A Business Model Enhanced through Transformation

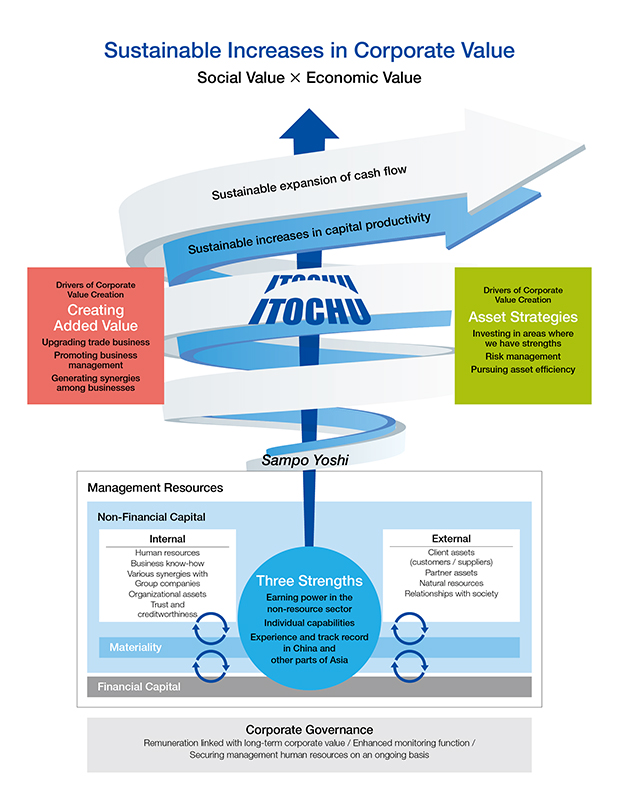

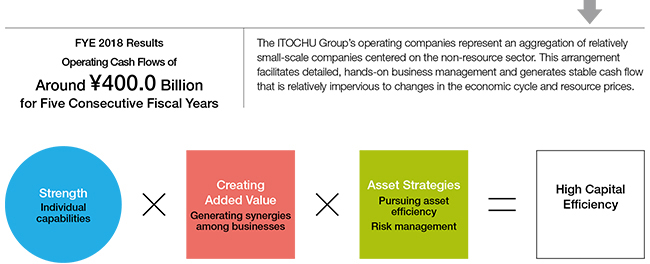

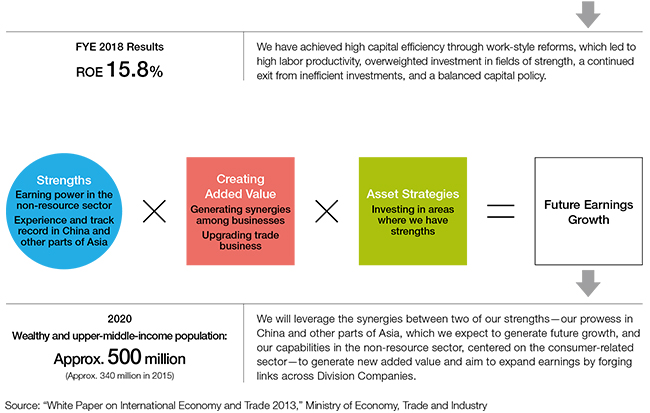

Our Business Model, as Seen through the Corporate Value Formula

Our business model is designed to comply with domestic and international disclosure frameworks and be easy for readers to understand. We have a universal and highly durable business model that applies to all Division Companies and incorporates clear financial logic. The flow charts below show how to read our business model from a financial perspective.

Our Business Model, as Seen through Business Development

We will take advantage of our distinctive strengths and consecutively expand our areas of operation, as well as promote an expeditious exit from inefficient assets to maintain and improve asset efficiency.

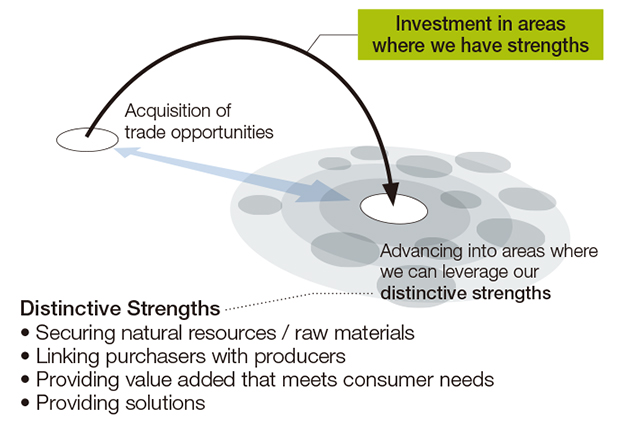

I. Advancing into Areas Where We Can Leverage Our Distinctive Strengths

ITOCHU narrows down possible areas to those in which it can generate synergies with existing businesses and control risk on its own, and on that basis the Company advances into new businesses and markets. Accordingly, we select areas in which we can leverage our distinctive strengths. In particular, we focus on whether or not we can secure trade business. Business investment is a key method of entering a new area.

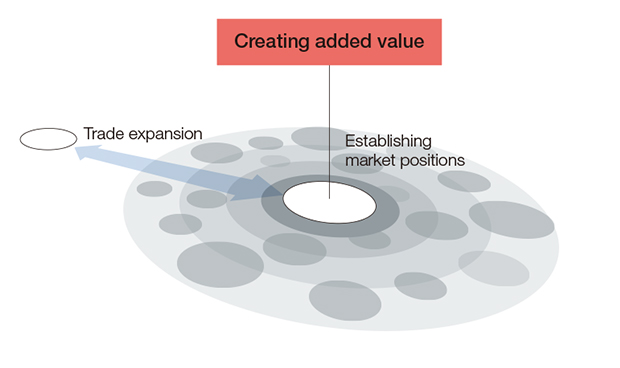

II. Establishing Market Positions

After advancing into a new area, we strive to accumulate business know-how. In addition, by applying the distinctive management resources of a general trading company, we take steps to increase the corporate value of the companies that we have invested in to establish a market position. At the same time, we are continually considering initiatives targeting the next business or market.

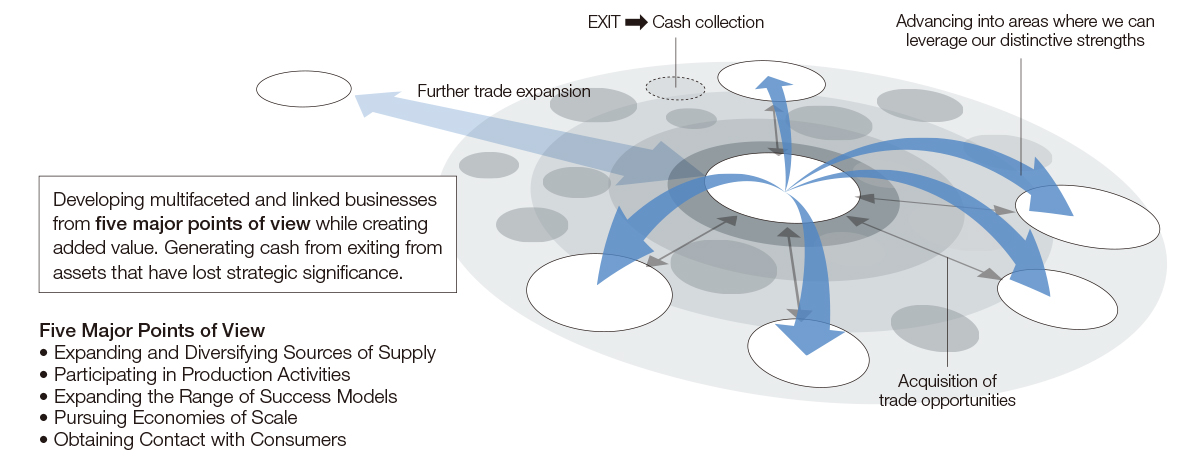

III. Multifaceted, Linked Business Development, and Flexible Exits

Starting from the areas in which we have established a presence, we leverage the business know-how that we have accumulated and the market positions that we have established. As we create new added value, we create new businesses in a multifaceted, linked manner with a view to further increasing earnings, mainly from the five perspectives outlined below. In addition, from the viewpoint of asset efficiency, we recover funds by exiting from assets that have lost strategic significance. We use the cash generated from exits to reinvest in new strategic fields to create new businesses.

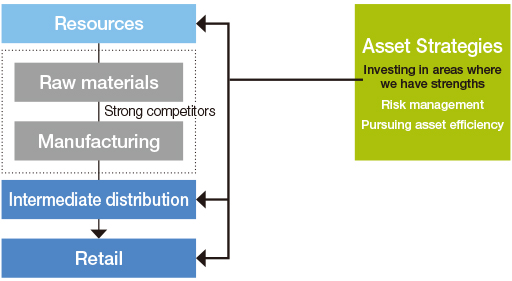

Our Business Model, as Seen in the Value Chain

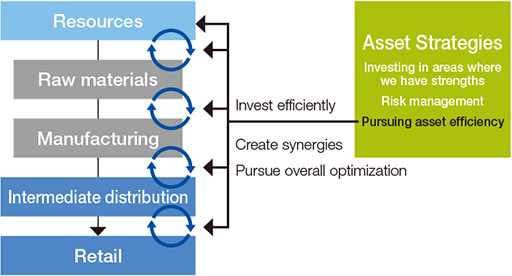

Across the industry value chain, or “longitudinally,” we seek to expand business opportunities while curtailing risks in business domains where we can make the most of functions in which we excel.

Avoid Competition with Strong Competitors

We move only into areas where we have strengths in various industry value chains, concentrating our investment of management resources. Rather than moving into domains in which strong competitors exist, we devote ourselves to the supplier and distribution side of the businesses.

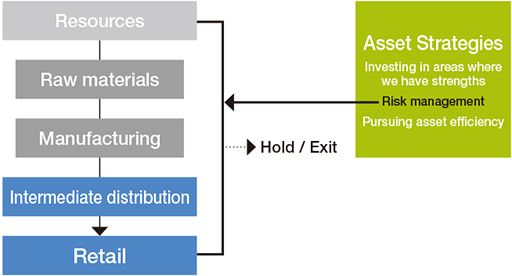

Pursue Asset Efficiency

We aim to maximize asset efficiency by minimizing our investment of management resources and pursuing overall optimization that makes the most of functions that are of use to investees.

Maintain or Improve Investment Efficiency through Risk Management

We monitor asset efficiency stringently and on an ongoing basis, exiting from assets that fall below our criteria. We also control the loss by setting exit conditions at the time of making an investment

(→Business Investment Process) ![]()

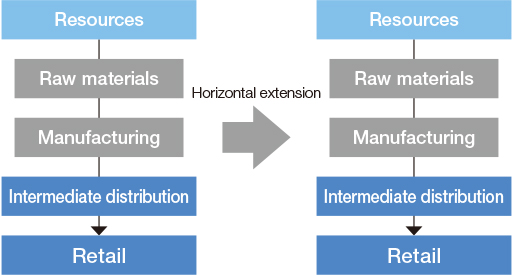

Horizontal Extension of Success Models

We reduce the cost and risk of moving into new areas through horizontal extension of successful business models into other industries and markets, customizing our approach to match industry and market characteristics.

How ITOCHU Differs from a General Private Equity Fund

As we consider business investment one of our major options, our business model is often compared to that of a private equity fund. There are certain similarities, such as the desire to contribute proactively to management and maximize the corporate value of investees. We view as different, however, the facts that we are also aiming to increase our own corporate value, we focus on generating synergy with existing businesses, and we enjoy returns (cash) centered on trading profits and dividends.

| Investee liquidity | Investee ownership ratio | Investee ownership period | Business synergies | Returns (cash) | |

|---|---|---|---|---|---|

|

General private equity fund |

In principle, unlisted |

In principle, majority stake to 100% |

Buy and hold having an exit strategy |

In principle, none |

Capital gains and dividends |

|

ITOCHU |

Either listed or unlisted |

Decided individually, based on business conditions and market environment |

Buy and hold |

Create synergies with existing businesses |

In principle, trading profit and dividends |

Our Business Model, as Seen through a Functional Example

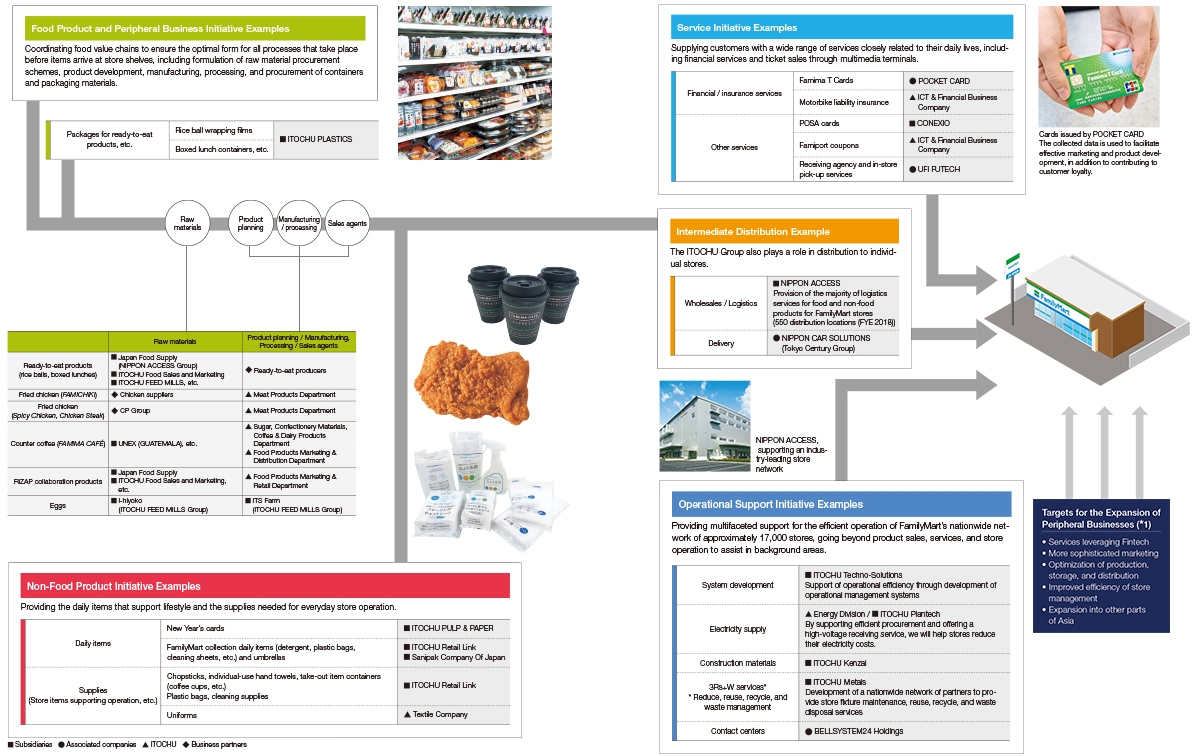

Expanding Vertical and Horizontal Synergies in the Convenience Store Business (FamilyMart)

The convenience store business is a good example of the Strategic Integrated System (SIS) strategy, which entails constructing and reinforcing a value chain spanning upstream and downstream areas to maximize earnings. In addition to constructing and strengthening the food value chain (vertically), we have branched out from supplying items necessary to daily lives to provide financial services and an array of other services. By building systems and providing construction materials, we aim to provide a broad range of operational support, creating business synergies that go beyond Division Company boundaries.

(*1)→An Example of "Enhancement of Value Chain in the Consumer Sector" ![]()

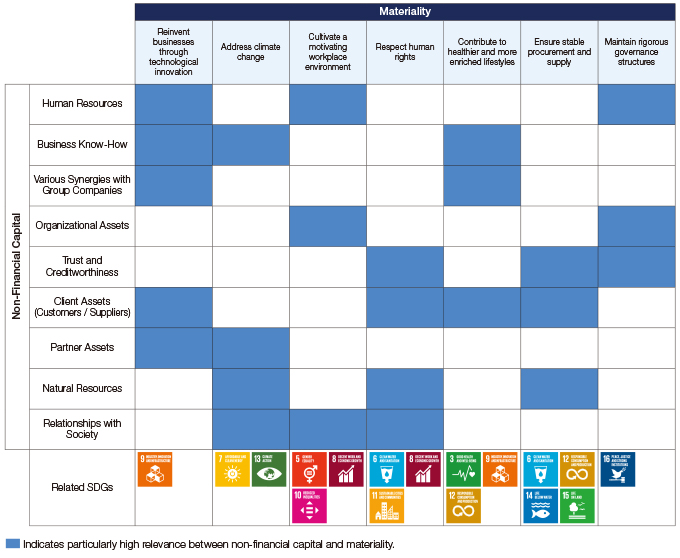

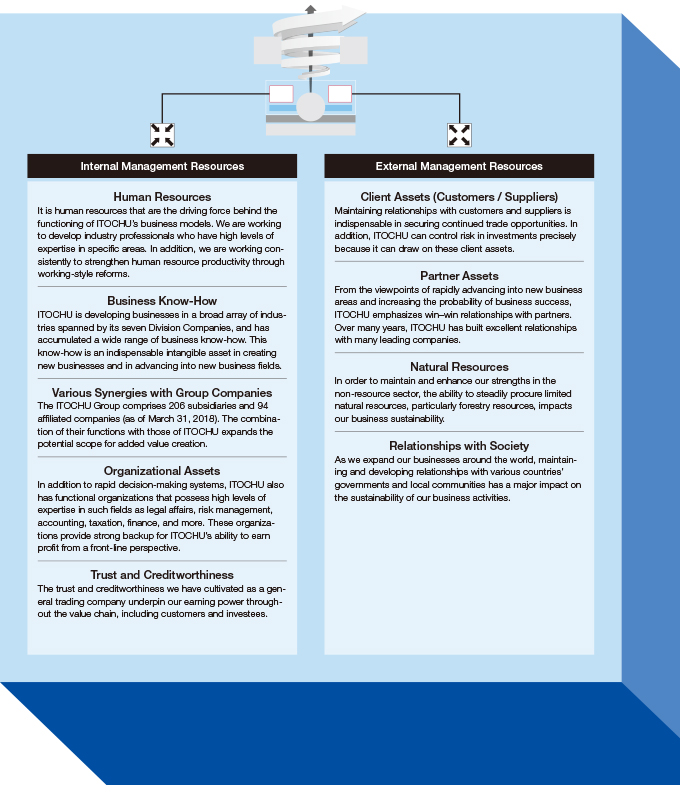

Maintaining and Enhancing Non-Financial Capital

ITOCHU has enhanced corporate value by vertically and horizontally leveraging various types of non-financial capital that are not clearly evident in financial information. We believe that maintaining and further upgrading this non-financial capital is an important way to sustainably increase corporate value.

Strong Non-Financial Capital

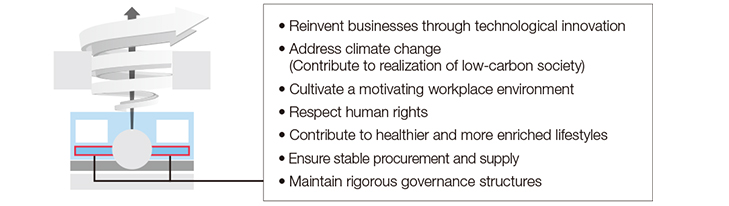

Initiatives Based on Materiality for Supporting the Maintenance and Enhancement of Non-Financial Capital

In line with our “sampo yoshi” philosophy, we have formulated a new Basic Policy on Promotion of Sustainability and defined material sustainability issues (Materiality) from the standpoint of sustainable business growth. Through initiatives based on this materiality, we sustainably increase corporate value by maintaining and upgrading non-financial capital. (→Sustainability ) ![]()

Relevance of Non-Financial Capital, Materiality, and the SDGs