Management Policy & Management Plan

The Management Policy

(Released on April 2024)

The Management Policy (Released on April 2024)

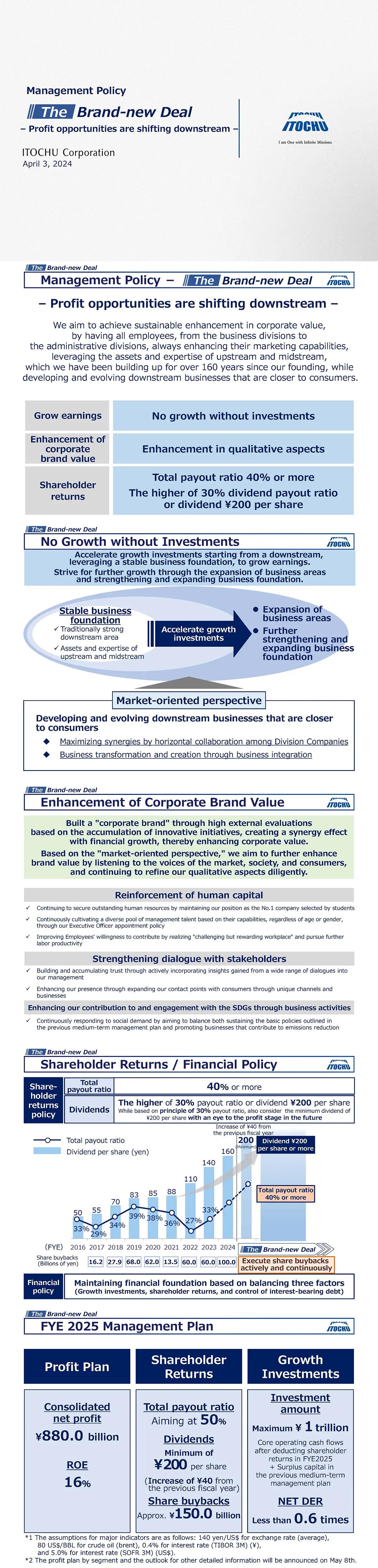

- In April 2024, we announced Management Policy, "The Brand-new Deal" as a long-term management compass, aiming for the sustainable enhancement of corporate value.

- We have decided to stop releasing medium-term management plan and will announce a single-year management plan (including profit plans, financial indicators,and shareholder returns) at the beginning of each fiscal year, which we can confidently commit to.