CFO INTERVIEW

We will continue to enhance “high-quality management,” maintaining financial and capital strategies that optimally combine “offense,” “defense,” and “preparations,” without letting our guard down against rapid changes in the business environment.

Member of the Board, Executive Vice President, CFO

Tsuyoshi Hachimura

Please explain your overall assessment of the financial and capital strategies in FYE 2023.

It was a year in which we saw solid results from our consistent financial and capital strategies.

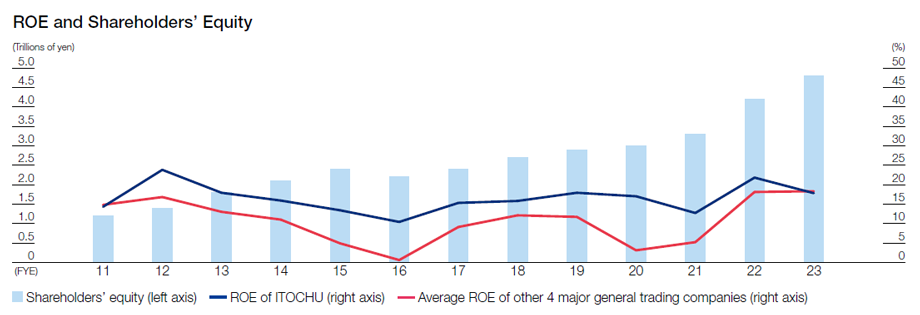

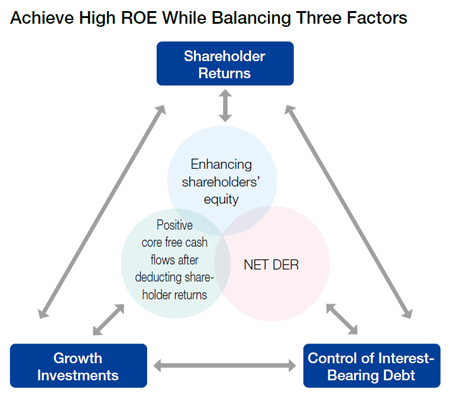

Since becoming CFO in FYE 2016, I have repeatedly stated that it is important to balance three factors (shareholder returns, growth investments, and control of interest- bearing debt) by appropriately assessing the business environment at the time. I have therefore focused on realizing high ROE, achieving positive core free cash flows after deducting shareholder returns, and thoroughly conducting hands-on management. It has been especially important these past few years, with the business environment changing rapidly, that we had to be mindful of both the equity side as well as the credit side, which at times conflict with each other, without tilting too much to either side. I believe executing well-balanced and consistent financial and capital strategies leads to highly efficient “high-quality management,” which will ultimately bring sustainability to our corporate value enhancement.

Since becoming CFO in FYE 2016, I have repeatedly stated that it is important to balance three factors (shareholder returns, growth investments, and control of interest- bearing debt) by appropriately assessing the business environment at the time. I have therefore focused on realizing high ROE, achieving positive core free cash flows after deducting shareholder returns, and thoroughly conducting hands-on management. It has been especially important these past few years, with the business environment changing rapidly, that we had to be mindful of both the equity side as well as the credit side, which at times conflict with each other, without tilting too much to either side. I believe executing well-balanced and consistent financial and capital strategies leads to highly efficient “high-quality management,” which will ultimately bring sustainability to our corporate value enhancement.

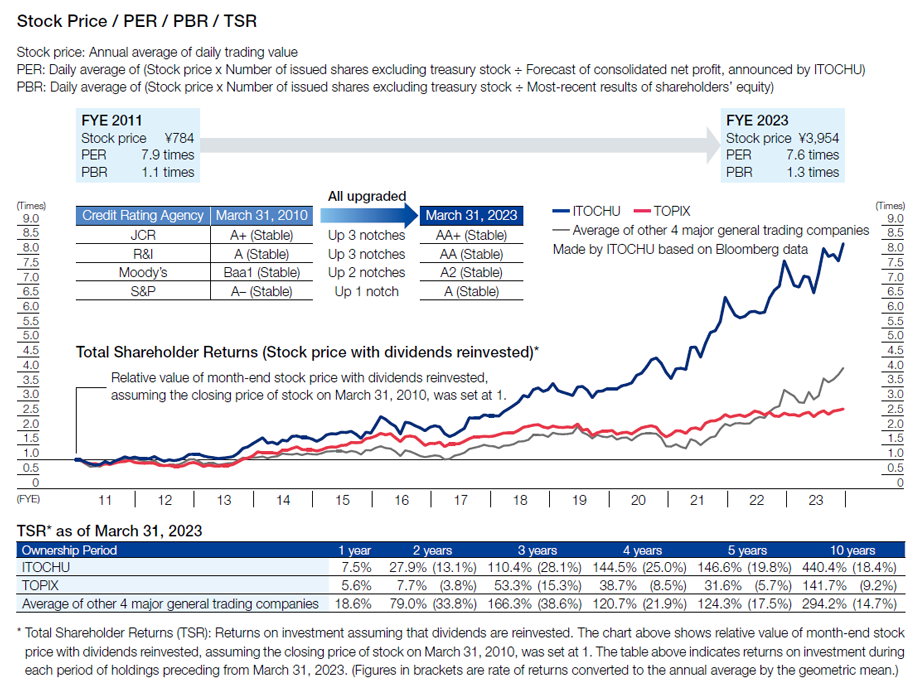

In line with this belief on the equity side, ITOCHU’s share price during the period of the medium-term management plan “Brand-new Deal 2023 (FYE 2022–2024)” set 43 record highs as of August 31, 2023. This was driven by a rise in our profit level to the ¥800.0 billion stage, and the consistent shareholder returns policy laid out subsequently, as well as being buoyed in part by yen depreciation and the “Buffett effect.” We think that this steady increase in share price shows the high expectations of investors and shareholders, as well as the high evaluation they continue to extend to the Company’s management.

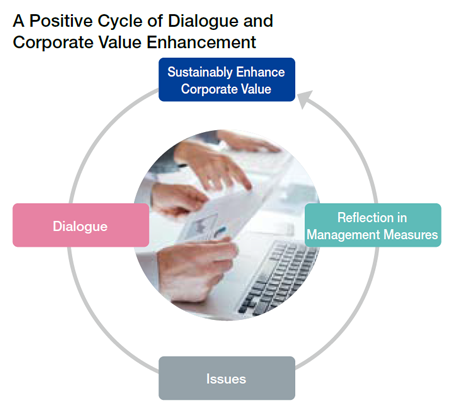

We also made progress on the credit side. ITOCHU’s credit rating was upgraded in FYE 2023 by the major overseas rating agency Moody’s, as well as major Japanese rating agencies Rating & Investment Information (R&I) and Japan Credit Rating Agency (JCR). In particular, the upgrade by Moody’s marked the first upgrade in credit rating for Japanese companies with an A rating since FYE 2020. As a result, we have secured the highest rating among general trading companies from every rating agency. Since our rating was last upgraded in FYE 2018, and especially since FYE 2022 when the anticipations of the post-pandemic recovery were heightened, expectations of shareholder returns for general trading companies have been high. To meet the expectations, ITOCHU has steadily enhanced its shareholder returns. However, amid a highly uncertain business environment, I have crafted and implemented consistent financial and capital strategies with the strong belief that reinforcing shareholders’ equity and improving financial indicators are essential and ultimately ensure stable corporate management and higher corporate value. The fact that ITOCHU refined its highly efficient earnings base and cash generation capability, together with executing financial and capital strategies that create a virtuous cycle leading to the further improvement of our financial indicators and reinforcement of shareholders’ equity, which increases risk resilience, led to the upgrades from the credit rating agencies. This enabled more flexible and diverse funding, further widening our options including bond issuances, and is sure to be a significant advantage to ITOCHU as we continue to consider growth investments, especially while the uncertainties lingering ahead.

Numerous IR activities underpin these efforts. In addition to securing its credit rating, the Company focuses on compiling the annual report as its most fair disclosure tool. ITOCHU delivered solid achievements last fiscal year, including receiving the highest evaluation from all three major awards for the annual report, which was the first accomplishment in Japan. We believe this kind of steady enhancement of non-financial capital, coupled with the aforementioned expansion of financial capital, will lead to higher overall corporate value, and ITOCHU will continue to commit to engaging in proactive IR activities.

What is the shareholder returns policy for FYE 2024?

As always, we commit to the steady enhancement of shareholder returns that are not swayed by economic volatility.

The two key points of our basic shareholder returns policy during the period of “Brand-new Deal 2023” are, “implementation of incremental increase to the minimum dividend and achieving a dividend payout ratio of 30% by FYE 2024” and “actively and continuously executing share buybacks.” The meaning of “actively and continuously” regarding share buybacks is that, in the event that the dividends based on our progressive dividend policy seem to fall short, we will assess the status of surplus capital at the time and continuously conduct share buybacks in an effort to enhance shareholder returns.

The two key points of our basic shareholder returns policy during the period of “Brand-new Deal 2023” are, “implementation of incremental increase to the minimum dividend and achieving a dividend payout ratio of 30% by FYE 2024” and “actively and continuously executing share buybacks.” The meaning of “actively and continuously” regarding share buybacks is that, in the event that the dividends based on our progressive dividend policy seem to fall short, we will assess the status of surplus capital at the time and continuously conduct share buybacks in an effort to enhance shareholder returns.

In early October 2022, we announced the “Upward Revision of FYE 2023 Forecast and Additional Shareholder Returns.” After revising our FYE 2023 forecast for consolidated net profit upward to ¥800.0 billion, we announced a ¥30 year-on-year increase in dividend per share (DPS) to ¥140, equivalent to a dividend payout ratio of 25.6%, and share buybacks totaling ¥35.0 billion. As ITOCHU aims to achieve a dividend payout ratio of 30% by FYE 2024, the market seemed to feel that this fell somewhat short. To meet market expectations amid this situation, we announced additional share buybacks of ¥25.0 billion in February 2023 for a cumulative total of ¥60.0 billion. By raising the total payout ratio to 33%, we showed our stance to the market that ITOCHU would stand by its commitment of achieving a dividend payout ratio of 30% by FYE 2024, the final year of our medium-term management plan.

In light of this development, for the initial plan for FYE 2024, we announced a ¥20 year-on-year increase in DPS to ¥160, a dividend payout ratio of 30%, along with consolidated net profit of ¥780.0 billion. At the same time, we stated our policy of ensuring the total payout ratio does not fall below 33%, which we reached in FYE 2023.

As for the share buyback announced in August 2023, our intention is to fulfill the commitment made at the beginning of the fiscal year by conducting the ¥25.0 billion as quickly as possible in the first place. Additionally, by extending our track record for share buybacks to eight consecutive years, we demonstrate the continuity of our policies. We will always focus on “actively and continuously,” and enhance our shareholder returns in FYE 2024.

Under the initial plan for FYE 2024, we announced that when we revise the forecast upward during the fiscal year, we would execute additional shareholder returns eyeing a total payout ratio of 40%. In order to meet market expectations for the final year of the medium-term management plan, in which we are at the ¥800.0 billion stage, we will first focus on firmly achieving the second quarter numbers, assess the future progress and growth expectations, and consider an upward revision.

What is your policy for growth investments in FYE 2024?

We will continue to consider and promote growth investments that contribute to the interests of all stakeholders.

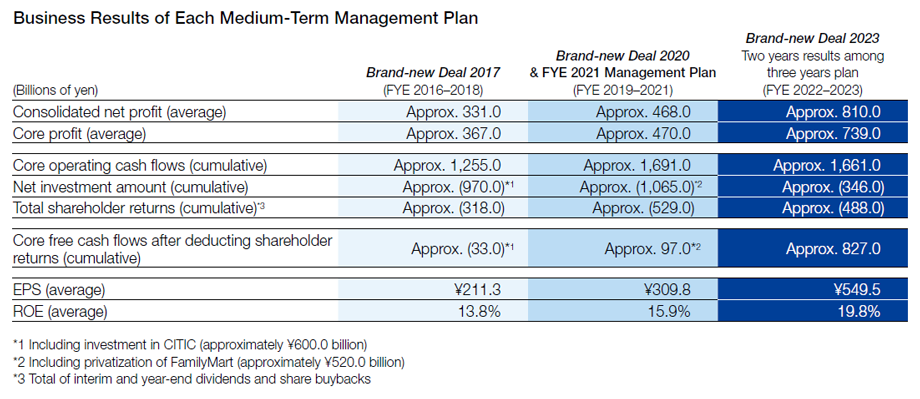

The current medium-term management plan is the third plan announced since I became CFO. Under “Brand-new Deal 2017 (FYE 2016–2018),” core operating cash flows for the three-year period comprised inflows of ¥1,255.0 billion and net investment cash outflows of ¥970.0 billion, due in part to our investment in CITIC. Core free cash flows after deducting ¥318.0 billion of shareholder returns were close to zero. Over the three years of this medium-term management plan, the ratio of shareholder returns to investments was approximately one for shareholder returns and three for investments. Next, under “Brand-new Deal 2020 and the FYE 2021 Management Plan (FYE 2019–2021),” core operating cash flows for the three years comprised inflows of ¥1,691.0 billion and net investment cash outflows of ¥1,065.0 billion, due in part to privatization of FamilyMart. Core free cash flows after deducting ¥529.0 billion of shareholder returns turned positive at approximately ¥100.0 billion. Over the three years, the ratio of shareholder returns to investments was approximately one for shareholder returns and two for investments. The ratio of shareholder returns was higher than the ratio during “Brand-new Deal 2017.” During the six years of these two medium-term management plans, although we invested in major projects that form our current foundation for growth, including the investment in CITIC and privatization of FamilyMart, we have maintained positive core free cash flows after deducting shareholder returns. In addition, consolidated net profit have almost doubled over these six years, expanding from approximately ¥400.0 billion to approximately ¥800.0 billion.

Finally, due in part to the steady accumulation of operating cash flows, core operating cash flows were approximately ¥1,661.0 billion positive during the previous two years (FYE 2022–2023) under “Brand-new Deal 2023.” While net investment cash outflows were approximately ¥346.0 billion, due in part to asset replacements and advanced divestments. Core free cash flows after deducting ¥488.0 billion of shareholder returns for the previous two years remained positive at ¥827.0 billion. Although we have not disclosed a forecast for core operating cash flows in FYE 2024, if the level remains similar to that of the past two years, because we have already committed to a dividend payout ratio of 30% and a total payout ratio of 33%, shareholder returns will be approximately ¥260.0 billion, and core free cash flows after deducting shareholder returns will be ¥500.0–¥600.0 billion. Similar to the two previous medium-term management plans, if core free cash flows after deducting shareholder returns are to be zero or just above zero for the three years of the current medium-term management plan, we would add ¥500.0–¥600.0 billion of core free cash flows after deducting shareholder returns in FYE 2024 to the ¥827.0 billion of core free cash flows after deducting shareholder returns generated in the previous two years. The total, excluding the capital expenditure which occurs regularly and additional shareholder returns, would be the investable amounts in FYE 2024.

In FYE 2024, including the tender offer bids (TOB) for CTC and DAIKEN CORPORATION, which were announced in August 2023, we have already built up a highly probable investment pipeline in each sector, and are planning to increase cash allocation to growth investments. We, of course, do not believe we will be able to execute every investments in the pipeline, but will maximize growth investments with the goal of boosting our current profit stage to beyond the ¥800.0 billion level. We will also continue “preparations” to maintain high ROE through sustained profit expansion.

In my ninth year as CFO, I held interviews with investors and shareholders, including members of Berkshire Hathaway Inc., who visited Japan in April 2023. I also represented ITOCHU in discussions with credit rating agencies. With a firm recognition of the significance of these actions, I will fulfill my duties as CFO. As I enter my sixth year as Chair of the Investment Consultative Committee, I promise to consider and promote growth investments that contribute to the interests of all stakeholders, by fully exercising my capabilities, following comprehensive assessments of the current economic situation, the trend toward sustainability, as well as lessons learned from our past investments.