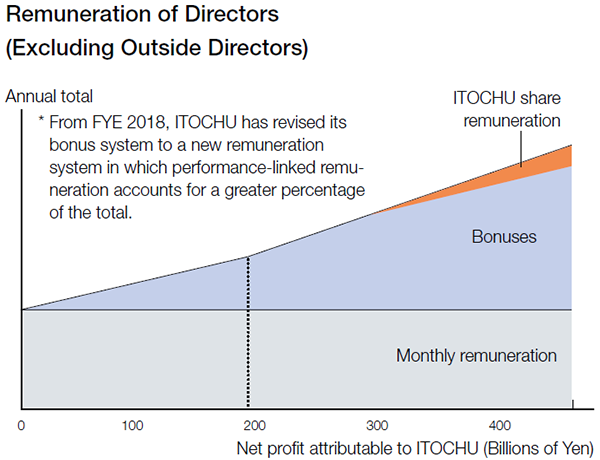

A Highly Transparent Remuneration System Linked to Increases in Corporate Value

Remuneration for directors (excluding outside directors) comprises (1) monthly remuneration, (2) performance-linked bonuses, and (3) performance-linked and share-based remuneration (trust type). The total amount of (1) monthly remuneration is determined by the contribution to ITOCHU of each director according to a base amount set by position, whereas the total amount of (2) performance-based bonuses and (3) performance-linked and share-based remuneration is determined based on net profit attributable to ITOCHU. The performance-linked and share-based remuneration was introduced in FYE 2017 with the aim of heightening awareness toward making contributions to improving our performance over the medium and long term and to increasing corporate value.

| Type of remuneration | Content | Remuneration limit | Resolution of General Meeting of Shareholders | |

|---|---|---|---|---|

| Directors | (1) Monthly remuneration | Monthly remuneration determined by the contribution to ITOCHU of each director according to a base amount set by position | ¥1.2 billion per year as total monthly remuneration (including ¥50 million per year as a portion to the outside directors) | June 24, 2011 |

| (2) Bonuses | Determination of total payment amount on the basis of net profit attributable to ITOCHU Refer to the formula below. | ¥1.0 billion per year as total bonuses paid to all directors (excluding outside directors) | ||

| (3) Share-based remuneration (trust type) FYE 2017 introduction |

The following is the limit for a two-year period for directors and executive officers (excluding outside directors)

|

June 24, 2016 |

||

| Audit & Supervisory Board Members | Only monthly remuneration | ¥13 million per month | June 29, 2005 |

Formulas for Performance-Linked Bonuses and Share-Based Remuneration

Total Amount Paid to All Directors

Total amount paid to all directors = (A + B + C) x Sum of position points for all the eligible directors ÷ 55

A = (Of net profit attributable to ITOCHU for FYE 2018, the portion up to ¥200.0 billion) x 0.35%

B = (Of net profit attributable to ITOCHU for FYE 2018, the portion exceeding ¥200.0 billion and up to ¥300.0 billion) x 0.525%

C = (Of net profit attributable to ITOCHU for FYE 2018, the portion exceeding ¥300.0 billion) x 0.525% (of which, 0.175% as share-based remuneration)

The total amount paid shall be the sum of A, B, and C, which shall be adjusted with due regard to the increase/decrease in the number of eligible directors and the change in position and other factors. (Remuneration limits exist on bonuses and share-based remuneration.)

Amount Paid to an Individual Director

Amount paid to an individual director = Total amount paid to all directors × Assigned position points ÷ Sum of position points for all the eligible directors

| Chairman President & Chief Executive Officer | Executive Vice President | Senior Managing Executive Officers | Managing Executive Officers |

|---|---|---|---|

|

10 |

5 |

4 |

3 |

Of the amount paid to an individual director, the portion corresponding to A and B in the total amount paid to all directors is paid entirely in cash. In regard to the portion corresponding to C, 0.175% is paid as share-based remuneration and the balance is paid in cash. In regard to share-based remuneration during the term of office, annual points are awarded (1 point = 1 share), and at the time of retirement share-based remuneration is paid from the trust in correspondence with accumulated points. Plans call for all of the shares paid from the trust to be acquired on the stock market, and accordingly there will be no dilution of shares.

Evaluation of the Compensation System

Ichiro Fujisaki

ITOCHU has revised its remuneration system and is moving to performance-linked bonuses for directors beginning in FYE 2018. Along with the stock remuneration plan, this revision increases the performance-linked percentage. The Governance and Remuneration Committee considers this approach to be appropriate, as the system targets further increases in corporate value and the concept is based on the payment of compensation to the management team commensurate with their achievement of high management targets.

The current medium-term management plan, which concludes in FYE 2018, targets two consecutive years of record high earnings and the achievement of consolidated net profit of ¥400.0 billion. The new, monitoring-focused Board of Directors will exercise an even greater supervisory function going forward.

Nomination

Nomination Committee Supervising Succession Planning

ITOCHU’s Nomination Committee was established in FYE 2016 as an advisory committee to the Board of Directors. In FYE 2017, an outside director was appointed as the committee’s chairman, and the committee transitioned to a structure in which outside executives comprise half or more of the total members. Under this system, the president is granted the right to propose candidates for appointments as executive officers, directors, and Audit & Supervisory Board Members. However, prior to such proposals, the Nomination Committee deliberates candidates and reports the results of such deliberations to the Board of Directors. Under this arrangement, the Nomination Committee’s primary function is to appropriately supervise the proposal-making process. By posing questions to the president, the Nomination Committee also takes part in the president’s succession planning and supervises its state of progress.

Status of Activity on the Nomination Committee

Chikara Kawakita

In keeping with the Corporate Message “I am One with Infinite Missions,” I would like to see all ITOCHU’s employees fulfill their individual missions and for ITOCHU to contribute even more to society as one of Japan’s leading companies. To these ends, it is important to create a management structure that enables each employee to take full advantage of his or her ambitions and capabilities.

ITOCHU’s Nomination Committee has been in place for two years. Taking advantage of the insight and experience of outside executives has led to a more proactive expression of opinions, and deliberations are vigorous on a variety of fronts, including succession planning. We aim to go about our work so that shareholders can feel peace of mind and a sense of major anticipation when approving proposals each year at the General Meeting of Shareholders.