Our Business Model, as Seen through Business Development

By utilizing financial and non-financial capital, focusing on fields where we can demonstrate strengths, and creating multifaceted, linked businesses, we strive to enhance the earning power of our trade and business investment. By leveraging our business know-how and client and partner assets, we expand trade by creating added value and invest in fields where we have knowledge and can control risk. Amid rapid changes in the business environment, we are also strengthening our earnings base through timely strategic investments and continuous asset replacement for businesses that have passed their peak and / or are low-efficiency. Going forward, we will sustain value creation by maximizing synergies and upgrading our businesses through business transformation that starts from downstream and is driven by market-oriented perspectives, while thoroughly instilling the “earn, cut, prevent” principles.

Action Principles:

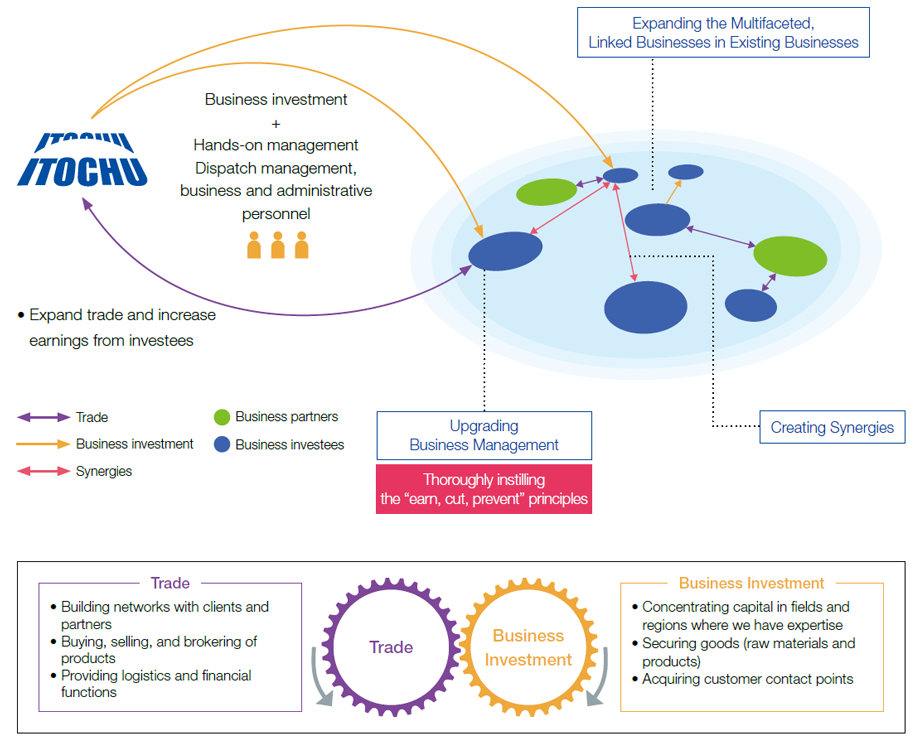

Forming Domains and Expanding Multifaced, Linked Business through Trade and Business Investment

We utilize our accumulated financial and non-financial capital to develop businesses through both trade and business investment. Our goal is to increase our earning power of trade and business investment. To this end, we upgrade business management by instilling the “earn, cut, prevent” principles and implementing a hands-on management, while creating multifaceted, linked businesses through new trade and creating synergies.

Responding to Changes in the Business Environment:

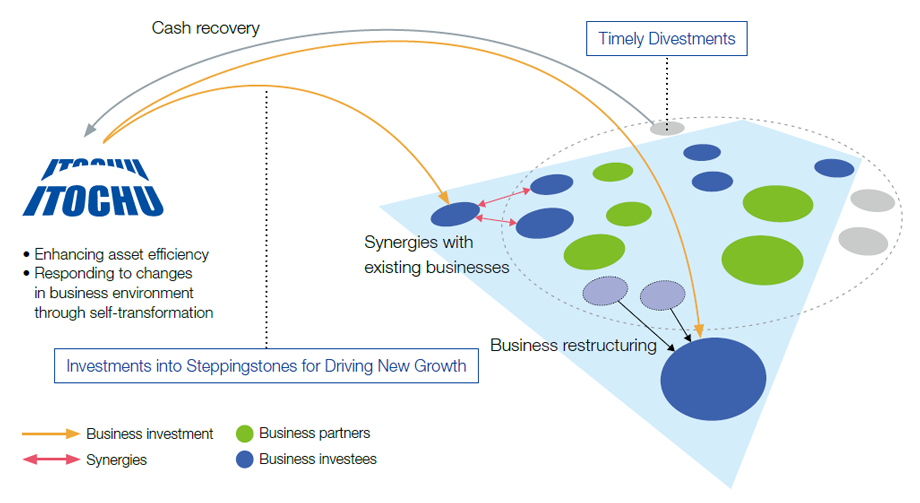

Building a Robust Earnings Base through Asset Replacement

We precisely assess changes in the business environment and execute cash recovery by business restructuring and exiting from assets that have lost strategic significance from the viewpoint of asset efficiency and risk management. By reinvesting the recovered funds into new strategic areas, we are building a more robust earnings base.

Meeting Consumer and Social Needs:

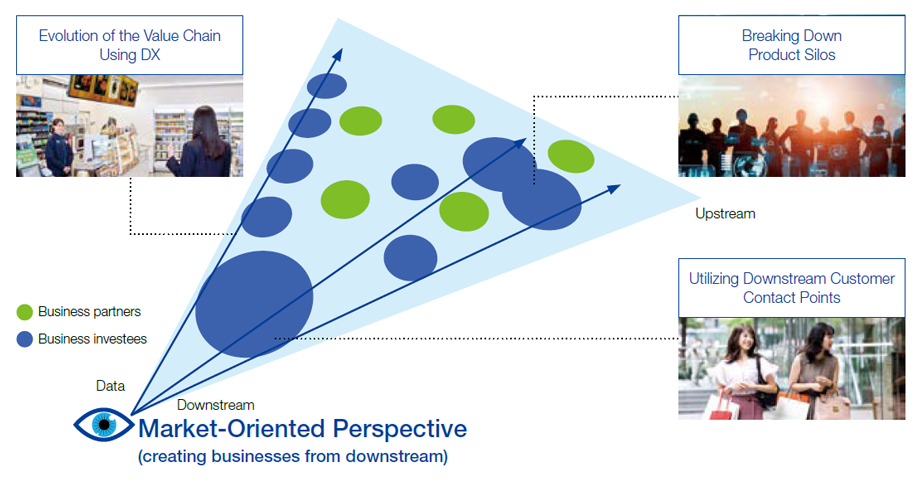

Upgrading Our Business Model from a Market-Oriented Perspective

We will build a business model that caters to consumer and social needs by shifting to a downstream-centered market-oriented perspective and by strengthening collaboration among Division Companies through breaking down product silos. Furthermore, we aim to expand our earnings base and improve asset efficiency through optimization of value chain by fully utilizing our real and digital customer contact points, and new technologies and data.

Frequently Asked Questions about Our Business Model

This section explains the key features of our business model and provides examples of it with the aim of addressing questions that are often asked by investors, shareholders, and other stakeholders.

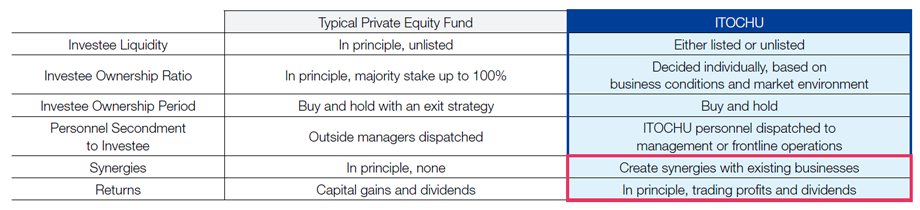

Q1. What are differences between investment business of ITOCHU and typical private equity fund?

There are certain similar aspects, such as the desire to contribute proactively to investees’ management and maximize the corporate value of investees. However, we are aware that there are differences in terms of dispatching our personnel, focusing on generating synergies with existing businesses, and enjoying returns centered on trading profits and dividends.

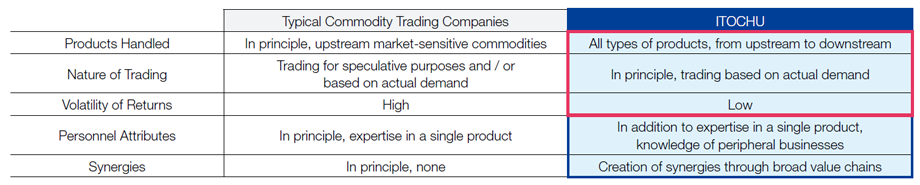

Q2. What are differences between trading business of ITOCHU and typical commodity trading companies?

Traditionally, general trading companies’ core businesses are engaged in trade. By buying, selling, and brokering products, we build relationships with customers and partners, and form sales channel of all kinds of products and information networks that have global reach. Although there exist similarities in the trading of such resources as crude oil and iron ore, and grains that is handled by ITOCHU and typical commodity trading companies in terms of buying, selling, and brokering products through global networks, we are aware that there are differences in terms of the products handled, nature of trading and volatility, etc.

Q3. Could you describe a specific case of asset replacement that took advantage of changes in the business environment?

One example of asset replacement in FYE 2023 was the sale of CONEXIO Corporation (CONEXIO). CONEXIO was a Group company that was originally spun off from ITOCHU’s mobile phone agency business, and it had been contributed to the Group’s profits over many years. However, as the business environment grew harsher in the mobile phone sales industry, such as declining sales of new devices, ITOCHU determined that accepting a tender offer for CONEXIO disclosed in FYE 2023 would further enhance the corporate value of both CONEXIO and the Company, and so we decided to implement strategic asset replacement.(→ Discussions at Meetings of the Board of Directors Related to an Individual Project)![]()

On the other hand, to take advantage of the growth in the used mobile phone device market against a backdrop of increasingly expensive new mobile devices and SDGs trends, we founded Belong Inc. in February 2019 as a foundation for building a new profit base. Leveraging the expertise that ITOCHU accumulated through the mobile phone device trade, along with the know-how and supplier network cultivated through mobile phone agency business, Belong Inc. buys back and sells used mobile phones and tablets with its own operation center for inspection, repair, storage, and delivery. In addition, Belong Inc. launched a business to rent out and buy back devices from corporate customers to address their needs for used mobile phones and tablets mainly due to rising prices of new devices. Furthermore, the company is working to diversify its businesses, such as starting an initiative to promote sustainability in food delivery businesses with Uber Eats Japan, Inc., with whom we are collaborating on a project to collect and reuse tablets.