Integrated Report 2024 (Digital Edition)

We outline the capital, which is the driving force behind the virtuous cycle of sustainable corporate value enhancement, and our strengths forged through history. Additionally, we explain their relationship with our material issues, the Management Policy that serves as a long-term management compass, and the financial logic behind the policy.

For details on Management Policy announced on

April 3, 2024, please click here.

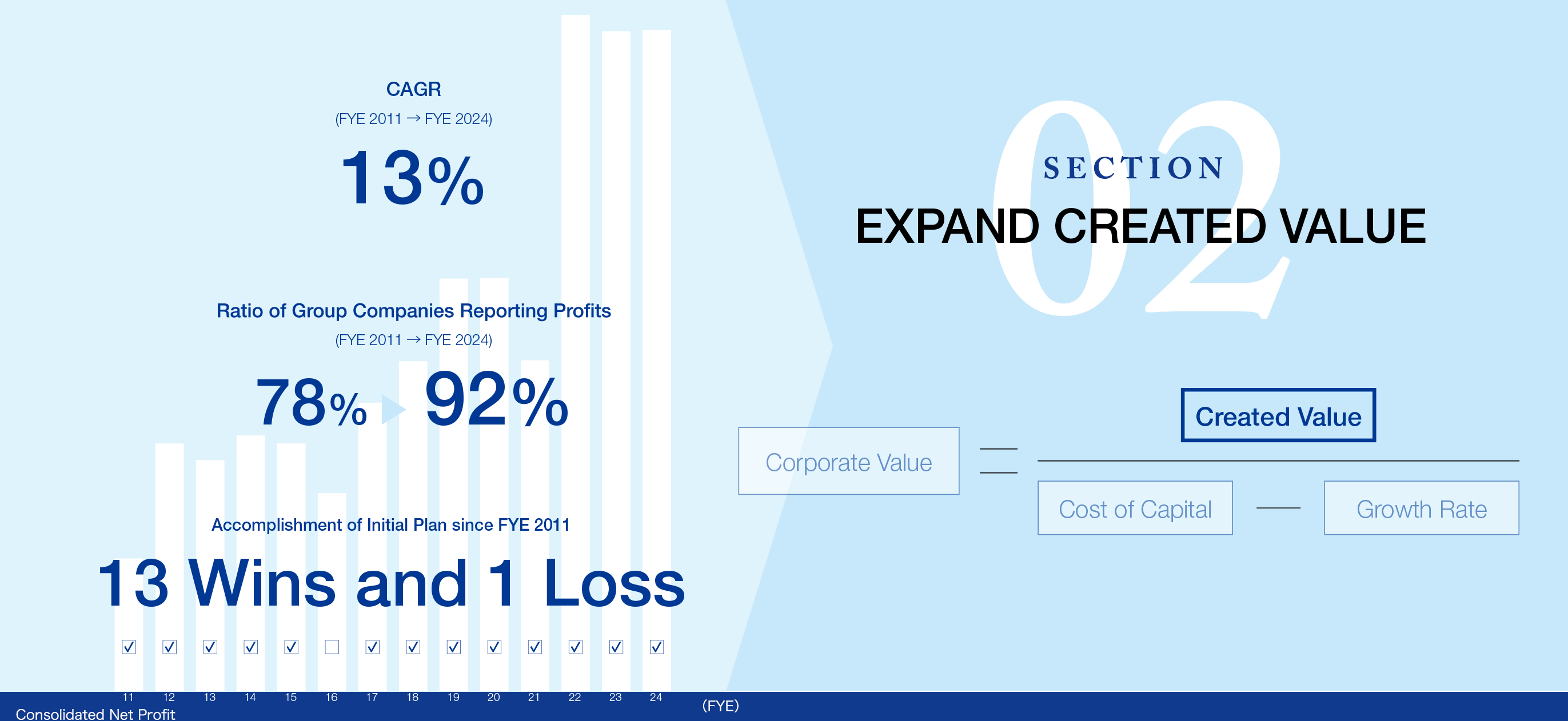

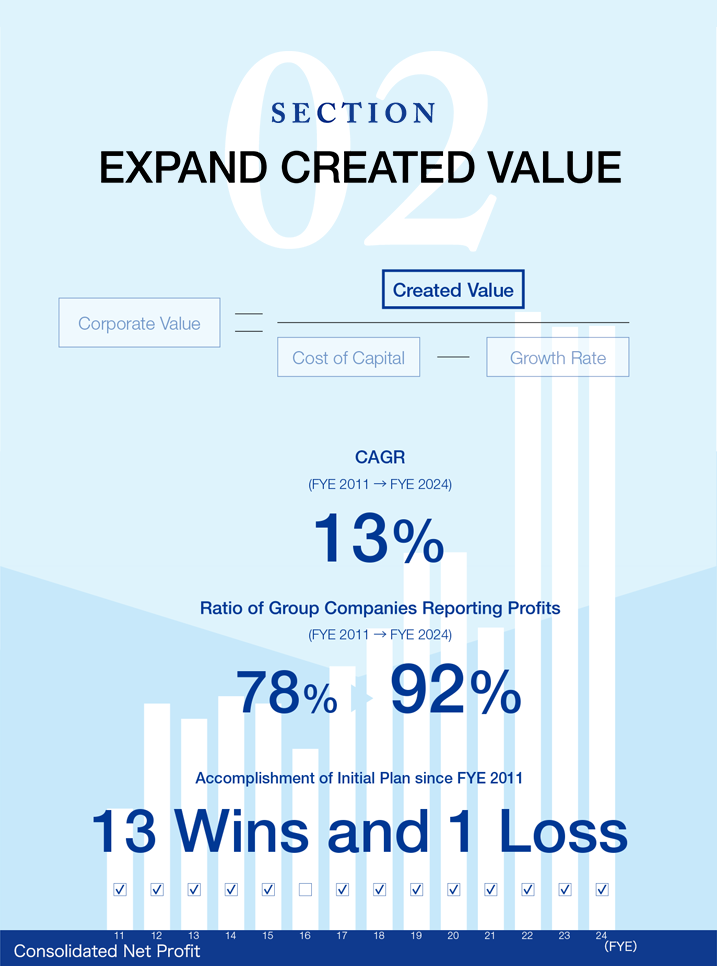

Since FYE 2011, we have achieved 13 wins and 1 loss in accomplishment of initial plans, steadfastly practicing a commitment-based management where we deliver on our promises. To enhance the credibility of our long-term Management Policy, we believe it is crucial to demonstrate our track record of consistently accumulating profits and achieving targets each fiscal year. In this section, we present our past track record built up and the factors underpinning it. Additionally, we explain how we steer management based on our understanding of the external environment and countermeasures for risks.

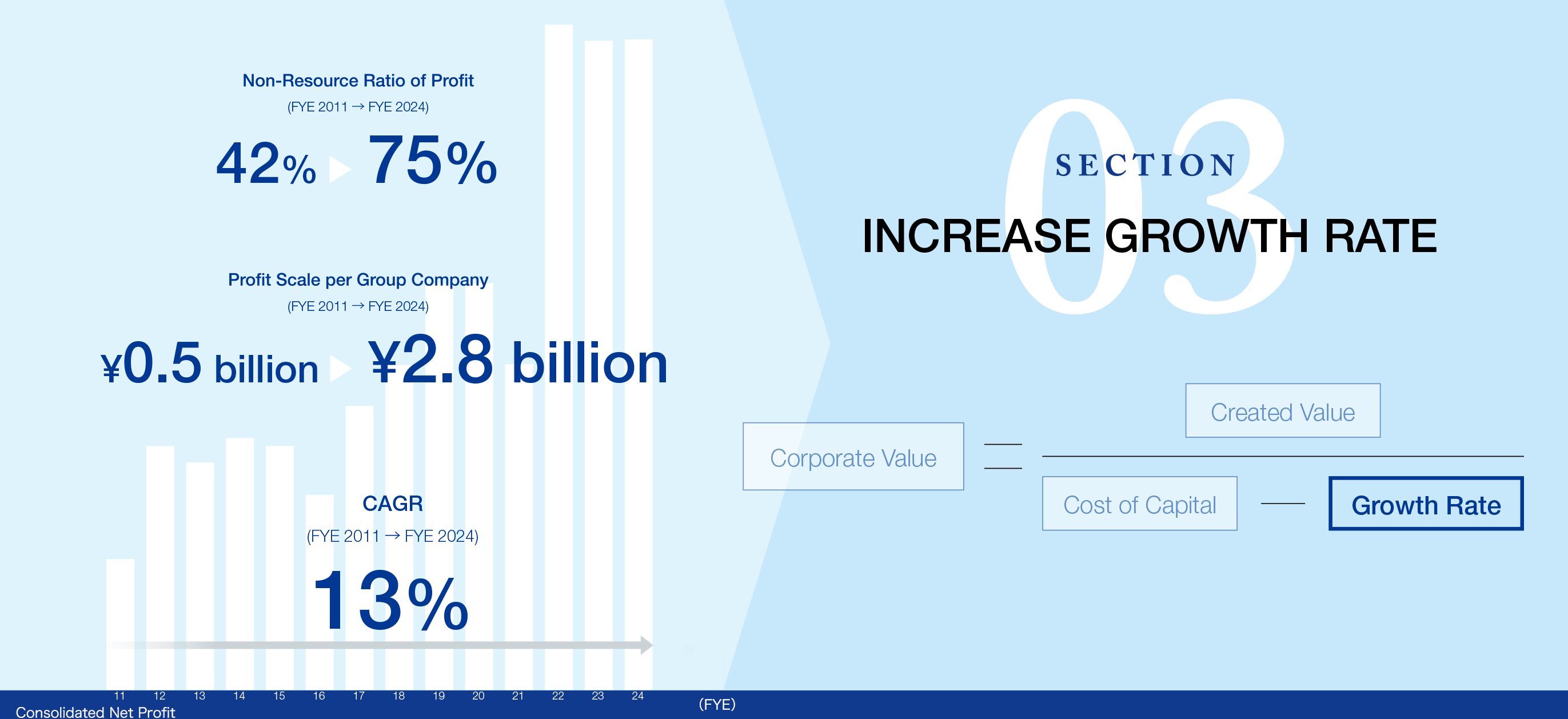

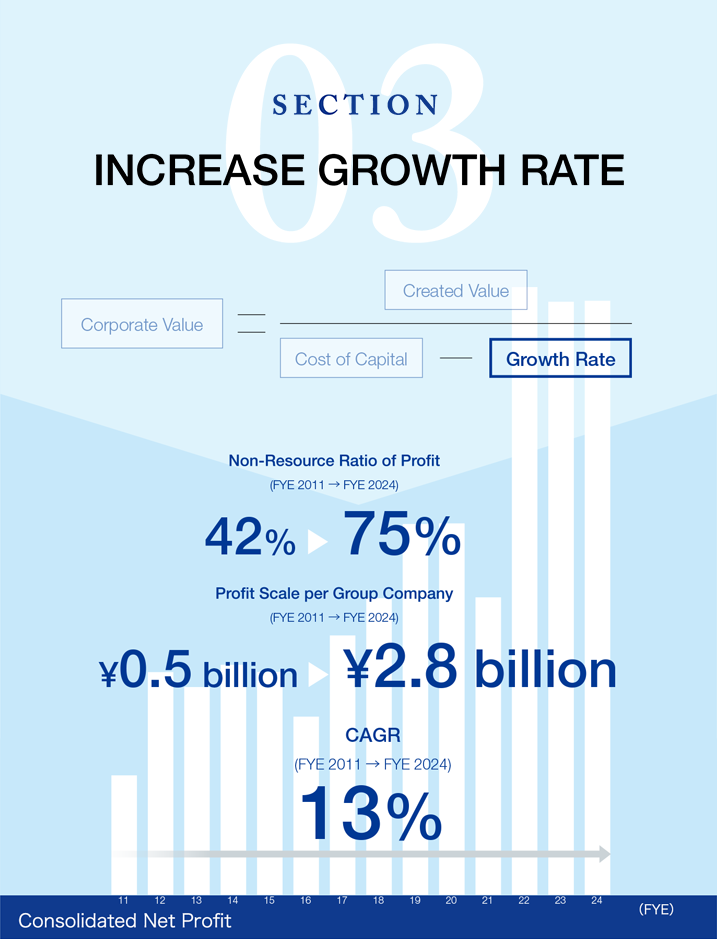

Since FYE 2011, we have achieved high profit growth with a compound annual growth rate of 13%. To sustain medium- to long-term growth moving forward, it is crucial to consistently set the steppingstones. In this section, we highlight the focus points for growth investments, which is key for our Management Policy, and our business development as part of our evolving business model. Additionally, we explain how we create business based on a market-oriented perspective, leveraging our strengths, by providing specific examples.

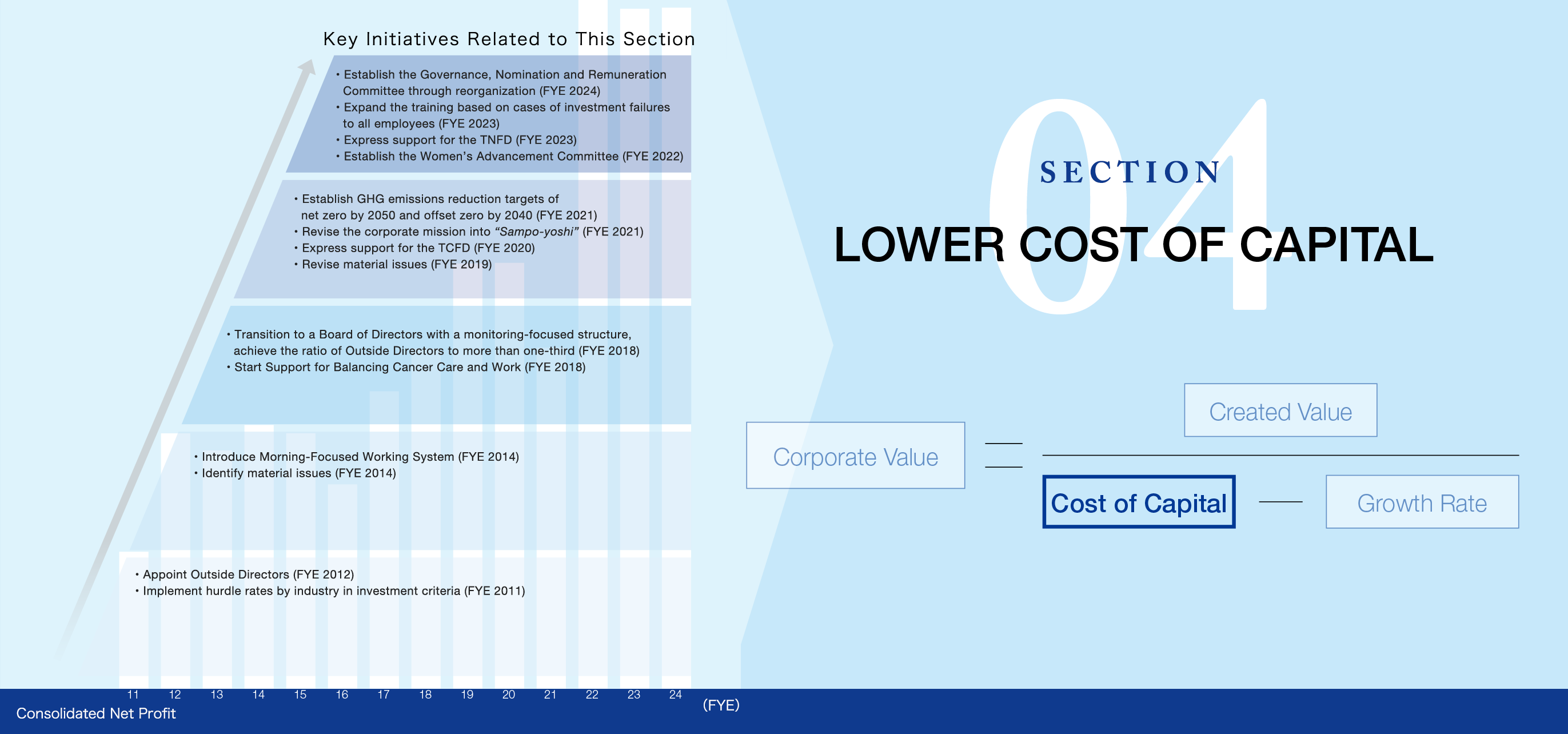

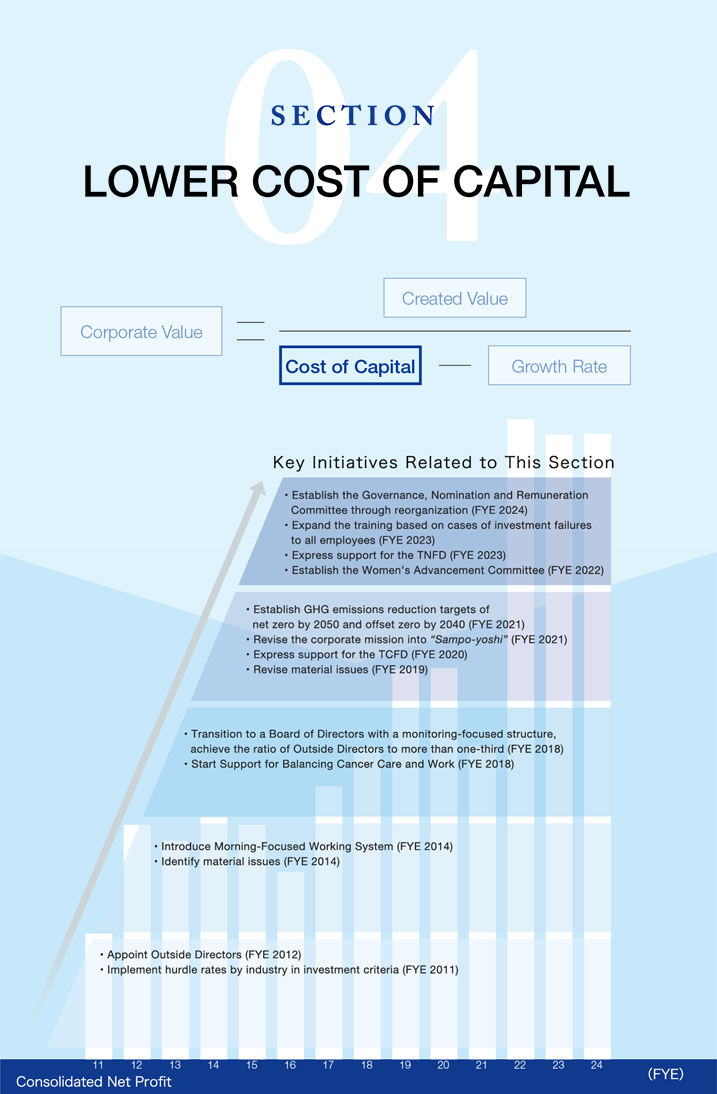

To strengthen our management foundation for the sustainable enhancement of corporate value, we continuously engage in various initiatives, listening to the voices of the market and society, and consistently upgrading our management foundation. This section explains our mechanisms for increasing the success rate of investments, our approach to promoting sustainability, our initiatives related to climate change and natural capital, our unique human resource strategy, and the steadily evolving corporate governance framework and policies.

In the context of strengths, risks, opportunities, and other factors in each business field, this section outlines the strategies of the Division Companies that comprise ITOCHU’s business portfolio. The explanation is given with an awareness of the corporate value calculation formula (with a view to investment decisions) and the bearing these strategies have on material issues.

Annual Report 2024 PDF Download

Download Separate Files

- Introduction (PDF 0.43MB)

- Editorial Policy / Contents (PDF 0.10MB)

- Management Messages (PDF 0.25MB)

- 01 Driving Force for Sustainable Value Creation (PDF 0.39MB)

- 02 Expand Created Value (PDF 0.23MB)

- 03 Increase Growth Rate (PDF 0.58MB)

- 04 Lower Cost of Capital (PDF 1.05MB)

- Business Portfolio (PDF 2.15MB)

- Data Section (PDF 0.18MB)

- IR Activities (PDF 0.19MB)