The Positive Cycle of Dialogue and Enhancing Corporate Value

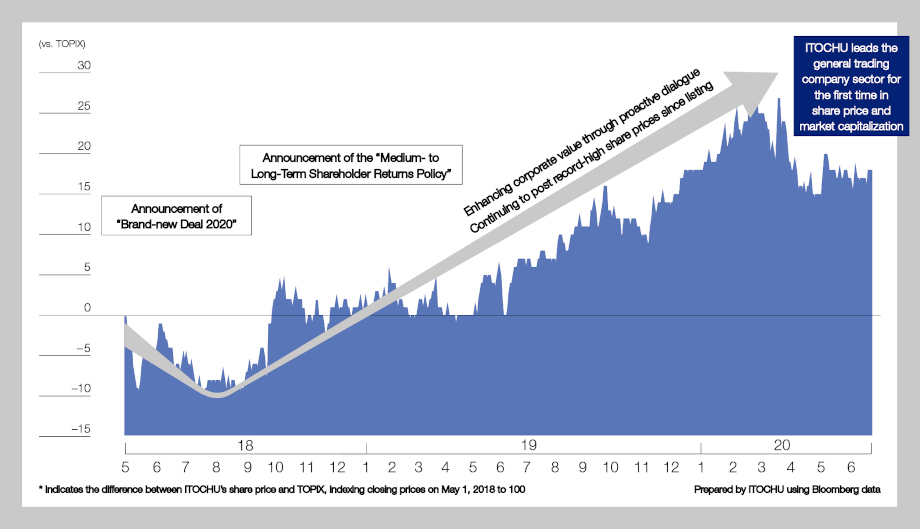

ITOCHU emphasizes dialogue with its shareholders, investors, and other stakeholders from the perspective of achieving sustainable growth and enhancing corporate value over the medium to long term. After announcing “Brand-new Deal 2020,” which failed to give due consideration to market expectations, the Company’s share price plunged. Learning from this experience, we now strive to reflect input obtained in investor meetings, general meetings of shareholders, and one-on-one meetings into our management strategies and financial and capital policies. Through commitment-based management, we are striving to expand corporate value and sustain a positive cycle through effective engagement.

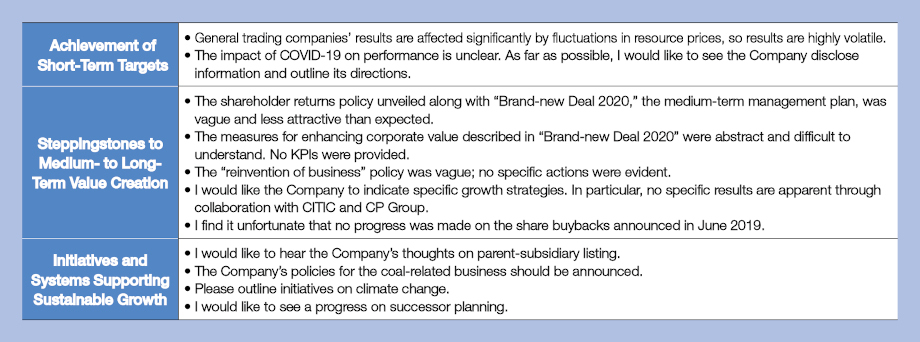

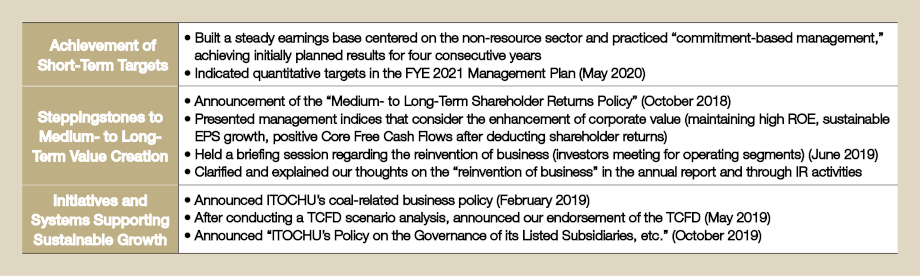

Examples of Feedback from Shareholders and Investors

Examples of Measures Launched as a Result of Dialogue

Issues the Company Recognizes It Needs to Address through Dialogue

ITOCHU’s Share Price Performance vs. TOPIX after Announcing “Brand-new Deal 2020”*

Steadily Moving Forward—Can ITOCHU Break through to Reinvention?

Managing Director

Equity Research Department

Nomura Securities Co., Ltd

Joined Nomura Securities Co., Ltd. in 1998. After being in charge of the shipping, land transport, and housing equipment sectors, took charge of the trading company sector in 2006. In the current position since 2015.

The general trading company business model is changing from a trading-oriented model to one based on business investment, and in recent years the Company has turned toward a strategy of augmenting business value by contributing actively to investees’ businesses. With peer companies struggling with low levels of profitability due to large investments and across-the-board investments, ITOCHU is focusing on consumer-related businesses—an area of expertise. The Company also focuses carefully on the profitability of investees via thorough cost management, therefore realizes steady profit growth and high profitability. While advances in information technology present general trading companies with good opportunities to create new businesses, such advances also pose the risk of making existing businesses obsolete. Reinventing its businesses in response to consumer needs and using its investment in CITIC as a lever to access China’s massive internal demand pose issues, as well as growth opportunities. We will be monitoring the situation.

Already Means Not Yet

Senior Analyst

Equity Research

SMBC Nikko Securities Inc.

In 2007, joined Morgan Stanley Securities Co., Ltd. (now Morgan Stanly MUFG Securities Co., Ltd.). After being assigned to the steel sector for approximately five years, in charge of the trading company sector since 2012. In the current position since 2013.

In its dialogue with the stock market, I give the Company high marks for the way top management took this input seriously. However, ITOCHU still needs to surmount a number of issues. In the short term, it needs to complete share buybacks. In the medium to long term, it needs to clarify its growth strategy, including the creation of synergies with CITIC, as well as further moves on climate change. Notably, low cash returns from CITIC are one reason the stock market is discounting ITOCHU’s shares. At present, we believe ITOCHU can maintain high ROE in FYE 2025, but I would like to see management set its sights even higher, at some “market expectation +.” If it can present a growth-oriented solution, ITOCHU may be able to change the way its shares are valued, stepping outside the framework of a general trading company.