Our Business Model, as Seen through Business Development

By utilizing financial and non-financial capital, focusing on fields where we can demonstrate strengths, and creating multifaceted, linked businesses, we strive to enhance earning power of trade and business investment. By leveraging our business know-how and client and partner assets, we expand trade by creating added value and invest in fields where we have knowledge and can control risk. Amid rapid changes in the business environment, we are also strengthening our earnings base through timely strategic investments and continuous asset replacement for businesses that have passed their peak and/or are low-efficiency. Going forward, we will sustain value creation by maximizing synergies and upgrading our businesses through business transformation that starts from downstream and is driven by market-oriented perspectives, while thoroughly instilling the “earn, cut, prevent” principles.

By utilizing financial and non-financial capital, focusing on fields where we can demonstrate strengths, and creating multifaceted, linked businesses, we strive to enhance earning power of trade and business investment. By leveraging our business know-how and client and partner assets, we expand trade by creating added value and invest in fields where we have knowledge and can control risk. Amid rapid changes in the business environment, we are also strengthening our earnings base through timely strategic investments and continuous asset replacement for businesses that have passed their peak and/or are low-efficiency. Going forward, we will sustain value creation by maximizing synergies and upgrading our businesses through business transformation that starts from downstream and is driven by market-oriented perspectives, while thoroughly instilling the “earn, cut, prevent” principles.

Action Principals:

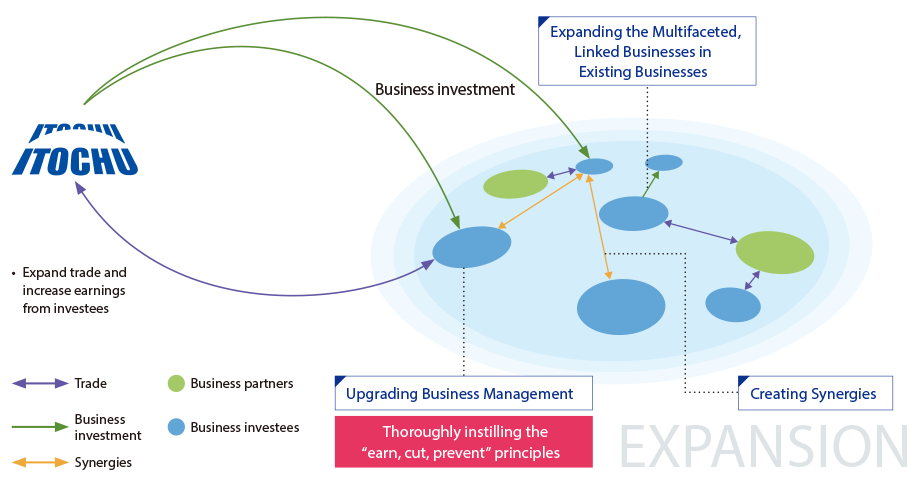

Forming Domains and Expanding Multifaceted, Linked Businesses through Trade and Business Investment

We utilize our accumulated financial and non-financial capital to develop businesses through trade and business investment. Our goal is to increase our earning power of trade and business investment. To this end, we upgrade business management by instilling the “earn, cut, prevent” principles, while creating multifaceted, linked businesses through trades and synergies.

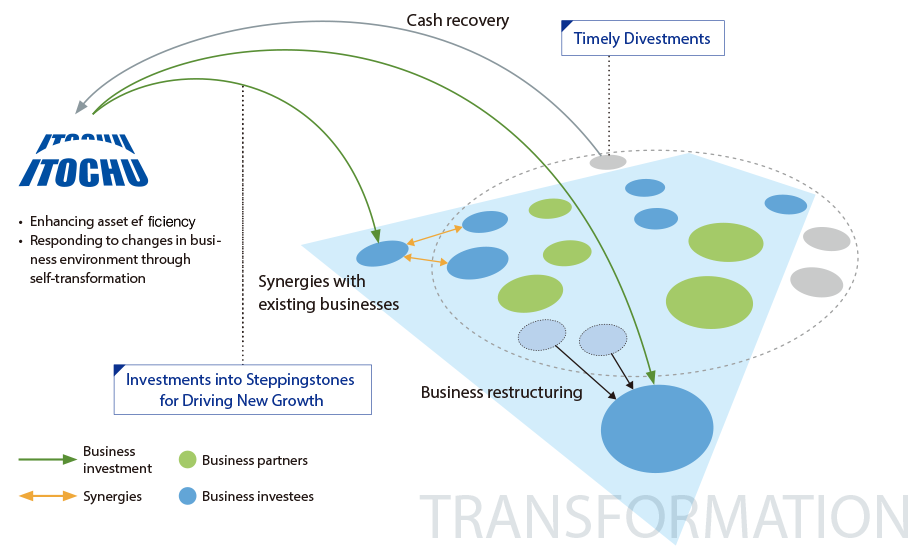

Responding to Changes in the Business Environment:

Building a Robust Earnings Base through Asset Replacement

We precisely assess changes in the business environment and execute cash recovery by business restructuring and exiting from assets that have lost strategic significance from the viewpoint of asset efficiency and risk management. By reinvesting the recovered funds into new strategic areas, we are building a more robust earnings base.

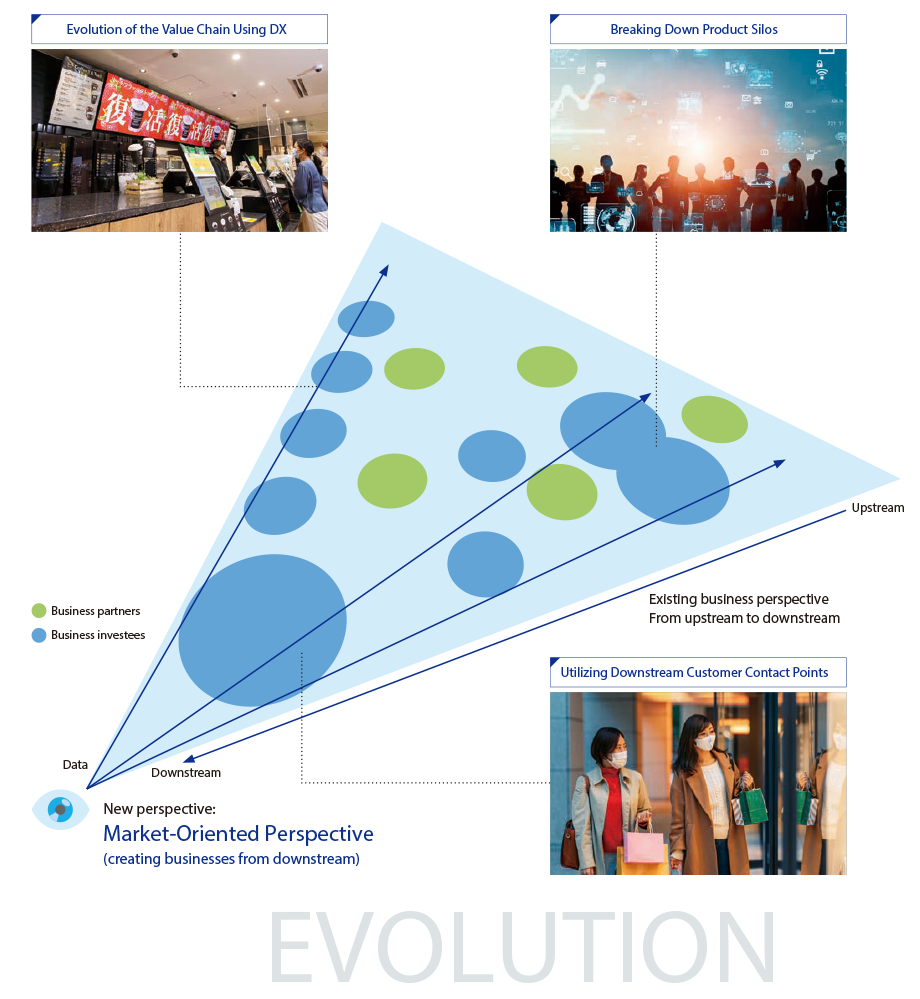

Meeting Consumer and Social Needs:

Upgrading Our Business Model from a Market-Oriented Perspective

We will upgrade businesses to respond to consumer and social needs by shifting to a downstream-centered market-oriented perspective and by strengthening collaboration among Division Companies to break down product silos. Furthermore, we aim to expand our earnings base by fully utilizing our real and digital customer contact points. We will further improve asset efficiency through optimization of value chains by utilizing data and new technologies and pursuit of greater efficiency of business management.

Basic Policies of “Brand-new Deal 2023”

ITOCHU is prompting business transformation based on basic policies of Brand-new Deal 2023: “Realizing business transformation by shifting to a market-oriented perspective” and “Enhancing our contribution to and engagement with the SDGs through business activities.” In this special feature, we will illustrate examples that we continue aiming to sustainably enhance corporate value and expand our earnings base by transformation of business model.

Realizing business transformation by shifting to a market-oriented perspective

TRANSFORMATION1:FamilyMart’s Goal of Renewed Growth Evolution of Value Chains, Starting with FamilyMart

TRANSFORMATION2:Self-Transformation in Anticipation of Changes in the Market of the ICT & Financial Business Company

TRANSFORMATION3:Polishing Business through a Hands-On Management Style (DESCENTE LTD. and YANASE & CO., LTD.)

TRANSFORMATION4:New Steppingstones for the Advancement of the Construction Machinery Business (Hitachi Construction Machinery Co., Ltd.)

Enhancing our contribution to and engagement with the SDGs through business activities

TRANSFORMATION5:Business Expansion in Accordance with a Decarbonized Society (Distributed Power System Supply Platform)

TRANSFORMATION6:Sustained Growth through Strengthening the Value Chain (Natural Rubber and Tire Business)