Corporate Governance

Further Enhancement of ITOCHU’s Corporate Governance System

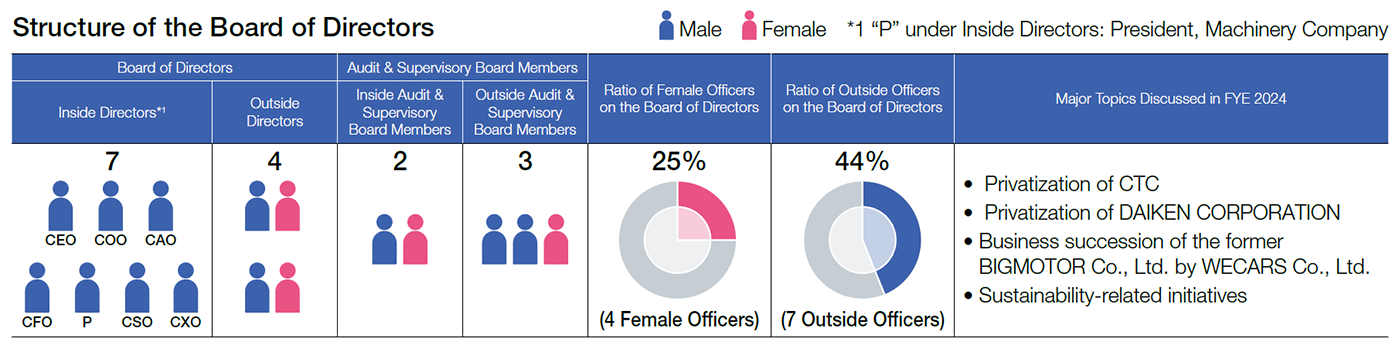

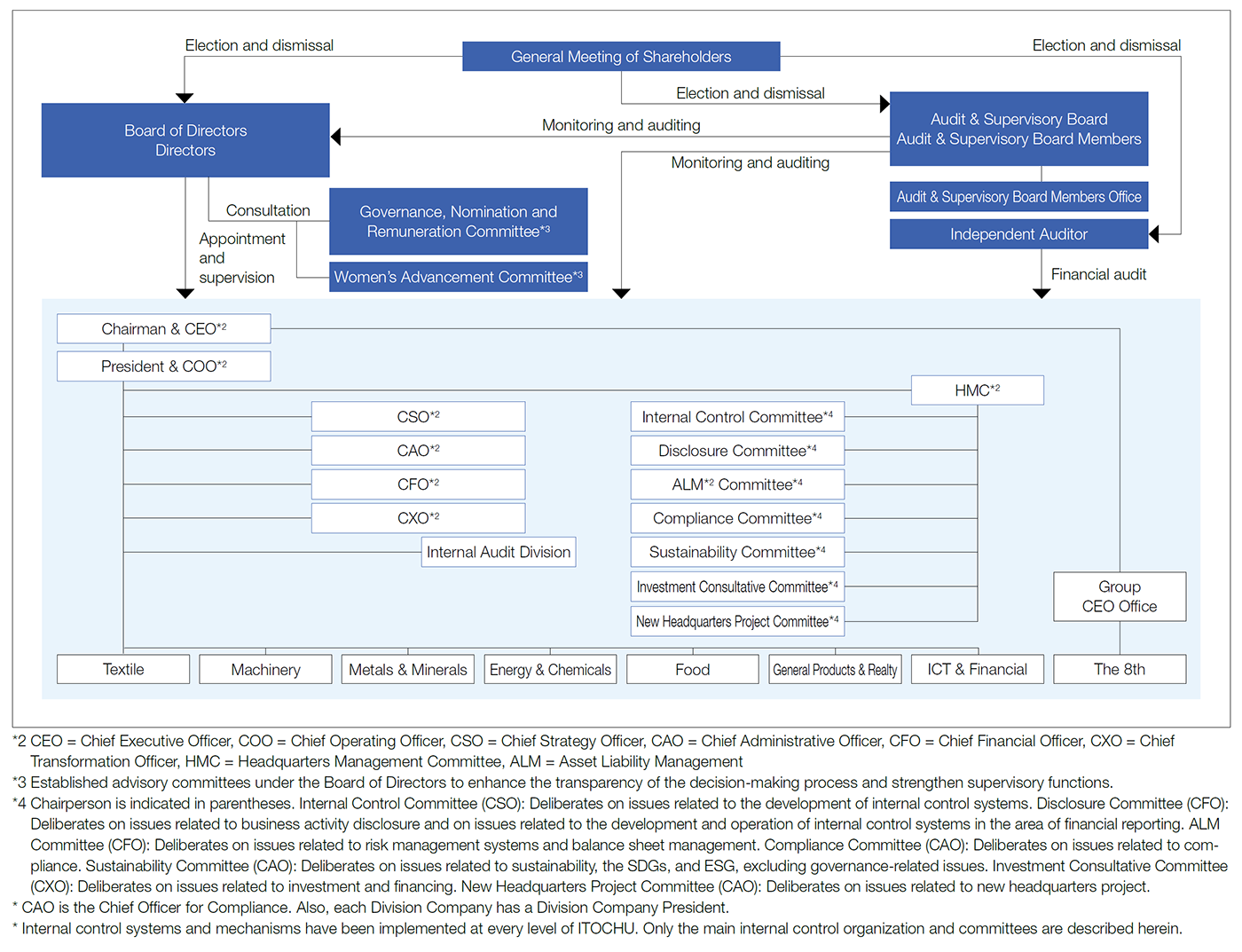

As a corporation with the Audit & Supervisory Board (kansayaku secchi kaisha), ITOCHU has adopted a governance structure that is centered on the Board of Directors, in which Outside Directors account for at least one-third of members; advisory committees to the Board of Directors, which mainly comprise outside officers; and an Audit & Supervisory Board with at least half of its members comprised of Outside Audit & Supervisory Board Members. Based on the belief that both the demonstration of sound leadership by members of the senior management team and transparent, fair decision-making are essential for the realization of a comprehensive corporate governance system, the Company is promoting the delegation of ordinary business execution matters to the senior management team within the scope permitted by law, while continuously enhancing the Board of Directors to strengthen the supervision of business management. The Board of Directors also deliberates on business execution matters that are highly important. Through a well-developed system for the disclosure of information and provision of support to outside officers, the Board has established innovative ways to ensure that the supervision of business execution is appropriate from outside perspectives, which is to say from the perspectives of the public and general shareholders. With a view to enhancing governance even further, ITOCHU will tirelessly pursue reforms in conjunction with continued efforts to place particular emphasis on the practical aspects of strengthening governance and to expand disclosure in light of trends related to the Corporate Governance Code and market feedback.

Overview of Corporate Governance and Internal Control System

(As of July 1, 2024)

Promoting Livelier Discussions at Meetings of the Board of Directors

To heighten the effectiveness of the Board of Directors, ITOCHU is focusing on strengthening capabilities for the provision of information and support to outside officers. In addition to providing outside officers with advance briefings on agenda items, the Company promptly shares detailed information on projects related to investment and financing, including deliberations by the Investment Consultative Committee and the HMC and the opinions of related administrative divisions. In these ways, the Company is enhancing deliberations on investment and financing. Also, through the organization of individual interviews with the Company Presidents and officers in charge of administrative divisions as well as the provision of opportunities for business visits in Japan and overseas, the Company aims to further outside officers’ understanding of its wide range of businesses, thereby enhancing the effectiveness of the Board of Directors and facilitating livelier discussions at Board meetings.

Discussions on Individual Projects

Based on the rules of the Board of Directors, investment or financing projects exceeding a certain monetary threshold require approval by the Board of Directors following approval by the HMC. In FYE 2024, multiple projects were submitted to the Board of Directors, including two tender offers.

More specifically, the business succession of the former BIGMOTOR Co., Ltd. by WECARS Co., Ltd. was one project that was discussed and carefully analyzed at two Board meetings. At the first meeting, the Board of Directors received a report on the methods of controlling such risks as the envisioned structure. In light of the resulting discussion, the Board of Directors expressed the intention of the business succession. At the second meeting, the Board held deliberations after receiving a report from the HMC on its discussions of the appropriateness of the investment amount, synergies with the ITOCHU Group, succession of personnel, and other items. Discussions were held not only on the profitability and risks of the project but also on the qualitative significance of the project. For example, there was a lively discussion on the significance of the project’s contribution to society; the importance of Companywide efforts to revitalize the business; the need to establish systems for the facilitation of compliance and a customer-first approach; and, given the high level of public interest in the project, the need to take measures to ensure that the project would not lead to the Company’s reputation being damaged. Based on these considerations, the execution of the project was unanimously approved.

Additionally, there was a project that was approved by the HMC but rejected by the Board of Directors after lively discussions that considered sustainability requirements. Such outcomes demonstrate that in the Company’s Board of Directors, business management monitoring and supervision by outside officers—who represent the viewpoints of the public and general shareholders—is operating effectively.

Activities of Advisory Committees to the Board of Directors

(→ Outside Directors & CAO Roundtable)

Governance, Nomination and Remuneration Committee

In FYE 2024, including the meetings of its predecessor—the Governance and Remuneration Committee—the committee met a total of five times, with all members in attendance. Committee members engaged in lively discussions on agenda items, which included a Board effectiveness evaluation, the skills matrix, succession planning, the officer remuneration system, and revision of the officer system. In discussions on the revision of the officer system, opinions were stated to the effect that, in relation to the introduction of a system of special measures for appointment of women to Executive Officers,*5 the pressure on selected Executive Officers is significant and that the provision of support going forward is important. The committee also expressed the opinion that regarding the introduction of tenure limits for Executive Officers and the establishment of Senior Operating Officers*6, it is important to ensure ongoing action entrenches business management that is in line with the aims of the introduction of the system of special measures, which include rejuvenating Executive Officers and creating a pool of human resources.

Women’s Advancement Committee

In FYE 2024, the committee met a total of two times, with all committee members in attendance. Committee members engaged in lively discussions on agenda items, which included overall policy for the advancement of women, elevation of the ratio of female officers, initiatives for female candidates for senior management positions, and the general employer action plan for FYE 2025 and beyond. With regard to the ratio of female officers, the committee held discussions to the effect that, given the Japanese government policy of raising the ratio of female officers on the Board of Directors to 30% or higher by 2030, there is a need to specifically consider a system for the appointment of female Executive Officers through affirmative action that includes training and that does not wait until candidates reach the average age of those normally given opportunities to become officers. The discussions of the committee were reported to the Board of Directors, which led to the introduction of the system of special measures for appointment of women to Executive Officers. Additionally, we have announced that we set a target to increase the ratio of female officers to 30% or higher by 2030, not only among Directors and Audit & Supervisory Board Members but also including Executive Officers.

*5 A system that enables affirmative action for the appointment of certain numbers of female Executive Officers by selecting female officers and giving them special opportunities to gain experience of Companywide business management

*6 Executive Officers (excluding those who hold key senior management positions such as Executive Officers who concurrently serve in senior management positions, Division Company Presidents, and officers in charge of headquarters administrative divisions as well as Executive Officers appointed through special measures for female Executive Officers) shall have tenures that are limited to a maximum of two years. After two years have elapsed, all officers shall be retired. Of those who have retired, those who continue the duties that they performed prior to retirement or who assume other positions within the Company shall be deemed Senior Operating Officers.