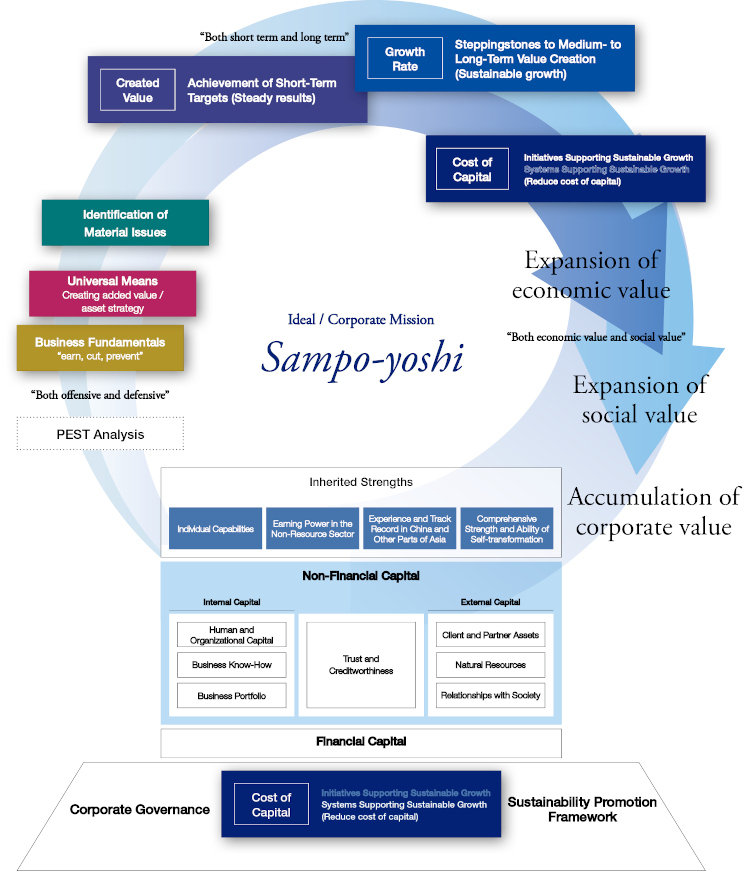

The "Merchant" Business Model

Pursuing “All the Priorities,” Not Just “a Single Expedient”

For more than 160 years, the “Sampo-yoshi” spirit has represented our unwavering ideal as a merchant. In keeping with this focus, rather than seeking to achieve a single target of either economic or social value, or either short-term targets or steppingstones for medium- to long-term growth, we aim to achieve “all the priorities.” Each of the merchants of the Group in charge of “Infinite Missions” makes the most of his or her “individual capabilities” to further enhance corporate value.

Explanation of Our Business Model

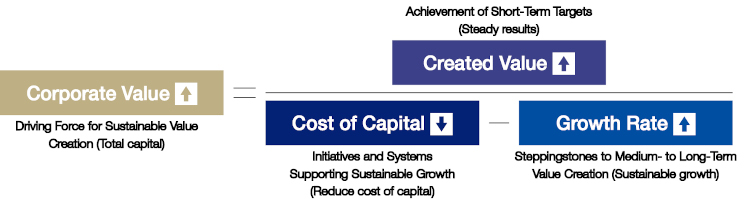

In our aim of enhancing corporate value, we must expand both economic and social value. Specifically, we are working to expand created value (Achievement of Short-Term Targets), increase growth rate (Steppingstones to Medium- to Long-Term Value Creation), and lower the cost of capital (Initiatives and Systems Supporting Sustainable Growth). As a result, we will realize a virtuous circle as we “reinforce capital,” which is a driving force for sustainable value creation.

Business Fundamentals and Universal Means as a Merchant

EARN

Conduct trade aligning with changes in the world and customer needs

CUT

Reduce expenses that are not cost effective, reduce unnecessary meetings and documents

PREVENT

Prevent outflows due to losses on receivables and impairment losses

Creating Added Value

We strive to stabilize commercial rights, expand trade, and increase the value of businesses including the companies that we have invested in, by leveraging the distinctive functions of a general trading company, continually creating added value from the viewpoint of our customers and the market-oriented perspective.

Coordination

In addition to the traditional functions of a general trading company, we aim to leverage client and partner assets to find optimal way of sales and cultivate sales routes and procurement partners as we respond to various customer needs and strive to expand trade.

Promoting Business Management

In addition to leveraging the various functions and management know-how we have accumulated as a general trading company, we take the initiative in forming business combinations and alliances with Group companies, enhancing the competitive advantage of our investees.

Generating Synergies among Businesses

By leveraging the Group’s management resources, we maximize synergies between existing businesses and Group companies, increasing the Group’s overall corporate value.

Asset Strategies

With the strategic importance of business investment increasing, we have developed and are steadily implementing asset strategies that emphasize investment in areas of strength, thorough risk management, and the pursuit of asset efficiency.

Investing in Areas of Strengths

We emphasize investment in areas where we have strength, such as the non-resource sector, centered on consumer-related businesses, and in China and other parts of Asia. On this basis, we are working to further reinforce our competitive edge.

Risk Management

In addition to managing total amount of risk by utilizing risk assets, we are also conducting risk management on a project-by-project basis through evaluation of investment efficiency using a hurdle rate based on the cost of capital. In this manner, we also work to analyze and control the various risks surrounding our businesses.

Pursuing Asset Efficiency

We exit from investments that are determined to be low-efficiency assets from such perspectives as scale of earnings, investment efficiency, and strategic significance. In this way, we are working to maximize free cash flows by increasing asset efficiency and strengthening cash generation power.