Special Feature 2:Polishing Our Existing Business and New Steppingstones

Polishing and Further Expanding the Earnings Base of the North American Construction Materials Business through a Hands-on Management Style

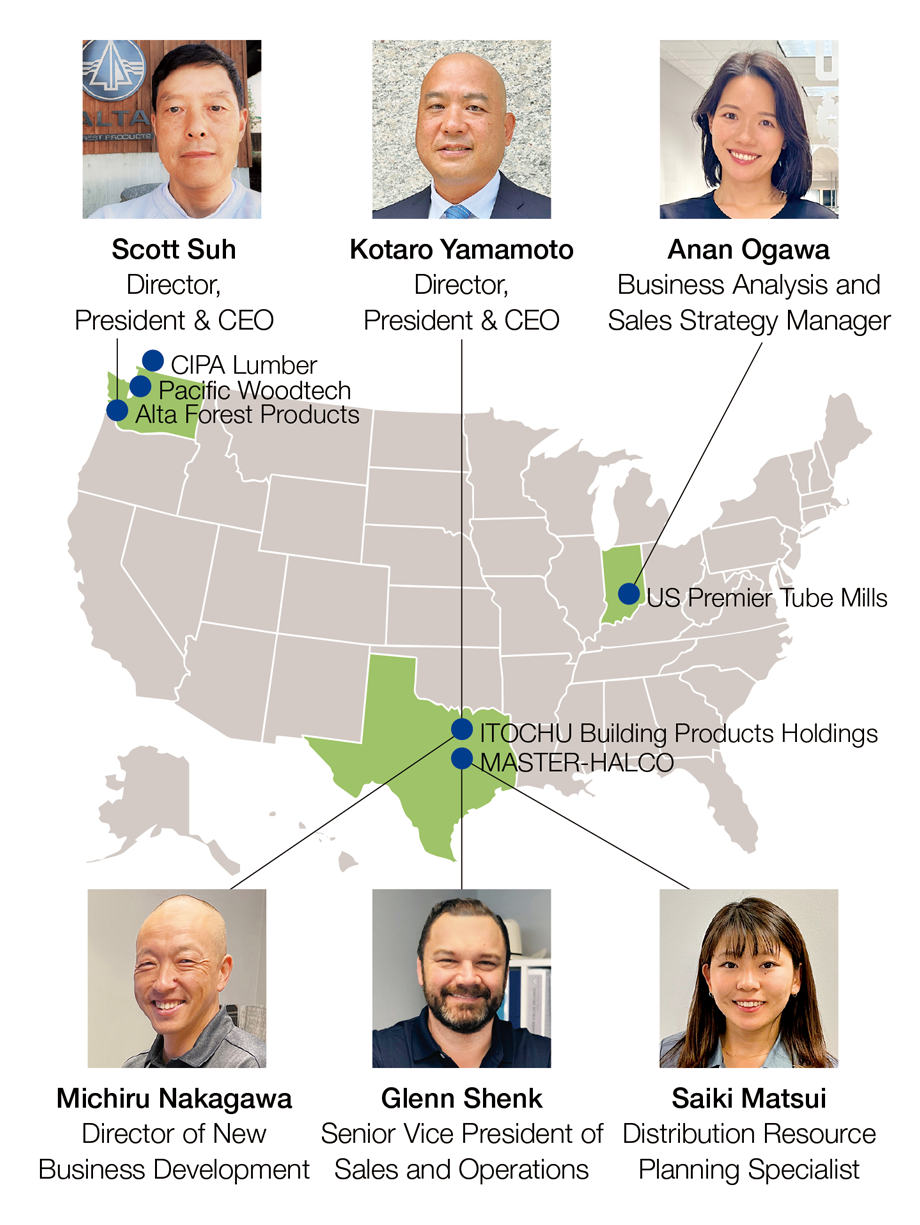

The hands-on management style practiced by ITOCHU is able to carefully refine each business by deploying ITOCHU’s management, sales and administrative personnel to key positions and frontline operations at investee companies. Once positioned overseas, our employees become deeply embedded into the local operations as part of our hands-on management style. The Company’s employees work closely with local employees to expand their company’s business and sustainably enhance its corporate value after learning about the trade customs and cultures of a particular country.

The North American Construction Materials Business: In the Early 2010s

MASTER-HALCO, Inc. (MH) engages in the manufacturing and wholesale of chain link fences at its own manufacturing facilities and through its own sales offices and distribution network covering all of North America. Despite having a network of prime customers including major home improvement retailers, MH continued to see losses in its operations since the global recession of 2008. ITOCHU had considered exiting the business. However, given the robust forecast called for continued strong growth in the North American market, etc., we decided to implement efforts to restructure MH by dispatching personnel well-versed in the North American business, and utilizing its hands-on management style.

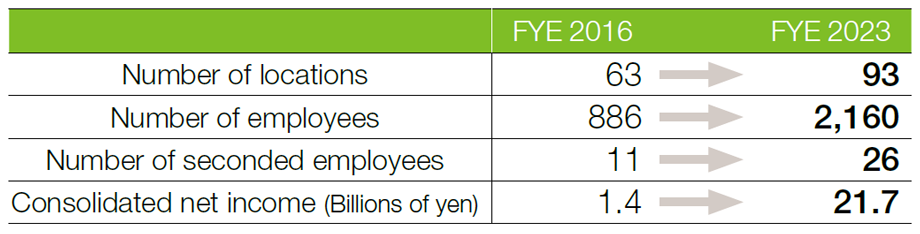

Transition of the North American Construction Materials Business

Refining MH Business through a Hands-On Management Style: After the Late 2010s

Management Reform of MH

The top priority was to urgently eliminate the losses, so ITOCHU dispatched personnel experienced in practicing our “cut” and “prevent” principles to a wide range of positions, including top management and the front lines. In addition to closing unprofitable factories and branches, which had consistently generated losses in the past, we revamped MH’s backbone system (ERP) that had not been renewed in about 20 years. We also established a management system capable of making detailed demand forecasts. These efforts succeeded, and we achieved profitability in FYE 2017. And to build an even more robust earnings base, we continued to promote further reforms. Utilizing our know-how gained from the business investment and trade, ITOCHU introduced refined pricing strategies, strict inventory management, and remuneration systems linked to profit rather than sales. In addition to these measures, marketing and sales activities were conducted mainly by local employees with a deep understanding of North American trade practices. As a result, our profit margin steadily improved, and we worked hard to strengthen our earnings base.

Expanding the Multifaceted, Linked Businesses in Existing Businesses

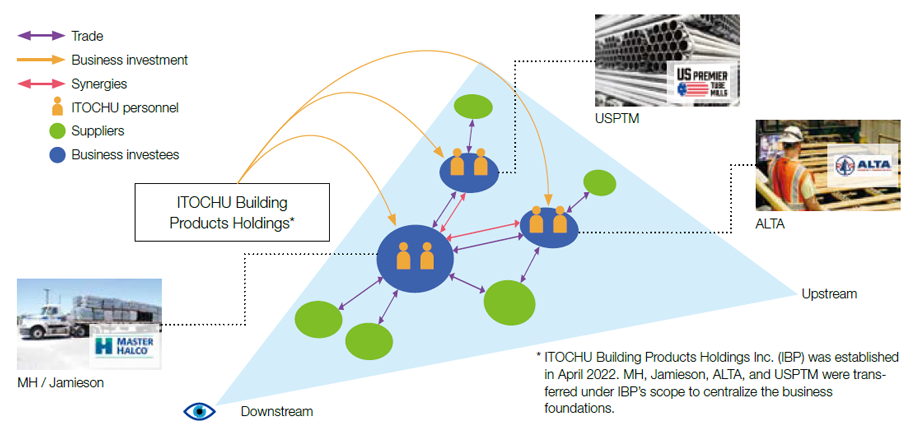

To achieve further profit growth and enhance customer services, multiple investments have been made in order to create synergies related to MH. We did not rely solely on acquisition candidates recommended by external sources, but instead conducted active research on our own to identify potential target companies based on our experiences and knowledge derived from our involvement with frontline operations, including the customers, competitors, and suppliers. Thus, we avoided overpaying and utilized knowhow gained from the business reforms implemented at MH to improve its performance and swiftly realize latent synergies. In the North American construction materials business, we pursued multiple strategic acquisitions and swiftly identified market trends and consumer needs by thoroughly conducting hands-on management and strengthening frontline operations. Sharing such information among our relevant group companies has helped us to successfully reform businesses using a market-oriented perspective to rapidly reflect market trends in the management of each company, and to establish a business foundation, capable of implementing effective initiatives throughout the entire supply chain.

Acquisition of Alta Forest Products LLC (ALTA), a leading U.S. Wooden Fence Manufacturer

In FYE 2018, ITOCHU and ITOCHU International Inc. acquired a wooden fence manufacturer ALTA. Given that MH’s mainstay product was chain link fences for commercial facilities and with an eye to the residential fence market, which was expected to see robust growth due in part to the rising population, we constructed a new pillar of revenue through this acquisition successfully. ALTA commands an overwhelming presence in the production of residential fences made with high-grade western red cedar. This type of wood is considered to be a premium material and is very popular among affluent customers. Moreover, after buying ALTA we succeeded in improving profitability through effective data management, development of attractive products using MH’s market data, and strengthened relationships with major home improvement retailers through efforts to improve the product brand awareness. Consequently, these efforts enabled us to expand the earnings base of ALTA.

Acquisition of Jamieson Manufacturing Co. (Jamieson), a U.S. Fence Manufacturer and Wholesaler

In FYE 2020, MH acquired its industry peer Jamieson and quickly went to work to successfully expand its sales channels and cultivate new customers. Subsequently, MH fully integrated Jamieson in FYE 2021, thereby merging their sales strategies and further expanding the earnings base. Furthermore, the number of consumer contact points increased through an expanded network of major home improvement retailers afforded by the integration, and has led to stronger product development that accurately identifies customer needs.

Acquisition of US Premier Tube Mills LLC (USPTM), a U.S. Chain Link Fence Pipe Manufacturer

In FYE 2021, MH acquired USPTM, which was a supplier of pipes for chain link fences. The founder of USPTM had been considering a business transfer due to his age, and he approached MH for a direct sale after recognizing that MH had developed a strong presence in the chain link fence industry after the acquisition of Jamieson. By acquiring USPTM, MH expanded its supply chain and enabled the in-house production of major components for chain link fences.

Steppingstones for Creating New Added Value

IBP was founded in April 2022, and centralization of group companies, their business administrative functions (such as accounting, human resources, and IT), and infrastructure (such as ERP systems) under IBP was undertaken to raise the earnings generating capabilities of this group of companies. Also, IBP established systems to make various business decisions, including those regarding acquisitions, in a quicker and more effective manner by consolidating information gained from the front lines of relevant group companies.

Going forward, in addition to investing in outdoor residential- related businesses such as decking, which is expected to have synergy with the existing fence business, IBP is considering entering the residential wood business, etc., by combining the product development capabilities and factory operation know-how of DAIKEN CORPORATION [in August 2023, ITOCHU announced a tender offer bid for DAIKEN CORPORATION], a business partner in the housing structural materials business (CIPA Lumber Co. Ltd. and Pacific Woodtech Corporation), with our customer and distribution network and business management know-how. We intend to further expand our product lineup and value chain and strengthen our earnings base.

At the same time, we will continue to focus on training managers to fortify their sense of international perspective and hands-on management style, which are necessary for our business expansion. In the North American construction materials business, we have conducted systematic personnel training. We dispatch junior employees to the front lines so that they can gain an understanding of industry practices and the nature of the businesses while accumulating frontline operational experience. We then promote them to management levels within the Group companies. Going forward, we will endeavor to create an optimal structure through methods such as training personnel who can apply ITOCHU’s unique hands-on management style to local workplaces. We will continue building a robust management system to fortify the earnings generating capabilities of the North American construction materials business.