CFO Interview

Q1.Please provide a general review of the financial and capital strategies under “Brand-new Deal 2017.”

We have steadily produced results.

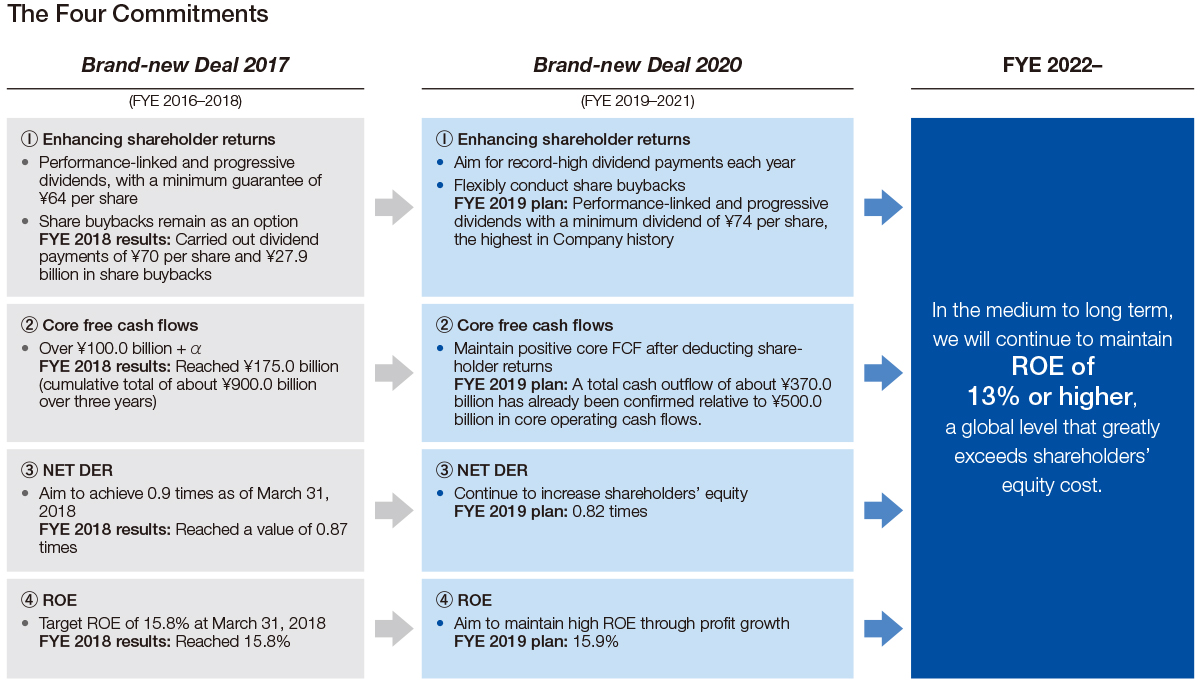

I believe we should tenaciously promote the Company’s financial and capital strategies with consistency no matter what kind of changes we face in the business environment. With this way of thinking, we steadily produced results based on our basic policies over our three-year medium-term management plan, “Brand-new Deal 2017.” In FYE 2018, the plan’s final fiscal year, we were able to fulfill all of the “four commitments” we had announced in the beginning.

First, in terms of “enhancing shareholder returns,” we advanced policies of “record-high minimum guarantees for dividends each year” and “performance-linked and progressive dividends” when we first announced “Brand-new Deal 2017.” We were able to keep these promises and also increase dividends by ¥15 year on year to ¥70 per share. Furthermore, continuing from the previous fiscal year, we conducted a ¥27.9 billion share buybacks, aiming to expand shareholder returns.

Next, in terms of “core free cash flows,” results produced in FYE 2016 and FYE 2017 combined with our strong resolve to steadily implement careful selection and control of investment pushed us to target a value higher than our previous target of “¥100.0 billion.” We were able to reach our new target in FYE 2018, with core free cash flows of ¥175.0 billion. Furthermore, our cumulative core free cash flows during “Brand-new Deal 2017” reached levels near ¥900.0 billion, greatly exceeding the approximate ¥600.0 billion we invested in CITIC in FYE 2016.

In terms of “net debt-to-shareholders’ equity ratio (NET DER),” we achieved a value of 0.87 times, lower than our target value of 0.9 times. Due partly to steady accumulation of record-high consolidated net profit, shareholders’ equity hit an all-time high. Additionally, we promoted improvements in investment control and asset efficiency. Thanks to these factors, net interest-bearing debt decreased compared to the end of the previous fiscal year.

Finally, in terms of ROE, we achieved a result of 15.8%, right in line with initial forecasts, and were able to maintain our position at the top level of general trading companies for the fourth period in a row.

Additionally, we acquired a credit rating of A from Moody’s for the first time in about 20 years. With this rating, ITOCHU now has ratings of A or higher from all four major rating agencies. We also received “outlook positive” evaluations from S&P and three other agencies.

I believe that these are also great results of our consistent financial and capital strategies.

Q2.Please inform us about financial and capital strategy points in the new medium-term management plan, “Brand-new Deal 2020.”

We will continue the policies of “Brand-new Deal 2017.”

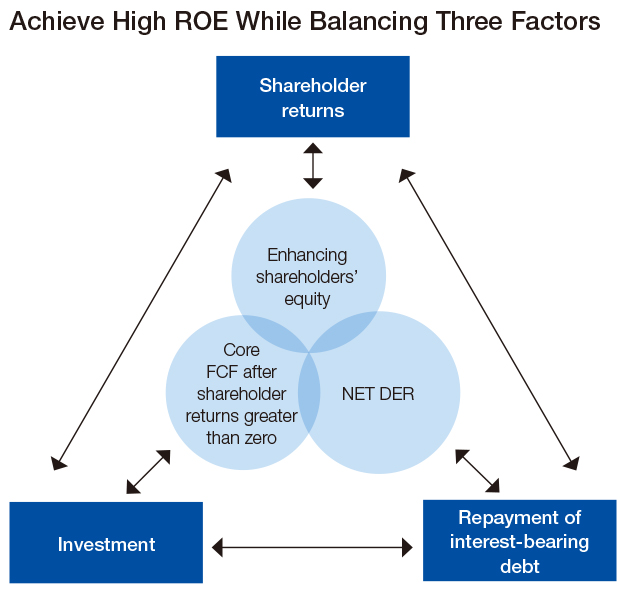

In terms of the new medium-term management plan, “Brand-new Deal 2020,” we are working out new basic polices, including our policy of “Reinvented Business.” However, our fundamental thinking regarding financial and capital strategies remains unchanged and we intend to produce results one by one while being mindful of the appropriate balance between shareholder returns, investment, and repayment of interest-bearing debt.

The low-volatility non-resource sector is at the center of the Company’s exposure, so we are not considering drastically lowering NET DER beneath current levels. On the other hand, we intend to aim for continued increases in shareholders’ equity. In the medium to long term, the Company will stick to its policy of maintaining high ROE at a global level of 13% or higher, which greatly exceeds shareholders’ equity cost, through the expansion of consolidated net profit. ROA is an important prerequisite factor for this goal, so we will thoroughly ensure further improvement in asset efficiency for each operating segment.

Additionally, in terms of core free cash flows for each fiscal year, we will take one step further than we did previously, with a policy of “maintaining positive results after deducting shareholder returns” as well as applying the policy to each Division Company.

During FYE 2019, the first fiscal year of “Brand-new Deal 2020,” we will steadily promote the “four commitments” displayed in the chart below.

In particular, we estimate ROE of 15.9% on the assumption that consolidated net profit reaches ¥450.0 billion. Core operating cash flows, an area of focus for the Company, are expected to exceed the previous fiscal year’s value by ¥40.0 billion and reach about ¥500.0 billion. Assuming shareholder returns of about ¥120.0 billion (with a minimum dividend of ¥74 per share), a ¥120.0 billion expenditure for the acquisition, making FamilyMart UNY Holdings Co., Ltd. a consolidated subsidiary, and around ¥130.0 billion in capital expenditure for operating companies during a typical year (the rough median between ¥100.0 billion and ¥150.0 billion), cash outflows will amount to about ¥370.0 billion. Subtracting cash outflows from forecast core operating flows leaves a remainder of about ¥130.0 billion. This figure may vary somewhat due to our continued asset replacement and increasing consolidated net profit but we will basically make considerations regarding investment and additional shareholder returns within this ¥130.0 billion scope. Accordingly, we will continue our policy of making judgments regarding investments extremely carefully.

Q3.Please describe your thoughts regarding the market reaction immediately following the announcement of “Brand-new Deal 2020.”

We will conscientiously explain our pursuit of “new record highs.”

When we announced both “Brand-new Deal 2017” and “Brand-new Deal 2020” medium-term management plans, we only specified quantitative targets for the first fiscal year of each plan. However, in “Brand-new Deal 2020” we did not include numerical imagery equivalent to “build solid earnings base to generate ¥400.0 billion level consolidated net profit,” which we advanced as a basic policy in “Brand-new Deal 2017,” nor did we specify a minimum dividend per share for the second and third year. I’m aware that these factors led to a difference in evaluation for the two medium-term management plans.

The record-high consolidated net profit of ¥450.0 billion and minimum dividend of ¥74 per share that we are planning for FYE 2019 are both nothing more than minimum commitments at the present time. Although we have not specified any concrete numbers, there is no change in our aim to achieve record-high consolidated net profit in FYE 2020 and FYE 2021, nor in our policy of progressive dividend increases to accompany these record-high profits. Additionally, there is no change in our policy of continuing to consider share buybacks as an option, as we plan to flexibly conduct them based on conditions such as Company stock prices and cash flows (→New Medium-Term Management Plan, Shareholder Returns Policy)![]() .

.

I think the probability that we will achieve quantitative targets for FYE 2019 is extremely high, considering our past performance, conservative assumptions for resource prices and exchange rates, and setting a buffer to cover unexpected losses. We plan to announce specific quantitative targets during the “Brand-new Deal 2020” at the appropriate times.

Q4.Please tell us about your investment policy aimed at “Reinvented Business.”

We do not plan to conduct large-scale investments.

Although there are some who are concerned that we may conduct unrealistically large-scale investments in leading-edge technology because we are advancing “Reinvented Business” in “Brand-new Deal 2020,” we are not planning to do so. Our Chief Strategy Officer will be the central figure involved in discussions about investments in next-generation or leading-edge technology fields. We plan to conduct venture investments within a defined scope. Our Company has the strong points of having branched out into venture investments since the early 1990s, conducted IT initiatives that were pioneering among general trading companies, highly developed judgement and a strong network. Accordingly, although we may not have a large amount of money available from an asset-scale perspective, we believe that we can efficiently conduct venture investment.

Additionally, since before the demise of the “commodities super cycle,” we have largely changed our course and conducted investment in the non-resource sector, which mainly revolves around the consumer-related sector. Regarding large-scale projects in particular, we have achieved results above a certain level as a result of working out various measures to improve profitability for each project. We are investing in “Reinvented Business” to further upgrade existing businesses that we have refined over time.

Furthermore, starting in FYE 2019 I am also serving in the position of chairman for the Investment Consultative Committee and plan to raise cash control effectiveness to higher levels than before. As mentioned in the preceding section, we plan to exercise extreme care when making investment decisions.

Q5.Please tell us about your operating company’s management direction.

There is still much room for improvement.

ITOCHU’s share of Group companies reporting profits in FYE 2018 was 91%. Although we are aware that this ratio is extremely high compared to other general trading companies, we want to further raise this value in FYE 2019. Out of our 300 operating companies, only a few reported profit of ¥10.0 billion or more, while about two thirds reported profit of ¥2.0 billion or less. The fact that earnings are not concentrated into specific operating companies but spread throughout them is one of the Group’s greatest strengths. We plan to continue upgrading investment management (→Business Investment )![]() , thoroughly adhere to our “earn, cut, and prevent” principles, implement meticulous hands-on management, and build an earnings base that is even stronger and more resistant to economic fluctuations. With regard to improving existing operating companies, some people say that we will reach our limit soon but I think that with the upgrades will come with “Reinvented Business” there is still a lot of room for improvement.

, thoroughly adhere to our “earn, cut, and prevent” principles, implement meticulous hands-on management, and build an earnings base that is even stronger and more resistant to economic fluctuations. With regard to improving existing operating companies, some people say that we will reach our limit soon but I think that with the upgrades will come with “Reinvented Business” there is still a lot of room for improvement.