Our Business Model, as Seen through Business Development

Expanding Our Multifaceted Businesses and Tirelessly Upgrading

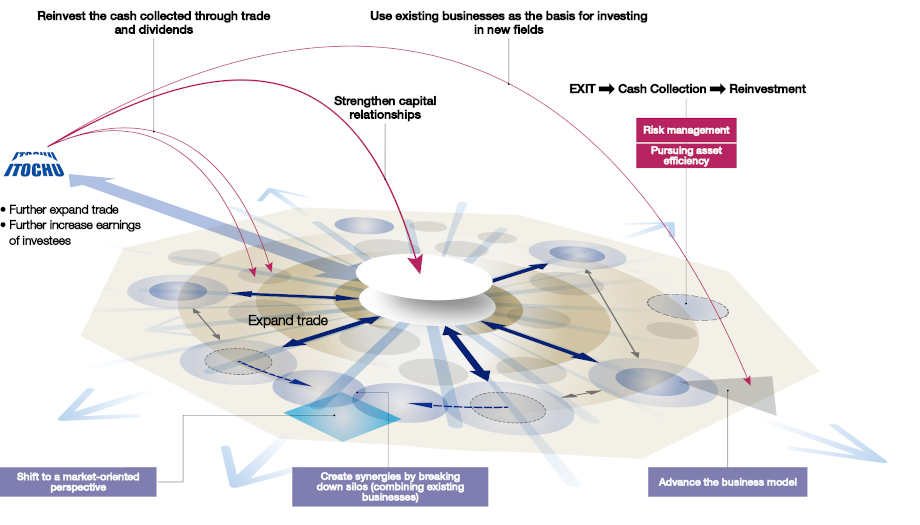

We are expanding our multifaceted businesses through a chain reaction by leveraging functional areas of strength. At the same time, we are combining existing businesses, shifting to a market-oriented perspective, and investing in new fields. Through such efforts, we continue to upgrade our business model and pursue a new vision of what a trading company can achieve.

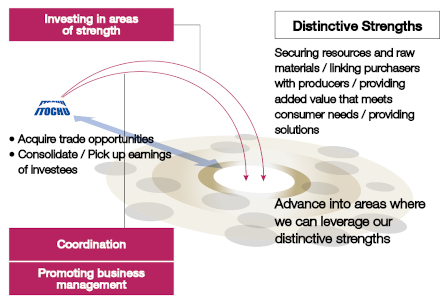

Advancing into Areas Where We Can Leverage Our Distinctive Strengths

We narrow down possible areas to those in which we can generate synergies with existing businesses and control risk, and advance into new businesses and markets through trade and investment.

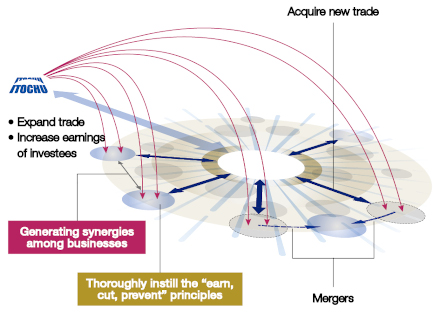

Establishing a Market Position and Creating Multifaceted, Linked Businesses

After advancing into a new area, we strive to acquire business know-how while setting our sights on the next step. At the same time, we leverage our management resources and create added value to increase investees’ corporate value and establish a market position. Thereafter, we continuously work to thoroughly instill the “earn, cut, prevent” principles, acquire new trade, generate synergies among businesses, and reorganize business, creating multifaceted, linked businesses.

Reinforcing Earning Power by Advancing (Upgrading) the Business Model and Strengthening Cross-Divisional Functionality, and Promoting Asset Replacement

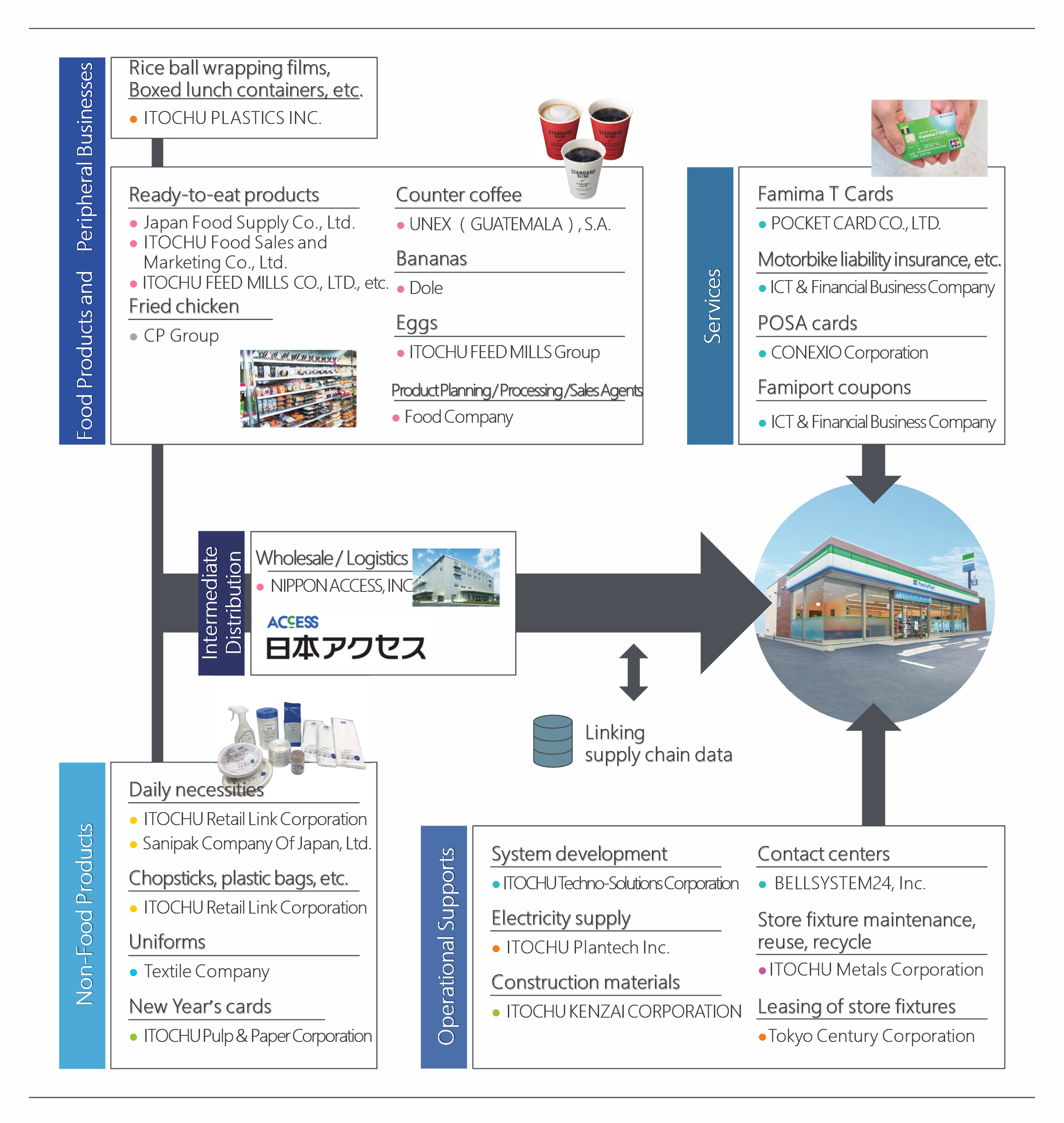

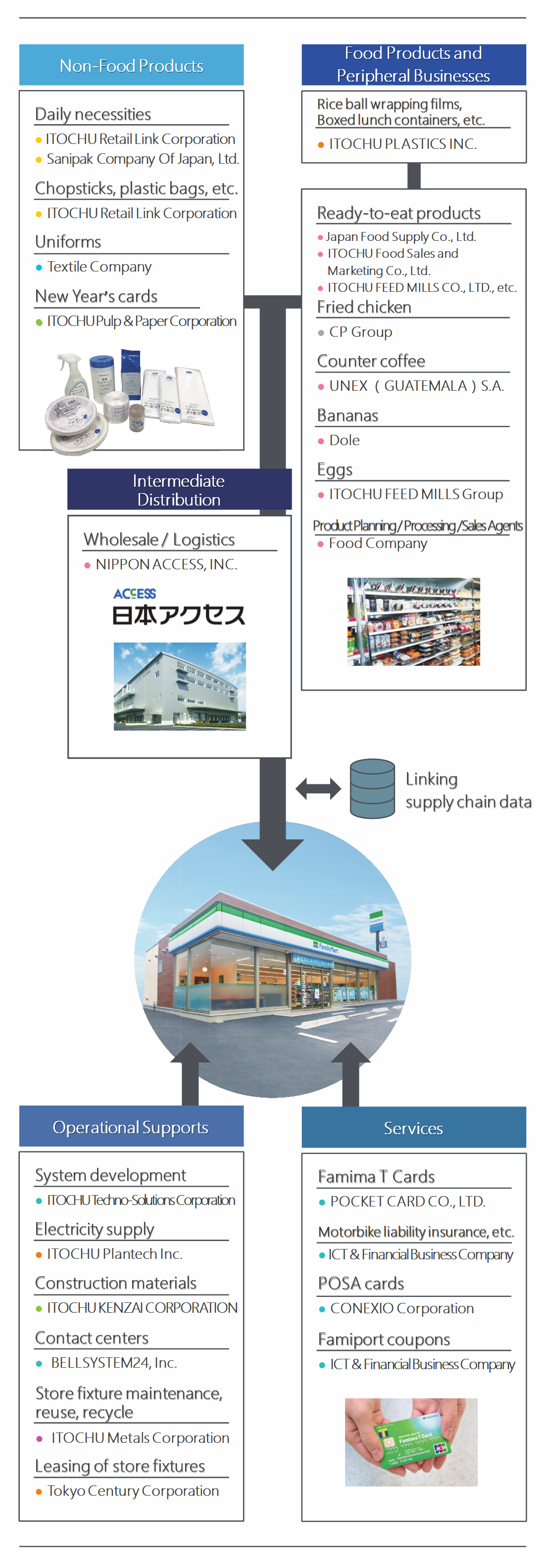

Examples from the Convenience Store Business

Acquiring Customer Contact Points

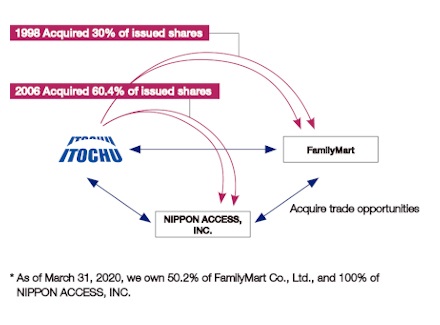

ITOCHU acquired approximately 30% of the issued shares of FamilyMart in 1998, marking our first full-fledged foray into the retail field. In 2006, we converted the general food wholesaler NIPPON ACCESS, INC., into a consolidated subsidiary. These moves accelerated reforms in our business model highlighted by the introduction of the Strategic Integrated System (SIS) strategy—building a value chain spanning the securement of foodstuffs; midstream processing, manufacturing, and intermediate distribution; and downstream retail.

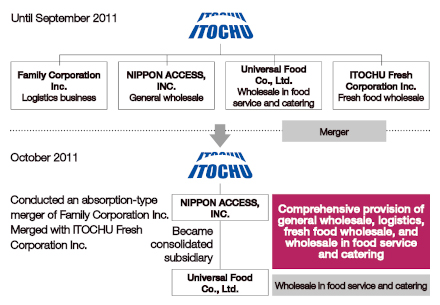

Strengthening the Intermediate Food Distribution Business through Reorganization

In October 2011, ITOCHU integrated its intermediate food distribution business, centering it on NIPPON ACCESS, INC. Through this reorganization, we built a system that can offer integrated handling of processed foods in all temperature ranges—ambient, frozen, and chilled—as well as the three main groups of fresh food products. This move also facilitated the provision of integrated distribution services. Now possessing top-class scale and functionality in the field of food distribution, we have created a structure providing our business partners with low-cost, high-quality logistics.

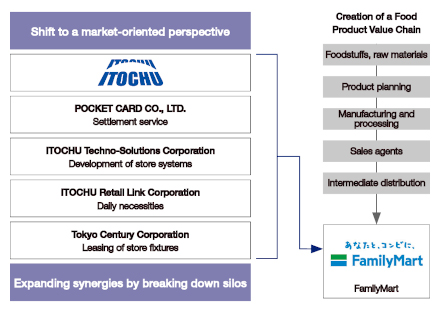

Creating a Value Chain in the Convenience Store Business

Centering on FamilyMart, we are creating and enhancing a value chain spanning upstream to downstream operations. At the same time, we are working to maximize Group synergies through the provision of business infrastructure involving such areas as non-food products, financial and insurance services, electricity supply, and system configuration. We are also collaborating with FamilyMart to utilize its data to develop new businesses and moving ahead with reinventing the value chain.

How ITOCHU Differs from a General Private Equity Fund

As we consider business investment one of our major options, our business model is often compared to that of a private equity fund. There are certain similar aspects, such as the desire to contribute proactively to management and maximize the corporate value of investees. We view as different, however, the facts that we are also aiming to increase our own corporate value as we focus on generating synergy with existing businesses and enjoy returns (cash) centered on trading profits and dividends.

Scroll

| General private equity fund | ITOCHU | |

|---|---|---|

| Investee liquidity | In principle, unlisted |

Either listed or unlisted |

| Investee ownership ratio | In principle, majority stake to 100% |

Decided individually, based on business conditions and market environment |

| Investee ownership period | Buy and hold having an exit strategy |

Buy and hold |

| Business synergies | In principle, none |

Create synergies with existing businesses |

| Returns (cash) | Capital gains and dividends |

In principle, trading profit and dividends |

Creating Synergies Infinitely —Vertically and Horizontally

The ITOCHU Group is building and enhancing a value chain spanning upstream to downstream operations with the aim of maximizing earnings from the Convenience Store business. In addition to fortifying the food value chain, we are generating synergies among businesses by making The 8th Company the starting point and going beyond Division Companies’ boundaries in such areas as daily necessities, fi nancial services, system development, and construction materials.