CFO Interview

![[image]](img/an09_im01.jpg)

Amid this year’s bruising business environment, we will balance our “offense” and “defense” to achieve a firm footing for even stronger growth.

Tsuyoshi Hachimura

Member of the Board, Senior Managing Executive Officer, CFO

Question 1

Please provide a general review of the financial and capital strategies in “Brand-new Deal 2020.”

Answer 1

We were able to achieve our promises a year ahead of schedule by steadily racking up accomplishments, one by one.

Despite a bruising business environment caused by the protracted U.S.–China trade friction and the emergence of COVID-19, FYE 2020 became ITOCHU’s most outstanding year ever in quantitative terms. We achieved our target of solidifying our earnings base at ¥500.0 billion in consolidated net profit for the second consecutive years and further strengthened our financial position. As a result, we were able to successfully conclude our three-year medium-term management plan, “Brand-new Deal 2020,” a year ahead of schedule. Moreover, we definitively kept our “four commitments” related to the financial and capital strategies that were set forth when “Brand-new Deal 2020” was released.

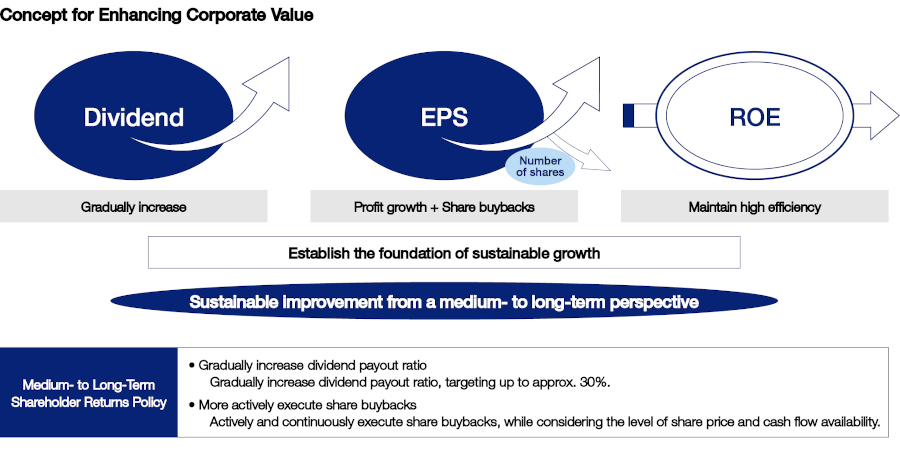

First, in terms of “enhancing shareholder returns,” we promised to continue our progressive dividend policy during the period of “Brand-new Deal 2020.” We achieved steady increases in dividends per share each fiscal year, up to ¥83 in FYE 2019 and ¥85 in FYE 2020, setting new record highs for both years. Furthermore, based on the “Medium- to Long-Term Shareholder Returns Policy” announced in October 2018, we showed our stance on maintaining high ROE management by continuously improving EPS (Consolidated net profit per share) through measures including share buybacks. Based on this policy, we dynamically and flexibly repurchased a cumulative total of ¥130.0 billion in shares in FYE 2019 and 2020. As a result, we were able to achieve a high level of shareholder returns in FYE 2020 with a dividend payout ratio of 25% and a total shareholder return ratio of 38%.

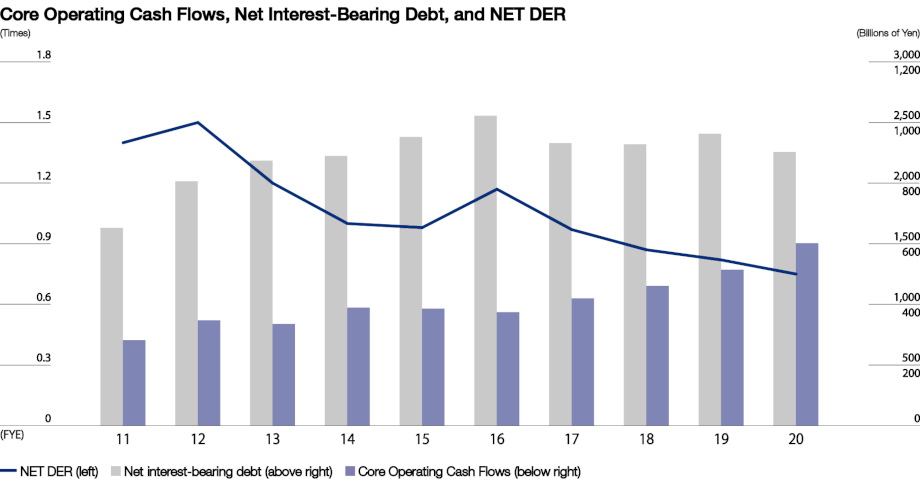

Next, in terms of “Core Operating Cash Flows,” we set record highs for the fourth consecutive year and exceeded ¥600.0 billion for the first time, reaching ¥602.0 billion. With our improving earning power, we also steadily racked up accomplishments in terms of “cash-generating power.” Amid an uncertain business environment, we conducted steady asset replacements while realizing the previously noted shareholder returns, and were able to maintain positive Core Free Cash Flows after deducting shareholder returns of ¥123.0 billion. Together with the ¥300.0 billion we recorded in FYE 2019, we have accumulated a huge cash inflow of more than ¥420.0 billion over the cumulative two-year period. We were able to further strengthen our financial position while acquiring a sufficient volume of excess funds for growth investments going forward.

In terms of NET DER, we achieved further improvement, reducing it from 0.82 times in FYE 2019 to 0.75 times and setting a new best record.

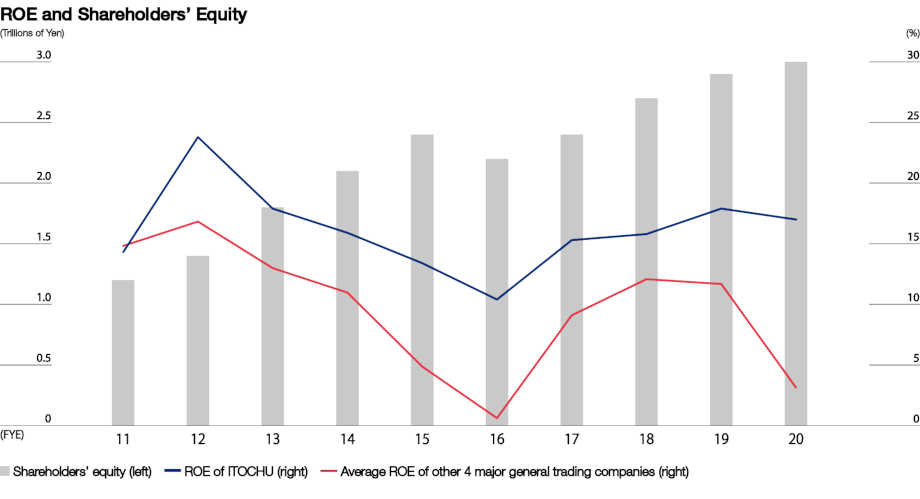

Finally, in terms of ROE, we hit 17.0%, beating our initial target of around 16%. By maintaining such a high level, we have held the No. 1 spot among general trading companies for six years running while striking a balance between “enhancing shareholder returns,” namely through higher dividends and share buybacks, and “enhancing shareholders’ equity.”

In addition to the methodical allocation of capital and enhancement of shareholder returns, we have once again earned praise from shareholders and investors regarding the stability and sustainability of our earnings in the non-resource sector, especially the consumer-related business, which is our strength. As a result, in FYE 2020 ITOCHU’s share price set 22 record highs.

Question 2

Are there any changes to the financial and capital strategies under the “FYE 2021 Management Plan?”

Answer 2

There have been no fundamental changes.

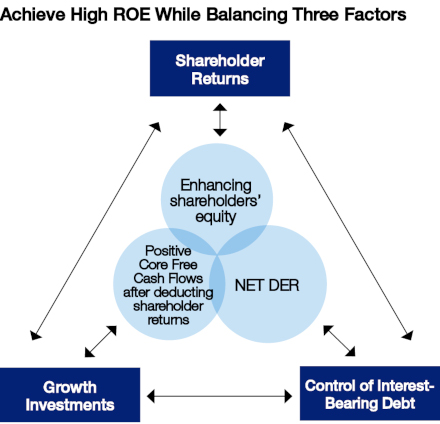

While the goals of “Brand-new Deal 2020” were achieved ahead of schedule, as mentioned previously, we have decided not to make any major changes under the single-year “FYE 2021 Management Plan” to the management policies in place. Neither have we made any changes to the “Policy to achieve high ROE while balancing three factors (shareholder returns, growth investments, and control of interest-bearing debt)” nor to the “Medium- to Long-Term Shareholder Returns Policy.”

The latter policy clarifies the two aspects of our approach to shareholder returns in the medium to long term (a period of three to four years from the policy’s announcement) concerning dividend payout ratio and share buybacks. It also sets forth our policy that focuses on EPS in order to achieve a medium- to long-term enhancement in corporate value. Basically, by working toward achieving profit growth, we aim to sustainably improve EPS and will therefore continue to search out growth investment opportunities. Meanwhile, we need to more seriously consider the financial impact of the extraordinary circumstances caused by the COVID-19 pandemic.

Regarding share buybacks, to live up to our commitments under this shareholder returns policy, we will continue to carry out the remaining “share buybacks of up to 35 million shares or ¥70.0 billion” as currently announced. However, we intend to continue to strike just the right balance to ensure that corporate management does not overemphasize either growth investments or shareholder returns. We seek to avoid becoming shackled to one side, which creates warped priorities.

Furthermore, regarding the status of our funding procurement, we have secured sufficient liquidity mainly through ample cash and deposits as well as commitment line agreements with financial institutions.

Question 3

Could you discuss ITOCHU’s investment policy as the economy teeters on the brink of recession?

Answer 3

Our policy is to minimize risks and carefully select investments that are certain to contribute to future earnings.

Amid concerns over geopolitical risks such as the U.S.–China trade friction and Brexit, and an emerging global economic recession due to COVID-19, we need to minimize risks surrounding growth investments and carefully select investments that are certain to contribute to future earnings.

Since investing in CITIC in FYE 2016, we were able to strengthen our financial position by restraining investment and promoting asset replacement. This has generated significant excess investment capacity. Going forward, we aim to achieve further profit growth by searching out investmenSince investing in CITIC in FYE 2016, we were able to strengthen our financial position by restraining investment and promoting asset replacement. This has generated significant excess investment capacity. Going forward, we aim to achieve further profit growth by searching out investment opportunities. At the same time, to ensure “balance sheet control for maintaining A ratings” as outlined under the FYE 2021 short-term management plan, we intend to pay full attention to “maintaining our financial discipline.” In other words, I think it is crucial that we achieve a good balance and consider the broader picture when investing, such as staying away from investments at their peak in order to refrain from unnecessary accumulation of goodwill, actively replacing low-efficiency or peaked-out assets, and ensuring sufficient shareholders’ equity as a risk buffer.

On the other hand, to date, the number of outstanding investment projects that would be suitable candidates for a merger or acquisition has been limited, and acquisition prices have remained high. As the economy begins to change direction, however, there is a high probability that there will be an increase in opportunities to invest in companies that are undervalued relative to their potential.

When investing, we, of course, consider candidates in line with our stringent investment criteria by fully leveraging the advantages of having the CFO as the chair of the Investment Consultative Committee. We steadily conduct highly strategic investments that will reinforce the fields of strength that ITOCHU has long accumulated, and will underpin continued profit growth going forward.

Question 4

Please tell us about the measures aimed at further enhancing corporate value.

Answer 4

I believe it is important that we steadily achieve our announced targets and promote reliable dialogue.

While forecasts predict a precipitous drop in global economic growth for 2020 as it is currently difficult to discern a way out of the COVID-19 pandemic, it is regrettable that the share price valuation of general trading companies remains low.

To further enhance ITOCHU’s corporate value, we will continue to steadily achieve the targets we announced, such as carrying out the aforementioned shareholder returns policy, maintaining a high ROE, and improving EPS over the medium to long term. Amid the COVID-19 pandemic, which continues to defy forecasts for containment, I think it is of the utmost importance that we continue to “disclose information” to facilitate deeper understanding and better decision-making, especially for all our shareholders and investors. As one of the leading general trading companies, we intend to continue fostering highly reliable dialogue through appropriate and timely disclosure.(→ The Positive Cycle of Dialogue and Enhancing Corporate Value)

In addition, speaking in ESG terms, due to the impact of COVID-19, greater attention is being paid not only to environmental efforts but also to corporate actions toward society. Because ITOCHU is a “general trading company” that sets importance on trade, we will continue working hard to resolve social issues by, for instance, providing a wide range of products and services and creating new businesses. We will also continue promoting balanced initiatives that take into consideration “all the priorities” including the environment and society, and not just “a single expedient.”

We will continue striving to sustainably enhance corporate value by diligently maintaining our unique, unshakable focus. This will also lead to a reduction in the cost of capital. Before concluding, I would like to mention that in June 2020 ITOCHU’s share price and market capitalization attained the top spot in the general trading sector. I would like to express my deepest gratitude to all our shareholders and investors. Moving forward, I intend to continue pursuing management that fully lives up to the expectations of our diverse stakeholders.