CFO Message

With a commitment to highly efficient management in line with global standards, and the consistent adherence to our financial policies, I will continue to support the enhancement of our corporate value under the new Management Policy.

Member of the Board, Executive Vice President, CFO

Tsuyoshi Hachimura

Reflecting Dialogue with the Market into the Management Policy that Now Serves as Our New Management Framework

As the head of investor relations, one of my key responsibilities is to engage in various discussions with institutional investors and analysts all over the world, including Berkshire Hathaway Inc. Entering my tenth year as CFO, these candid exchanges of opinions based on the trust built with our long-term shareholders provide invaluable insights. In anticipation of starting a new medium-term management plan from FYE 2025, I have particularly focused the dialogue on the future direction of ITOCHU. During these discussions, I have come to understand that the market is highly interested in two key aspects: “growth” (the future growth of ITOCHU and its achievable profit levels) and “highly efficient management” (the targeted ROE levels, balancing growth and shareholder returns). Both are crucial points for realizing the sustainable enhancement of corporate value. I have brought these opinions back to the management team and shaped the direction to ensure they are thoroughly discussed in our management meetings. The outcome of these discussions is the long-term Management Policy we announced this April. This is the culmination of the series of “Brand-new Deal” strategies (medium-term management plans) started from FYE 2012, and simultaneously embodies a new growth strategy aimed at achieving sustainable enhancement of corporate value.(→ Management Policy)![]()

Reflecting on the past decade and considering the key phrases that encapsulate our performance, I would summarize it from a CFO’s perspective as “a proven track record of achieving growth” and the consistent practice of “highly efficient management.” In formulating the new Management Policy, we have earnestly pondered and deliberated on how to maintain our steadfast commitment to high growth and high efficiency, and how we should confidently and persuasively demonstrate this based on our past track record.

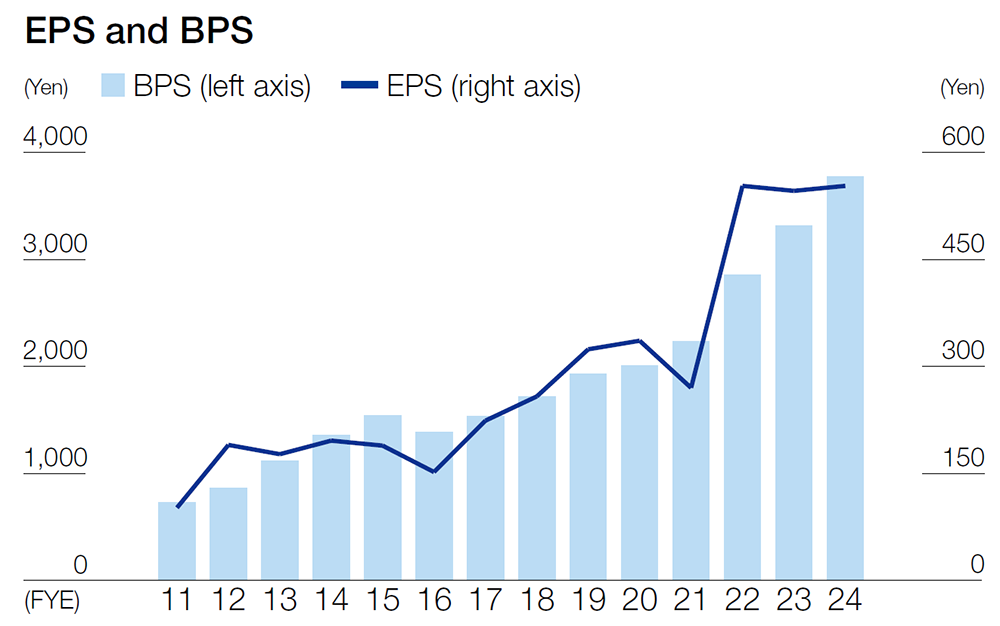

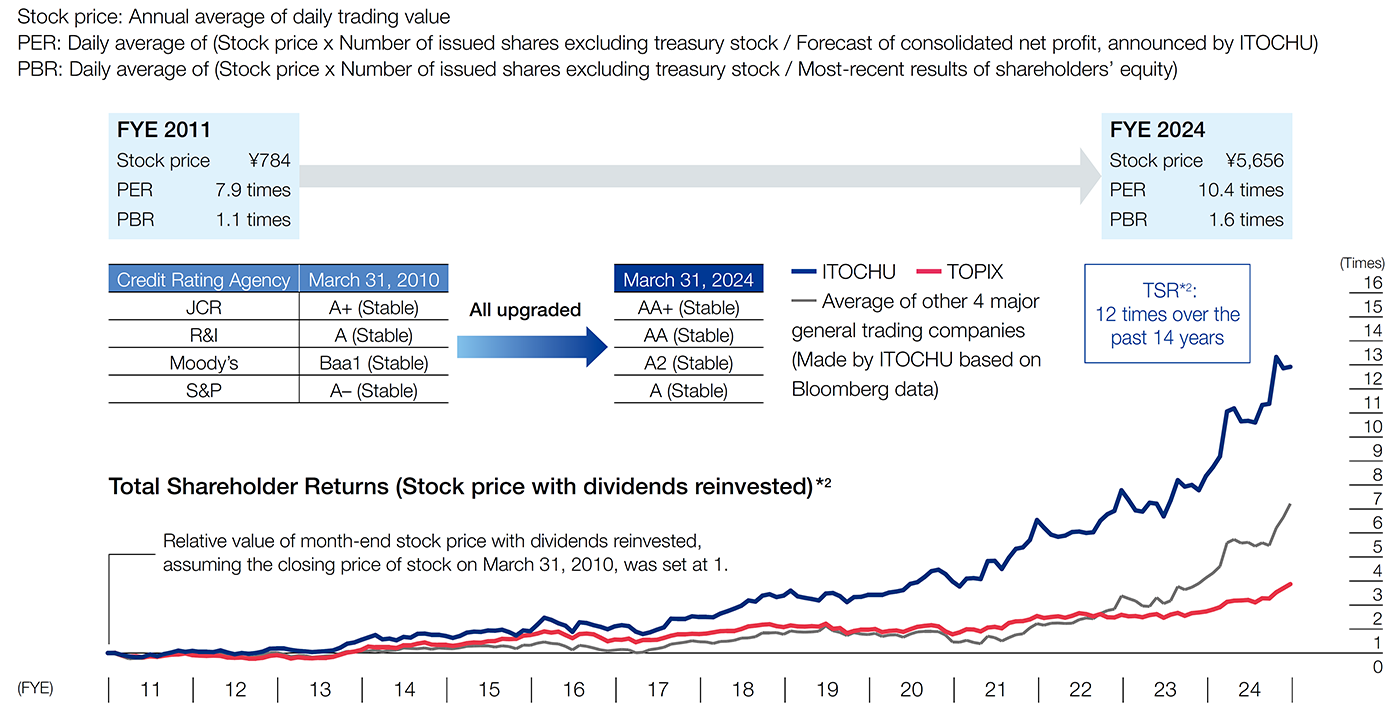

Our Commitment to Profit Growth and ROE Enhancement

Under the series of “Brand-new Deal” strategies, we have achieved steady profit growth. In FYE 2011, our consolidated net profit was less than ¥200.0 billion, but we consistently elevated our profit stage, and under Brand-new Deal 2023, we established a solid stage of ¥800.0 billion. During this period, our consolidated net profit has grown at a compound annual growth rate of 13%, surpassing the economic growth rate in major countries around the world, including Japan, the United States, China, and India. As a result, our market capitalization, which was around ¥1 trillion in 2010, has reached over ¥12 trillion in June 2024. One of the factors that made this possible was certainly our steady profit growth and high growth rate. However, while the market has recognized our past growth, questions have also risen about the next profit stage and whether we can truly continue to grow from here. I strongly felt the need to provide clear answers to these questions. The answer lies in one of the pillars of our Management Policy: “Grow earnings.” The top management team continues to steer the Company without wavering. Based on the track record built by this management team, we recognize the utmost importance of continuing to achieve growth with a consistent management style. In FYE 2024, although it was a slight increase, we were the only one among the five general trading companies to achieve a year-on-year profit increase and, while some others are expecting their profits to decline in FYE 2025, ITOCHU is planning nearly 10% growth in both consolidated net profit and core profit. FYE 2025 will be an important year for us to continue achieving high growth rate moving ahead. As CFO, I am committed to first firmly managing the Company at present to ensure steady profit growth, as well as securing high growth rate going forward.(→ Track Record of Profit Growth under “Brand-new Deal” Strategies)![]()

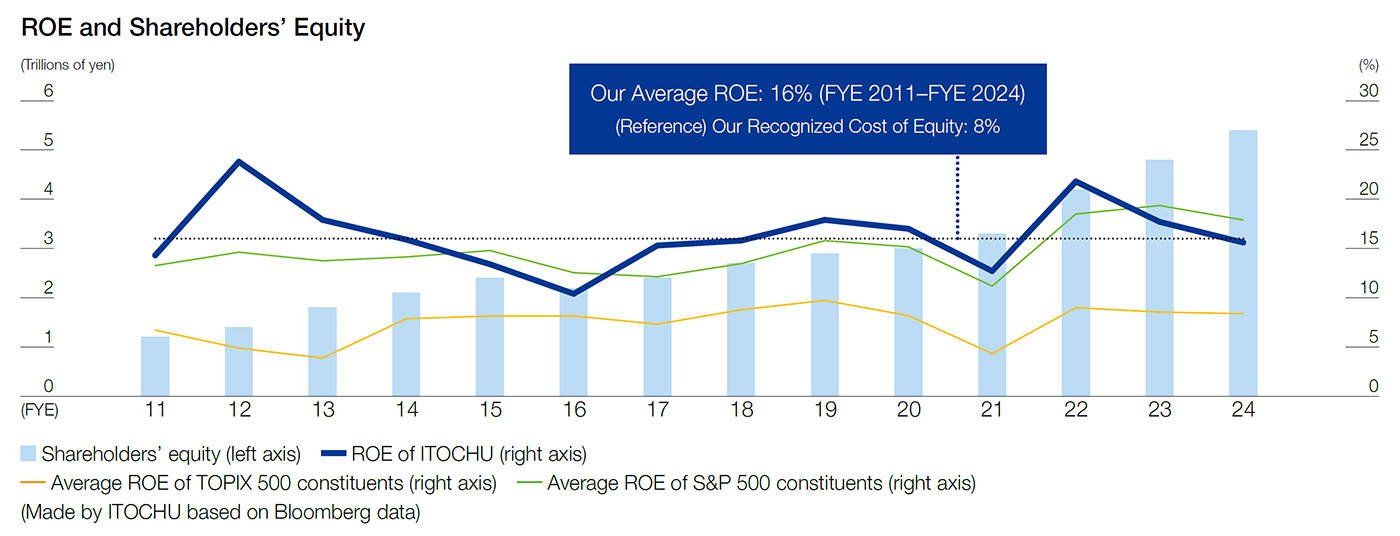

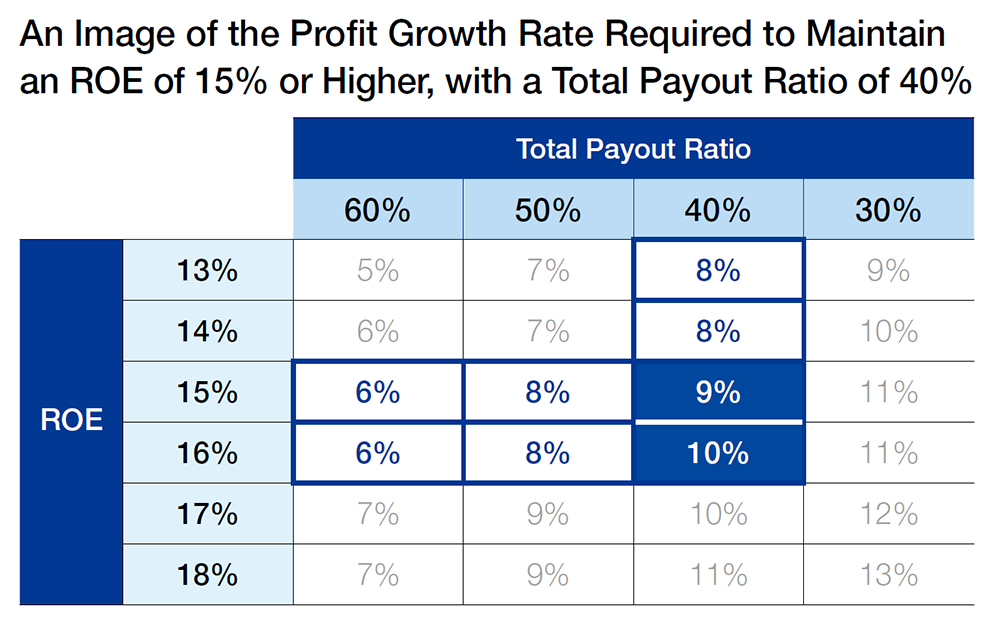

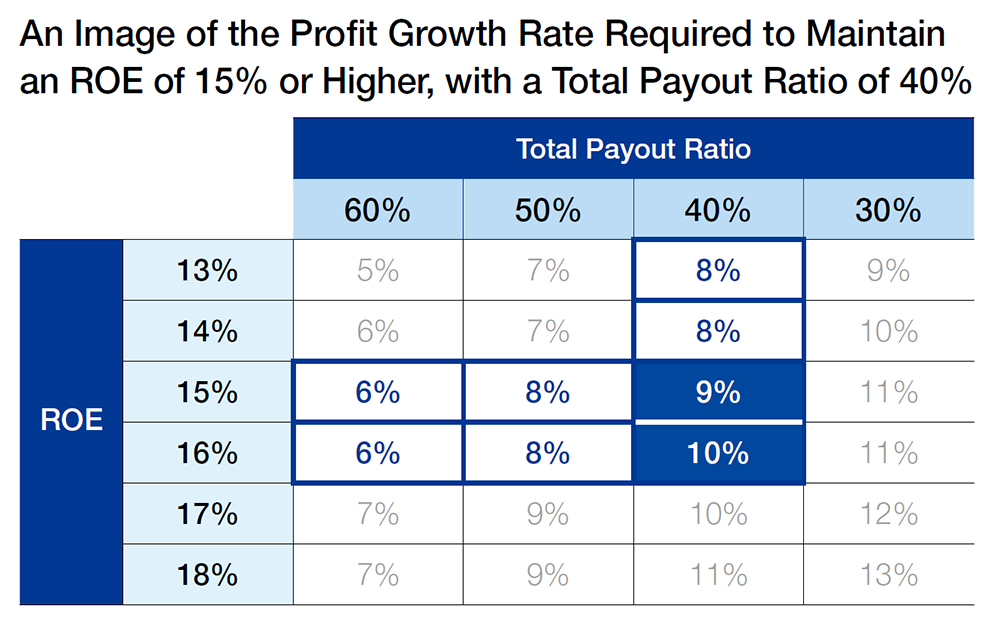

Another key topic in our dialogue with the market was highly efficient management. With around 40% of our investors being overseas institutional investors, I fully understand as CFO that a minimum ROE of 15% is a threshold for being considered a viable investment under global standards, and that if we do not reach this threshold, we may not even pass the initial screening by investors. To continue receiving high evaluations from our investors, it is crucial to maintain an average ROE of 15% or higher over the medium to long term. We have achieved an average ROE of 16% over FYE 2011 to FYE 2024, which demonstrates one of our competitive advantages. The commitment to highly efficient management, specifically achieving high ROE, has been a consistent focus since I assumed the role of CFO, and I intend to continue this with unwavering conviction.

Furthermore, the way we achieve the high ROE is also important. While excessive shareholder returns can improve ROE by decreasing the denominator, equity (E), this is not at all healthy from the perspective of enhancing equity, specifically expanding the risk buffer. ROE improvement should be realized through the enhancement of return (R). In this sense, sustainable profit growth is synonymous with sustainable EPS growth. Our long-standing approach of achieving high ROE management through sustained EPS growth and steady expansion of BPS remains unchanged.

Furthermore, the way we achieve the high ROE is also important. While excessive shareholder returns can improve ROE by decreasing the denominator, equity (E), this is not at all healthy from the perspective of enhancing equity, specifically expanding the risk buffer. ROE improvement should be realized through the enhancement of return (R). In this sense, sustainable profit growth is synonymous with sustainable EPS growth. Our long-standing approach of achieving high ROE management through sustained EPS growth and steady expansion of BPS remains unchanged.

In addition, having served as the chair of the ALM*1 Committee for many years, I have consistently emphasized the improvement of ROA in each business segment. Since we manage our leverage across the Company, I have continually emphasized the importance of improving ROA at the operational level as a way to enhance ROE. While ROIC management is often discussed recently, achieving high efficiency requires practical effectiveness over theoretical concepts. For individual businesses, we make management decisions based on the cost of capital. However, from the perspective of portfolio management, considering that ITOCHU, including our subsidiaries, has traditionally operated with significant operating receivables, we have consistently emphasized the importance of ROA. This awareness has steadily taken root at the operational level. Going forward, it is necessary to focus on efficiency at the operational level more than ever before. In some cases, it may be necessary to significantly overhaul the way existing businesses are conducted. In order to continue refining the Company’s strengths, I, as CFO, will steadfastly maintain this commitment.(→ Portfolio Management)![]()

*1 ALM: Asset Liability Management

Financial Strategies Conscious of the Matrix of Growth Rate, Shareholder Returns, and ROE

Starting this fiscal year, we have decided to stop releasing medium-term management plans and instead disclose a long-term management policy and single-year management plans. Backcasting from an extremely uncertain future does not convey the correct message to the market. Under the Management Policy, we have deliberately refrained from specifying concrete profit targets. However, I believed it would be difficult to garner the market’s trust if we do not at least present specific figures for our financial strategies. Therefore, as part of our long-term policy, we have made a specific commitment regarding shareholder returns: a total payout ratio of 40% or more, and the higher of 30% dividend payout ratio or a dividend of ¥200 per share. Starting with the total payout ratio of 40% or more, if we achieve approximately 10% profit growth based on our past track record, we can realize an ROE of 15% or higher. This matrix has always been in my mind. Based on this financial logic, the Management Policy and financial strategy were formulated with a balance between profit growth and shareholder returns in mind. Given the large scale of our profits, there may be short-term fluctuations in performance. However, within the long-term management framework we have presented, we are committed to a total payout ratio of 40% or more and to achieving long-term profit growth and high growth rates, thereby maintaining a high ROE level that meets global standards. I hope you will understand this approach.

Starting this fiscal year, we have decided to stop releasing medium-term management plans and instead disclose a long-term management policy and single-year management plans. Backcasting from an extremely uncertain future does not convey the correct message to the market. Under the Management Policy, we have deliberately refrained from specifying concrete profit targets. However, I believed it would be difficult to garner the market’s trust if we do not at least present specific figures for our financial strategies. Therefore, as part of our long-term policy, we have made a specific commitment regarding shareholder returns: a total payout ratio of 40% or more, and the higher of 30% dividend payout ratio or a dividend of ¥200 per share. Starting with the total payout ratio of 40% or more, if we achieve approximately 10% profit growth based on our past track record, we can realize an ROE of 15% or higher. This matrix has always been in my mind. Based on this financial logic, the Management Policy and financial strategy were formulated with a balance between profit growth and shareholder returns in mind. Given the large scale of our profits, there may be short-term fluctuations in performance. However, within the long-term management framework we have presented, we are committed to a total payout ratio of 40% or more and to achieving long-term profit growth and high growth rates, thereby maintaining a high ROE level that meets global standards. I hope you will understand this approach.

Firmly Balancing Three Factors

There is another key concept that I have focused on and incorporated into the Management Policy as CFO. That is maintaining our financial foundation based on a balance between three factors (growth investments, shareholder returns, and control of interest-bearing debt), which we have continuously practiced. Considering the need for further diversification of funding in a world where interest rates matter again, maintaining a high credit rating will be extremely important. To sustain our current highest credit rating among general trading companies from all major credit rating agencies, we are committed to keeping NET DER at less than 0.6 times in the FYE 2025 management plan, even while making significant growth investments.

Moreover, for the first time, we have clearly outlined our cash allocation for a single fiscal year in numerical terms. For FYE 2025, we plan to allocate core operating cash flows approximately “1:1” between growth investments and shareholder returns, with a total payout ratio aiming at 50% for the year. In addition, the carryover of core free cash flows after deducting shareholder returns during the previous medium-term management plan period, totaling around ¥700.0 billion, will be fully allocated to growth investments. Under the principle of “No growth without investments,” we will proactively conduct growth investments up to a maximum of ¥1 trillion in FYE 2025. However, I want to emphasize that there will be no change to our investment discipline or internal rules related to investments. We remain committed to meticulously planning, structuring and executing investments that contribute to growth.

The financial policy we have adhered to over the years has supported the enhancement of our corporate value. I am committed to unwaveringly continue our financial and capital strategies, firmly balancing the three factors in my tenth year as CFO.

Enhancement of Corporate Value and the Role of CFO

In the long-term dividend policy mentioned earlier, the theoretically derived profit level based on “the higher of 30% dividend payout ratio or a dividend of ¥200 per share” is ¥960.0 billion. While we have not specified the timeline for achieving this, the target is set with the belief that it can be reached in the near future. The long-term Management Policy outlines a path toward sustainable corporate value enhancement, incorporating various financial logic, including growth rates, shareholder returns, and high ROE. Management requires both change and consistency, and the same applies to financial and capital strategies. My role as CFO is to diligently promote both aspects and deliver results. This commitment remains unchanged as I enter my tenth year in the position. I am determined to continue steadily realizing sustainable corporate value enhancement.

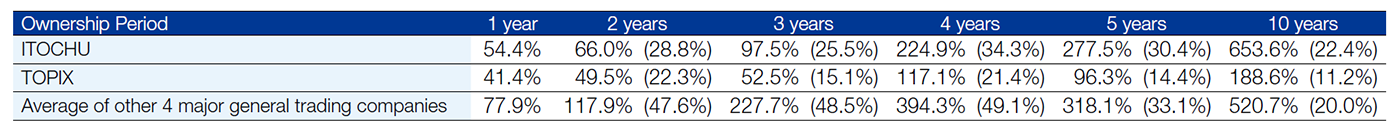

Stock Price / PER / PBR / TSR*2

TSR*2 as of March 31, 2024

*2 Total Shareholder Returns (TSR): Returns on investment assuming that dividends are reinvested. The chart above shows relative value of month-end stock price with dividends reinvested, assuming the closing price of stock on March 31, 2010, was set at 1. The table above indicates returns on investment during each period of holdings preceding from March 31, 2024. (Figures in brackets are rate of returns converted to the annual average by the geometric mean.)

For details on Management Policy announced on

April 3, 2024, please click here.