Corporate Governance

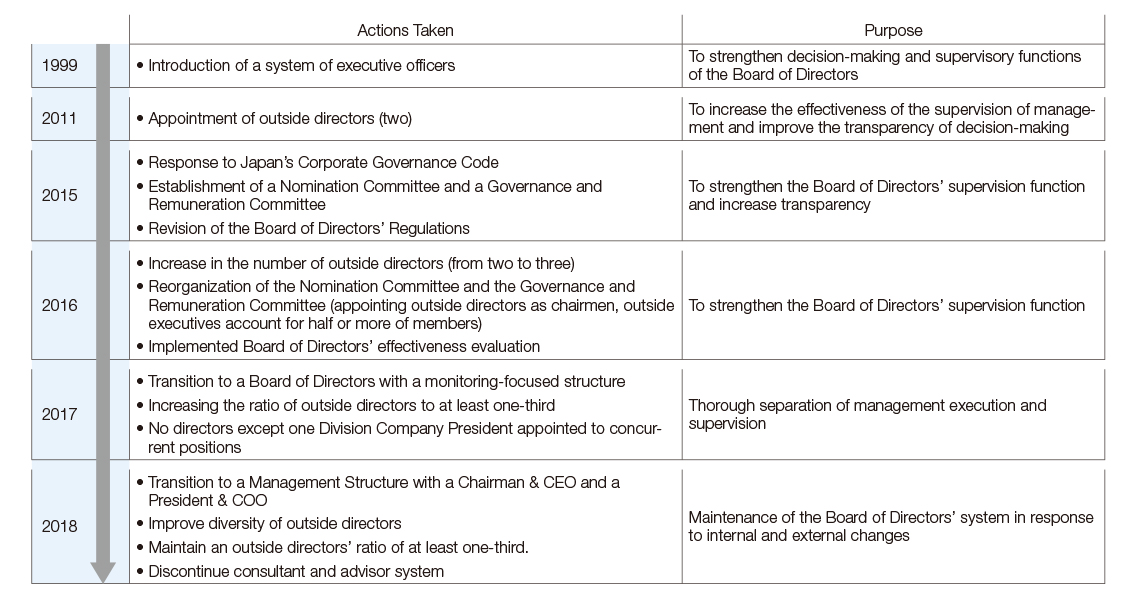

Steps Taken to Strengthen Corporate Governance

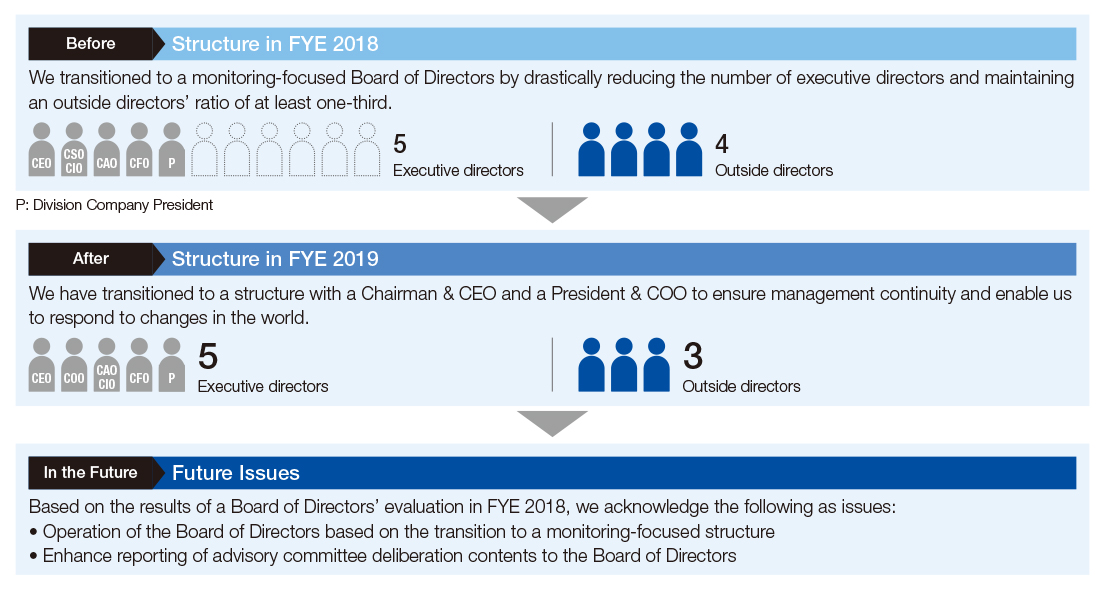

Transition to a Structure with a Chairman & CEO and President & COO(→Next-Generation Management Structure)

Outside Director Changes

At the 94th Ordinary General Meeting of Shareholders, outside directors Ichiro Fujisaki and Chikara Kawakita retired and Masatoshi Kawana was newly appointed as an outside director.

This change was made because of a need to further diversify opinions in order to increase corporate value and accomplish the goals laid out in the new medium-term management plan, “Brand-new Deal 2020,” which started in FYE 2019. Additionally, Mr. Fujisaki and Mr. Kawakita had both assumed their positions in 2013, already five years ago, and it was time to make a change in outside directors.

In terms of outside directors, the Company has a policy of preferentially appointing people who fulfill independence requirements established in its “Independence Criteria for Outside Directors and Outside Audit and Supervisory Board Members” and can be expected to contribute to its management with deep insight cultivated through experience in various categories. In addition to experience and insight, we also regard character as important and in FYE 2019 only one additional person was selected for appointment as an outside director. There has been no change to our policy of maintaining at least a one-third ratio of outside directors and we are discussing increasing their numbers should appropriate candidates be available.

Messages from Outside Directors

Toward a More Energetic Board of Directors

Atsuko Muraki

Ms. Muraki was appointed as a director of ITOCHU in June 2016, following positions including the Vice Minister of Health, Labour and Welfare. She is a chairman of the Governance and Remuneration Committee. In addition to work-style reforms, she proactively offers advice on compliance issues and sustainability issues in management plans.

I assumed my role of outside director two years ago and have participated closely in the Company’s governance system as a member of the Governance and Renumeration Committee. In FYE 2018, we dramatically reconfigured the Board of Directors to separate the execution and supervision of management. We are transitioning to a structure with a Chairman & CEO and a President & COO in FYE 2019 to achieve management continuity and to respond to rapid changes in the world. This structure is the result of careful consideration of what our Company’s ideal form should be based on the business environments we found ourselves in during each of these two fiscal years. I believe this consideration provides the foundation for us to accomplish the goals laid out in the new medium-term management plan, “Brand-new Deal 2020,” which started in FYE 2019. The subtitle of “Brand-new Deal 2020” is “ITOCHU : Infinite Missions : Innovation.” This subtitle communicates the strong will of “merchants,” the symbol of our Company’s strength, to free themselves from the status quo and achieve major transformation in order to respond to new eras. It was decided that I would begin serving as chairman of the Governance and Renumeration Committee after the end of the general meeting of shareholders in FYE 2019; I plan to help the Company evolve and transform itself in my new roles.

Aiming to Become the No.1 Health Management Company

Masatoshi Kawana

Mr. Kawana has worked as a physician for Tokyo Women’s Medical University Hospital for many years and has also holds the position of associate director. He assumed a position as a member of the Board of Directors at ITOCHU Corporation in June 2018. He is also a member of the Company’s Governance and Remuneration Committee.

Our human resources are a precious management resource and to further strengthen “individual capabilities, which are one of the Company’s strengths under the new medium-term management plan, “Brand-new Deal 2020,” we are advancing our goal of becoming the “No. 1 Health Management Company” as a basic policy. In addition to progressive measures the Company is already taking, such as its “Support Measures for Balancing Cancer Care and Work,” it is important to develop environments in which employees can actively work to their heart’s content while simultaneously feeling secure about their health and a sense of job satisfaction. We will adopt a variety of measures to this end in order to become a Company that not employees but also their families can call the “best company in Japan.” I would like to greatly contribute to our progressive health management initiatives, which utilize the experience I have accumulated while participating in the medical field for many years and also adopt a medical point of view. Additionally, at my current post as associate director at Tokyo Women’s Medical University Hospital, I have participated in all aspects of hospital management and, from a manager’s point of view, have actively worked to adapt a variety of measures and improve profit structure. Based on this experience, I want to help out with the medical care business, which the Company is planning to expand in the future, and, while maintaining full awareness that my primary duty as an outside director is to function as the “public eye,” work to further increase sustainable corporate value.

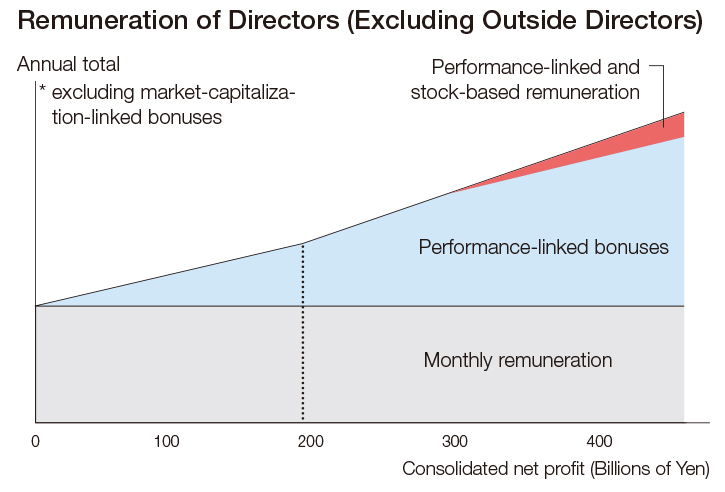

A Highly Transparent Remuneration System Linked to Increases in Corporate Value

The total amount of (1) monthly remuneration is determined by the contribution to ITOCHU of each director according to a base amount set by position, whereas the total amount of (2) performance-linked bonuses and (4) performance-linked and stock-based remuneration is determined based on consolidated net profit. (3) Market-capitalization-linked bonuses were introduced in FYE 2019 as an incentive aimed at increasing corporate value. Furthermore, (4) the performance-linked and share-based remuneration was introduced in FYE 2017 with the aim of heightening awareness toward making contributions to increasing corporate value over the medium and long term.

| Type of Remuneration | Content | Remuneration Limit | Resolution of General Meeting of Shareholders | |

|---|---|---|---|---|

| Directors | (1) Monthly remuneration | Monthly remuneration determined by the contribution to ITOCHU of each director according to a base amount set by position | ¥1.2 billion per year as total monthly remuneration (including ¥50 million per year as a portion to the outside directors) | June 24, 2011 |

| (2) Performance-linked bonuses | Total amount paid is decided based on the basis of consolidated net profit Refer to the formula (*1) below. | ¥1.0 billion per year as total bonuses paid to all directors (excluding outside directors) | ||

| (3) Market-capitalization-linked bonuses | Total amount paid is decided based on the amount the Company’s market capitalization increased in comparison to the previous fiscal year Refer to the formula (*2) below. | |||

| (4) Performance-linked and stock-based remuneration | Total amount paid is decided based on the basis of consolidated net profit Refer to the formula (*1) below. | The following is the limit for a two-year period for directors and executive officers (excluding outside directors) Upper limit for contribution to trust from ITOCHU: ¥1.5 billion Total points awarded to persons eligible for the plan: 1.3 million points (conversion at 1 point = 1 share) |

June 24, 2016 | |

| Audit & Supervisory Board Members | Only monthly remuneration | ¥13 million per month | June 29, 2005 |

*1 Formulas for (2) Performance-Linked Bonuses and (4) Performance-Linked and Stock-Based Remuneration

Total Amount Paid to All Directors

Total amount paid to all directors = (A + B + C) x Sum of position points for all the eligible directors ÷ 55

A = (Of consolidated net profit for FYE 2019, the portion up to ¥200.0 billion) x 0.35%

B = (Of consolidated net profit for FYE 2019, the portion exceeding ¥200.0 billion and up to ¥300.0 billion) x 0.525%

C = (Of consolidated net profit for FYE 2019, the portion exceeding ¥300.0 billion) x 0.525% (of which, 0.175% as stock-based remuneration)

* Remuneration limits exist on bonuses and stock-based remuneration.

Amount Paid to an Individual Director

Amount paid to an individual director = Total amount paid to all directors × Assigned position points* ÷Sum of position points for all the eligible directors

Of the amount paid to an individual director, the portion corresponding to A and B in the total amount paid to all directors is paid entirely in cash. In regard to the portion corresponding to C, 0.175% is paid as share-based remuneration and the balance is paid in cash. Furthermore, the value of 70% of the portion paid in cash will increase or decrease depending on the rate by which the responsible organization meets its projected targets.

In regard to share-based remuneration during the term of office, annual points are awarded (1 point = 1 share), and at the time of retirement share-based remuneration is paid from the trust in correspondence with accumulated points.

* Points assigned by position

| Chairman | President | Executive Vice President | Senior Managing Executive Officers | Managing Executive Officers |

|---|---|---|---|---|

|

10 |

7.5 |

5 |

4 |

3 |

*2 Calculation Formula for (3) Market-Capitalization-Linked Bonuses

Amount Paid to an Individual Director

Amount paid to an individual director = (Average amount of daily stock market capitalization in FYE 2019 – Average amount of daily stock market capitalization in FYE 2018) × 0.1% × number of Position point ÷ 108.8

Position point for Board of Director members are the same points that are used to calculate performance-linked bonuses.