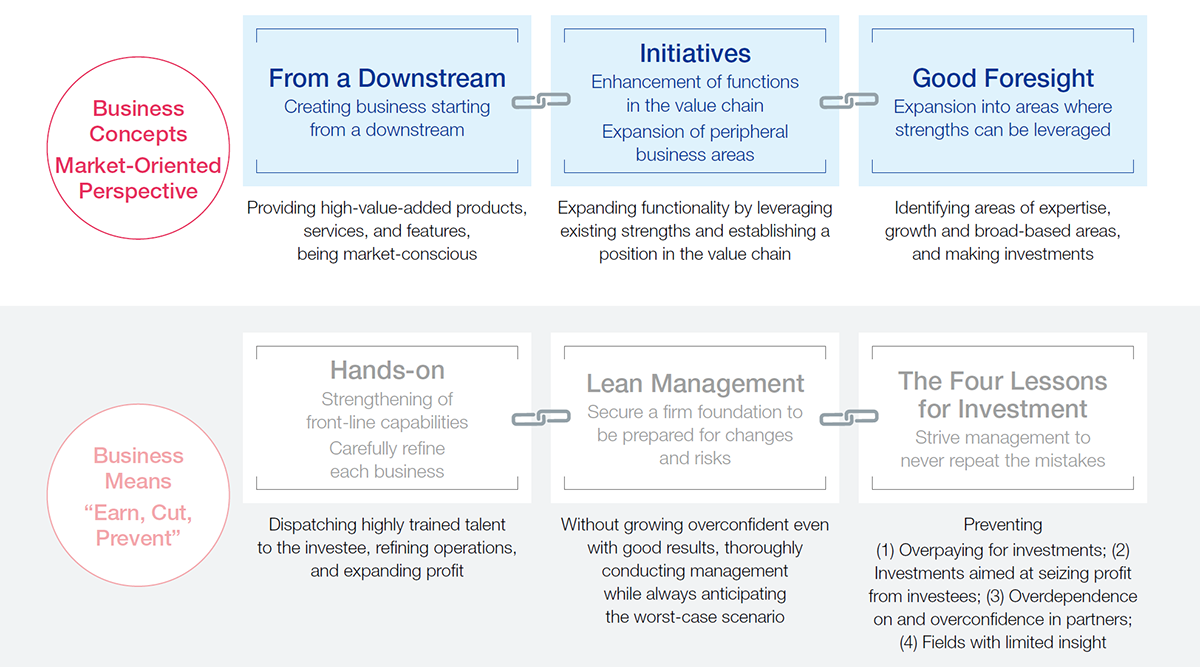

Special FeatureCreating Businesses by Leveraging Our Strengths

—Business Concepts and Means—

ITOCHU has sustained value creation by focusing on fields where it can demonstrate strengths and by creating and expanding multifaceted, linked businesses. In this special feature, we highlight specific examples of how ITOCHU is driving profit growth while strengthening our business foundation. This is achieved by thoroughly implementing the business concepts of a market-oriented perspective and the business means of “earn, cut, prevent,” which are fundamental to our business. In particular, we break down our market-oriented perspective into three categories—“From a downstream,” “Initiatives,” and “Good foresight”—and present the key points of each case through these lenses.

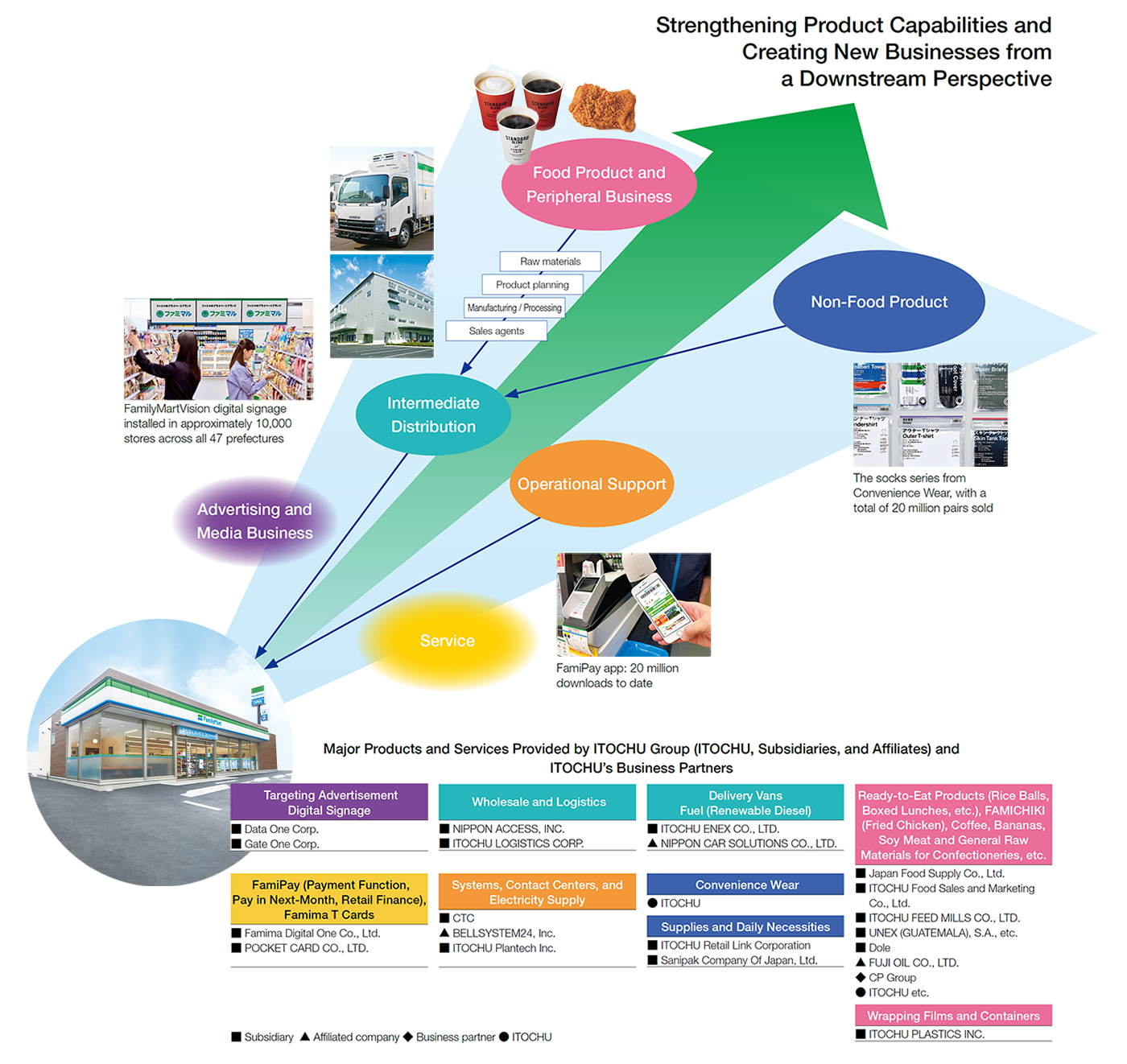

01:Expanding the Group’s Earnings Base by Leveraging Combined Strengths, Centered on FamilyMart

With our strengths in the consumer sector, ITOCHU is enhancing collaboration with Group companies to build a robust value chain from downstream to upstream, centered around FamilyMart, which operates our convenience store business. Leveraging FamilyMart’s daily interaction with 15 million consumers, we not only strengthen product procurement and sales but also enhance value and broaden the product range across the entire value chain. Furthermore, by creating new businesses such as advertising and media business using digital signage as well as the FamiPay app and other financial businesses, we aim to expand the earnings base of the entire Group.

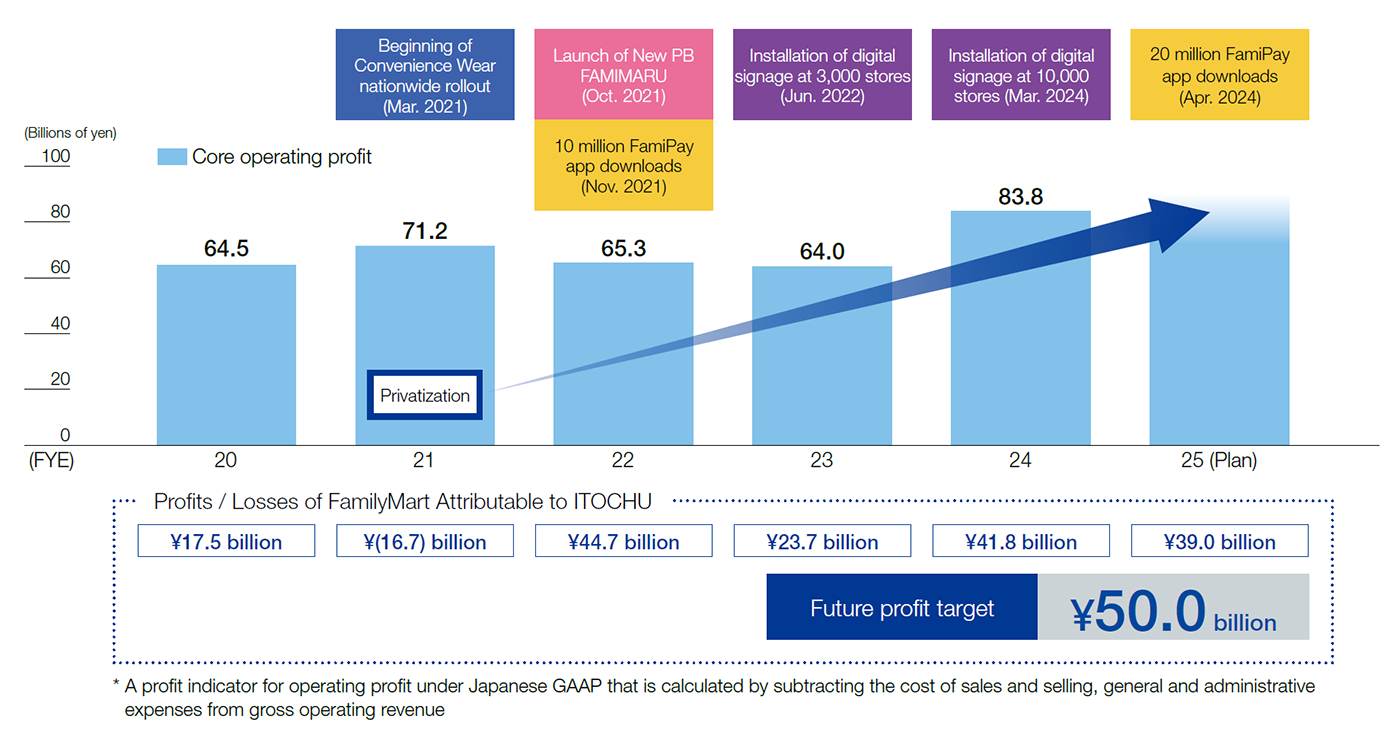

Trends in FamilyMart’s Core Operating Profit

Since FamilyMart’s privatization in FYE 2021, we have strengthened hands-on management. By implementing product strategies and promotions that meet customer needs through a market-oriented perspective, daily sales have surpassed the previous year’s same month for 35 consecutive months as of July 2024. Additionally, core operating profit* reached a record high in FYE 2024, driven by increased daily sales, a higher proportion of PB products, enhanced store efficiency through digitalization, and early development of advertising and media businesses ahead of competitors.

A New Challenge to Break through the Conventional Expectations of Convenience Stores —Convenience Wear—

From March 2021, we have started the nationwide expansion of our PB products, focusing on clothing and general goods, under the concept of “Good materials, good technologies, good design.” With the supervision of global fashion designer Hiromichi Ochiai, we developed products that achieve both comfort and eco-consciousness by using sustainable materials such as recycled polyester, while maintaining high design quality. Our flagship product Line Socks have garnered attention on social media, and since launching in March 2021, the total number of socks sold has surpassed 20 million pairs. We are enhancing our product lineup, as demonstrated by the industry’s first fashion show, Fami-Fest, held in November 2023, and the joint development and sales of stationery with KOKUYO Co., Ltd.

In the development of clothing, we leverage our robust business foundation in textile fields to support raw material procurement and the establishment of production systems. Going forward, we will continue to support various initiatives of FamilyMart, centered around The 8th Company, that challenge the conventional expectations of convenience stores.

Overseas Expansion for Further Growth of FamilyMart

FamilyMart has expanded into six Asian countries and regions (Taiwan, China, Malaysia, Indonesia, Vietnam, and the Philippines) and operates around 8,000 stores outside of Japan. In March 2024, we reached a basic agreement with our Chinese business partner, the Ting Hsin Group, regarding a business restructuring aimed at expanding the FamilyMart business in China. Upon completion of the relevant procedures, the business entities will be divided by region between the Ting Hsin Group and FamilyMart. This will clarify management responsibilities and speed up decision-making. By fully leveraging our Group’s extensive expertise and network built over many years in the Chinese market, we aim to accelerate our business expansion in China, the world’s largest consumer market.

02:Accelerating the Growth and Expanding Business of

CTC through the Digital Value Chain Strategy

Even after the resolution of the COVID-19 pandemic, demand remains strong for business model transformation driven by digital transformation (DX), and this momentum continues to grow daily. Particularly, the emergence of diverse solutions utilizing generative AI is having a significant impact on business and corporate practices, driving further evolution in DX. Amid this trend, the IT industry is sustaining a high growth rate; however, the competitive environment is intensifying due to the entry of companies from different industries, coupled with an increasingly severe shortage of IT human resources. In this environment, we executed a tender offer for CTC in 2023, taking it private. Together with CTC, we aim to implement growth strategies more agilely, accelerate our digital value chain strategy through collaboration with the group of digital businesses we have built, and further strengthen our earnings base.

Business Expansion Leveraging the True Value of CTC

The ICT & Financial Business Company is a key segment that represents a major strength of ITOCHU, with significant growth potential. At the core of this segment is CTC, a leading system integrator in Japan. CTC has grown by accumulating advanced technological expertise and has played a pioneering role in Japan by introducing cutting-edge technologies and solutions, discovered through ITOCHU’s investments in venture capital funds in Silicon Valley and other regions. With a robust customer base of over 10,000 companies, primarily major corporations including telecommunications carriers, CTC excels in building advanced IT infrastructure leveraging a broad portfolio of cutting-edge IT products. This strength is further evidenced by its partnerships with leading IT companies all over the world, as well as the amount of business it handles. There are many products for which CTC handles the largest volume in Japan and the Asia–Pacific region. For example, it achieved the highest transaction volume in Japan for products from NVIDIA Corporation, a leading company in the field of generative AI, in FYE 2024*1 and was awarded “Best NPN of the Year*2.” As IT services expand across society and the demand for data centers rises, CTC is steadily accumulating orders for building operational infrastructure for generative AI development. By leveraging its established strengths to meet market needs, CTC is driving significant business expansion. The order backlog at the end of FYE 2024 reached a record high, further heightening expectations for further growth in the future.

*1 The fiscal year of NVIDIA Corporation: From February 2023 to January 2024

*2 “Best NPN (NVIDIA Partner Network) of the Year”: An award given to the partner company that has made the most significant contributions in expanding and promoting AI usage across various industries and in proposing platforms that include NVIDIA products.

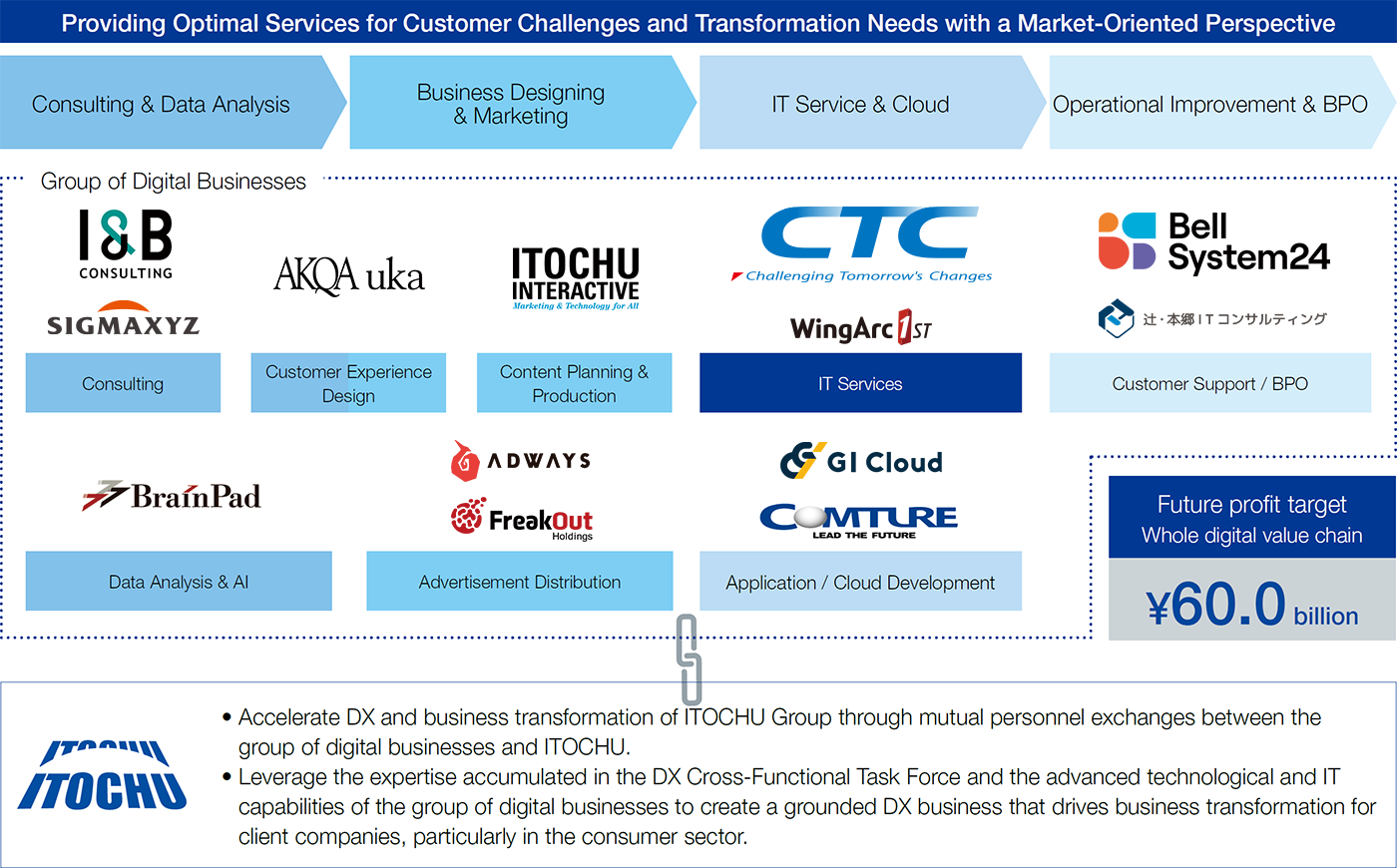

Creating Added Value through Collaboration with the Group of Digital Businesses

In recent years, the use of digital technology in business has extended beyond internal systems, significantly impacting companies’ business models. As many companies drive DX, the importance of providing comprehensive IT services that deliver end-to-end solutions from upstream to downstream is increasing. Rather than just focusing on system development, it is crucial to address customer needs for business model transformation by providing consulting services to untangle client challenges, designing user experiences in app development, and delivering integrated services that meet these evolving demands. Additionally, there has been a surge in cases where companies from previously different industries, such as consulting firms with strengths in understanding customer needs in upstream processes, are entering the downstream field of IT system construction. These companies are achieving high profit margins and growth rates, making them formidable competitors.

In addition to long-standing subsidiaries such as CTC and BELLSYSTEM24 Holdings, Inc., we have been making strategic investments since around 2020 in companies with high expertise and technical capabilities in specific areas, such as BrainPad Inc., which excels in data analysis, and AKQA UKA, which has insights into customer experience design. By fostering collaboration among these companies, we are building a group of digital businesses capable of meeting a wide range of customer needs.

Furthermore, to accelerate the expansion of our value chain and secure resources, we have been continuously pursuing partnerships with consulting firms to enhance our upstream functions, as well as M&As to secure engineering resources, following the privatization of CTC. Through these efforts, we aim to further improve our growth and profitability.(→ Advancing a Joint Venture with Boston Consulting Group, a Leading Management Consulting Firm)![]()

Evolution of the Value Chain through Expertise and Frontline Capabilities

To fully leverage the outcomes of our digital value chain strategy, it is essential to establish effective collaborations that go beyond mere equity relationships with our group of digital businesses, providing optimal solutions to customers with a market-oriented perspective. Our ICT Division has formed the DX Cross-Functional Task Force to expand our digital value chain strategy. This initiative aims to position us as a preferred partner for customers in driving DX by offering them comprehensive services.

The DX Cross-Functional Task Force is a cross-divisional team composed of employees from our ICT Division and IT & Digital Strategy Division, as well as secondees from various companies within our group of digital businesses. Initially launched in 2019 with a few members, the task force has now grown to a team of 50. We hold bi-weekly meetings to share project information and case studies, and we also organize specialized subcommittees focusing on themes such as generative AI. By strengthening collaboration within our group of digital businesses, we have established a structure to make joint proposals to clients, driving the creation of new businesses and the acquisition of DX project mandates. The task force also makes cross-divisional proposals to customers and Group companies of our other Division Companies, and since its inception, it has made over 1,000 proposals, maintaining high levels of order records.

By combining the high expertise of our group of digital businesses with the insights gained from diverse business fields, we are developing practical DX initiatives that create new added value.

03:Evolving Our Collaboration with Hitachi Construction Machinery:

Initiatives in Downstream Business Expansion and Horizontal Alliances

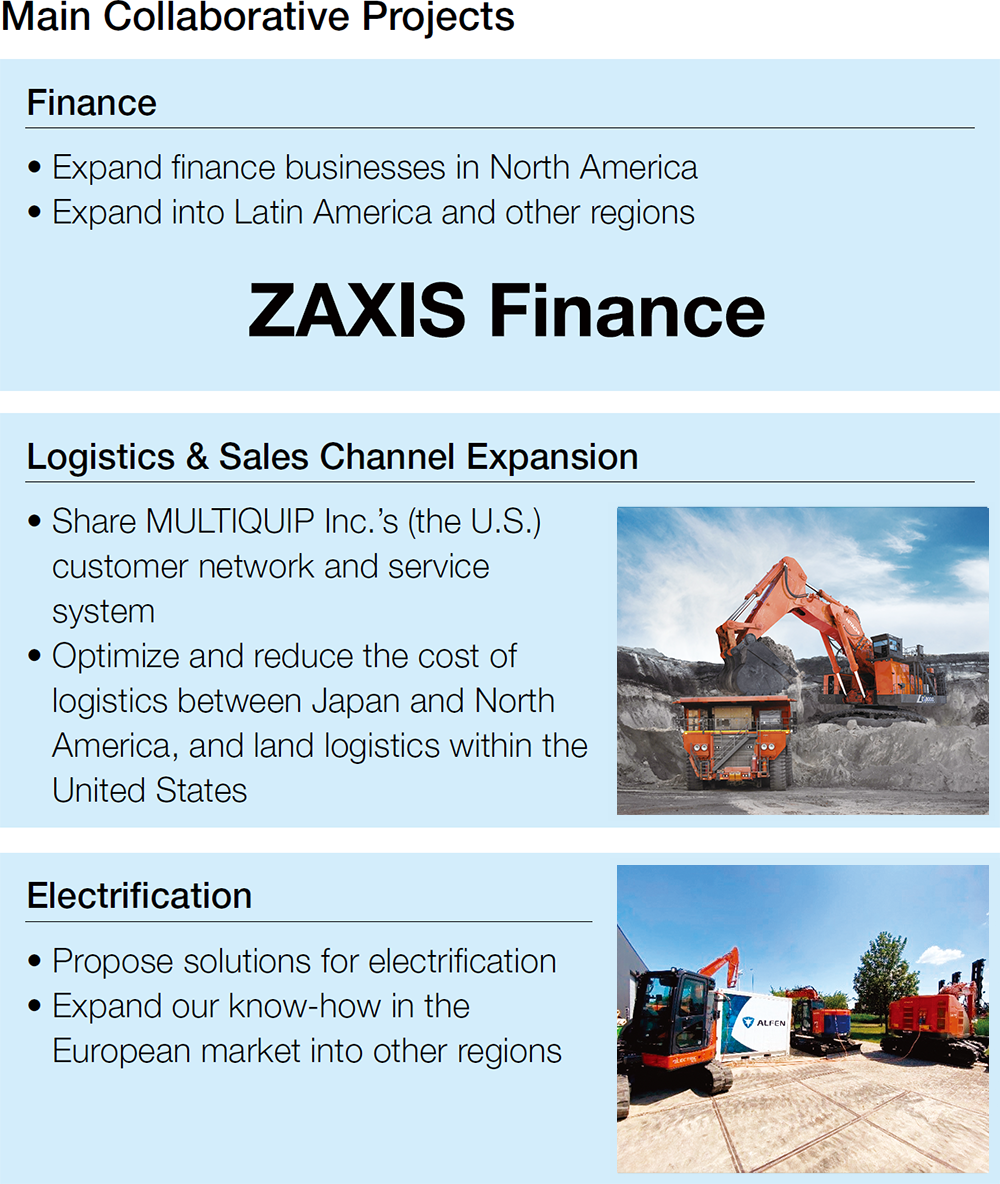

In August 2022, the special purpose company (SPC) that we established jointly with Japan Industrial Partners, Inc. acquired a 26% stake in Hitachi Construction Machinery Co., Ltd. As a new business partner of Hitachi Construction Machinery Co., Ltd., we support the strengthening of its downstream businesses not only through traditional distributor functions but also by providing various functions including finance, logistics and sales channel expansion, and electrification.

Main Collaborative Projects and Growth Strategies

Since the 1990s, ITOCHU and Hitachi Construction Machinery Co., Ltd. have expanded collaboration through trade and joint venture businesses. Hitachi Construction Machinery Co., Ltd. had begun its independent operations in its mainstay North American market after dissolving its alliance with U.S.-based Deere & Company. By leveraging our expertise in the North American construction machinery business and our know-how in the finance business, we aim to accelerate our collaboration with Hitachi Construction Machinery Co., Ltd. and pursue further growth.

In the North American market, around 90% of customers use financing options to purchase construction machinery from dealers, making the presence of a captive finance company that offers rapid financing approvals and competitive financing options extremely important. Following our investment in Hitachi Construction Machinery Co., Ltd., the first step in our collaboration was the establishment of a finance company jointly with Hitachi Construction Machinery Co., Ltd. and Tokyo Century Corporation, thereby accelerating our cooperation in the domain of finance. We are expanding the finance business by leveraging the strengths of Hitachi Construction Machinery Co., Ltd., utilizing operational data of construction machinery and offering financing options, such as reduced payments during the low-activity winter months. Additionally, we aim to secure new sources of profit by retaining ownership of machinery returned at the end of lease terms and then re-leasing, renting, or selling it as used equipment.

Beyond North America, we are leveraging our global network to expand distribution and sales channels, initiating various projects such as introducing potential dealers and approaching clients in the resource sector. We are already making progress, including negotiations for delivering Hitachi Construction Machinery Co., Ltd. products to mines where the Metals & Minerals Company holds a stake.

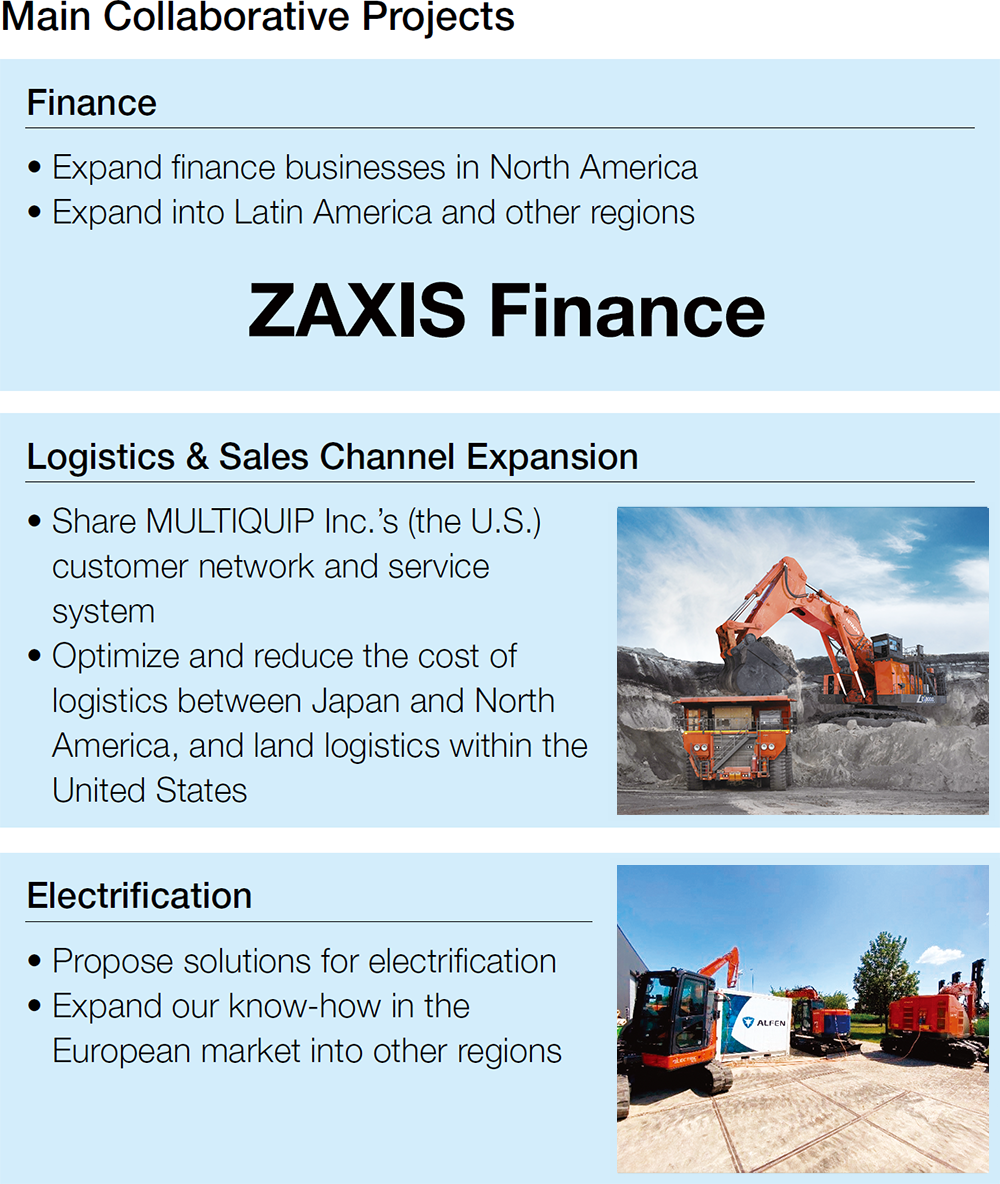

Initiatives aimed at electrifying construction machinery to contribute to decarbonizing construction sites are advancing first in Europe, where government support such as subsidies is robust. Hitachi Construction Machinery Co., Ltd. has already gained a significant market share by collaborating with European partners to diversify its product lineup. In collaboration with Alfen N.V., a Netherlands-based mobile charging equipment manufacturer, we will continue to support financing, logistics, and the construction of sales infrastructure for electric construction machinery and charging equipment in Europe. Furthermore, we are expanding our business fields into surrounding areas such as securing green power, as well as recycling and reuse, by collaborating with the energy storage system business of the Energy & Chemicals Company.

Going forward, we will steadily advance these collaborations to drive sustainable growth for our entire Group, including Hitachi Construction Machinery Co., Ltd. This will involve supporting logistics to improve transportation efficiency and reduce costs within the United States, horizontally expanding the North American collaborative model, including finance, and the European electric construction machinery business, to other regions, and evolving our business model through the active utilization of next-generation technologies such as remote control and autonomous driving.

04:DAIKEN’s Growth Strategies and Business Expansion Combining

Technical Expertise and Management Capabilities

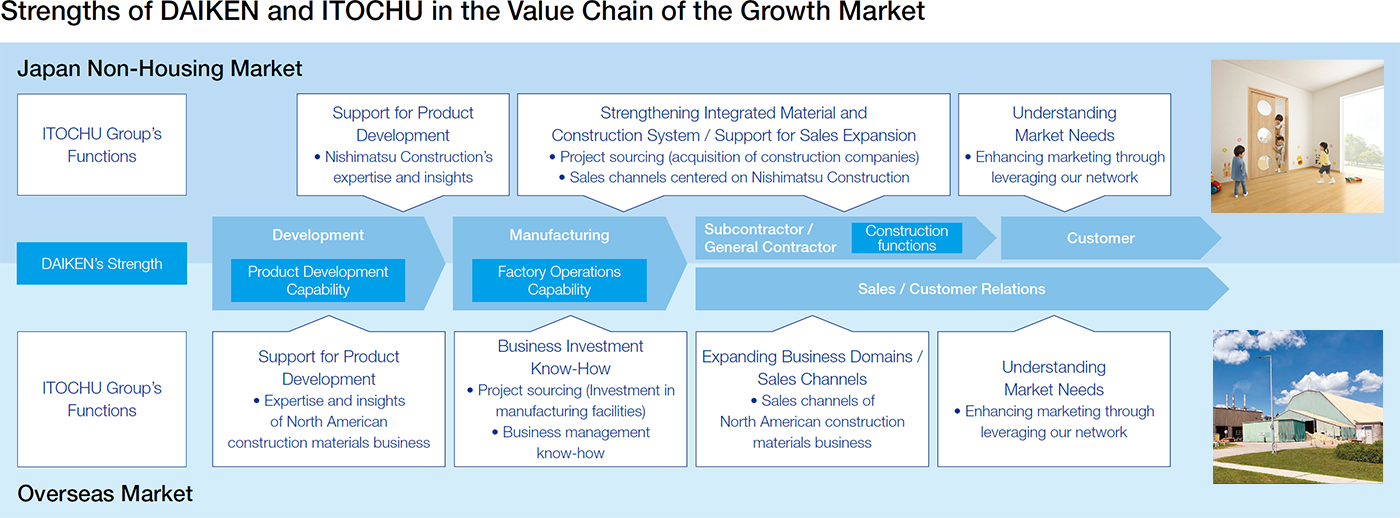

In 2023, ITOCHU launched a tender offer to privatize DAIKEN CORPORATION (DAIKEN), one of Japan’s leading manufacturers of wooden interior building materials. Currently, we have dispatched personnel, from the senior management level to the operational level, to implement hands-on management, thereby uniformly promoting growth strategies while fully leveraging the Group’s resources.

Executing Growth Strategies Tailored to Market Characteristics

DAIKEN’s primary markets are categorized as Japan Housing, Japan Non-Housing, and Overseas. In the Japan Housing market, which is their mainstay business and a mature market, further management improvements are necessary due to the decline in housing starts associated with the population decrease. Therefore, among the “earn, cut, prevent” principles, we are particularly focusing on “cut” and “prevent.” In the manufacturing and distribution processes, we will continue strengthening the business foundation by promoting supply chain reforms and data-driven management based on supply and demand data, as well as enhancing the efficiency of logistics operations. Furthermore, by leveraging the Group’s comprehensive strengths, we will work closely with DAIKEN to enhance various functions.

In the Japan Non-Housing market, there is growing demand from general contractors, who are DAIKEN’s primary customers, not only for the supply of building materials but also proposals that include both materials and construction services (integrated material and construction solutions). Therefore, by leveraging our network with general contractors, including Nishimatsu Construction Co., Ltd., with whom ITOCHU has partnered, as well as major developers, we aim to expand DAIKEN’s product lineup based on customer needs while also advancing roll-ups that strengthen and complement construction functions. For example, DAIKEN made Kiyota Kougyo Co., Ltd. (an air conditioning equipment installation company) a subsidiary in March 2024, aiming to expand its capabilities. Going forward, we will continue to promote initiatives toward establishing an integrated material and construction solutions system.

In the Overseas market, particularly in North America, where steady growth is anticipated, we are leveraging DAIKEN’s robust technical capabilities in the wood board business and the strengths of our North American construction materials business, which has conducted multiple strategic acquisitions, to jointly advance our initiatives. In particular, to meet the rising demand for interior material alternatives driven by increased awareness of tropical rainforest conservation, we are utilizing the sales channels established by our North American construction materials business for marketing activities. In July 2024, we acquired a new factory in Canada. This facility is being set up to handle not only its existing product lineup but also to serve as a production base for new types of wood boards.

In this way, while securing steady profits in the declining Japan Housing market, we aim to achieve medium-to long-term profit growth by identifying new sources of profit in the growing Japan Non-Housing and Overseas markets. By accurately understanding the characteristics of each market and steadily implementing strategies that leverage the Group’s resources and management capabilities, we will sustainably enhance the corporate value of not only DAIKEN but also the entire Group, including our North American construction materials business.

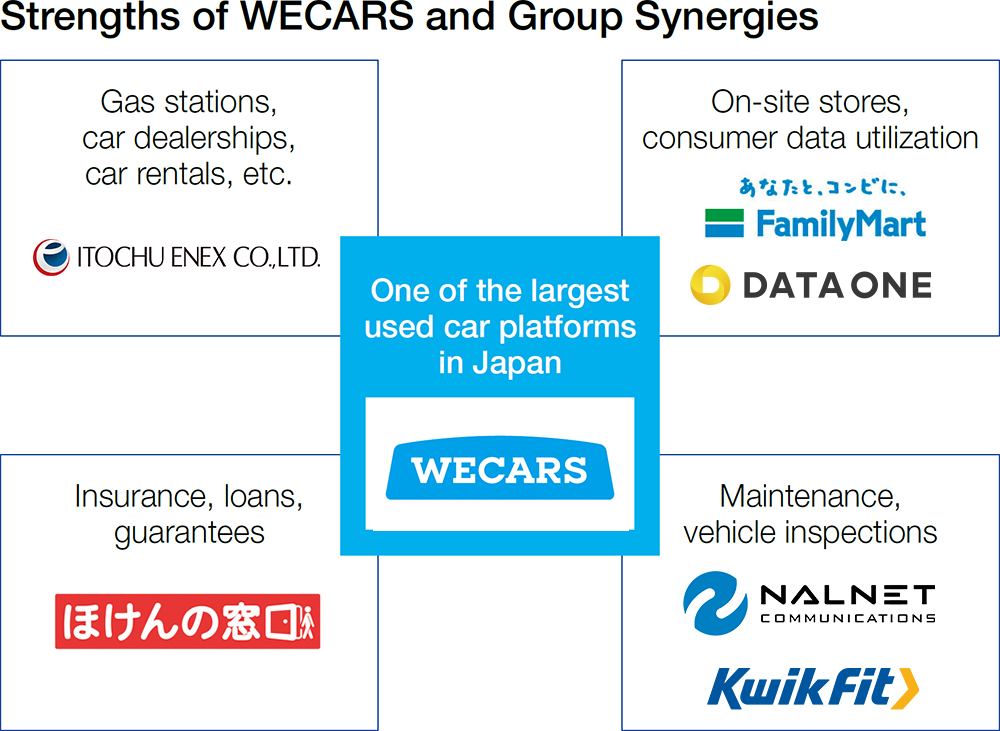

05:Rebuilding WECARS by Leveraging Our Comprehensive Capabilities

In May 2024, ITOCHU succeeded the used car purchase and sales business of the former BIGMOTOR Co., Ltd. and established WECARS Co., Ltd. The former BIGMOTOR Co., Ltd. had been involved in multiple compliance violations, including fraudulent auto insurance claims and the falsification of damage to repair vehicles, which became a major social issue and led to a dramatic decline in its performance. Through the reconstruction of this business, which had been No. 1 in its industry, we aim to address the social issue of restoring trust in the entire industry by making the used car business more transparent, provide safety and security to consumers, and secure employment for staff. Through these efforts, we believe we can realize the Company’s corporate mission of “Sampo-yoshi.”

Initiatives for Rebuilding the Business

The concepts of the business reconstruction are “breaking from the past” and “putting customers first.” From the perspective of breaking from the past, any liabilities related to past fraudulent incidents will be handled by the former BIGMOTOR Co., Ltd., and the newly established WECARS Co., Ltd. will focus on rebuilding the business with a new organizational structure that does not include the former management members. From the customers first perspective, we aim to build a company that sincerely engages with customers and society, earning their trust and being seen as attractive. To achieve this, we are prioritizing reforming the corporate culture, thoroughly educating employees, and establishing an internal control system. We have initiated direct dialogues between management and frontline employees, and we are also taking specific actions such as diligent compliance with laws and regulations, strengthening the internal reporting system, and more.

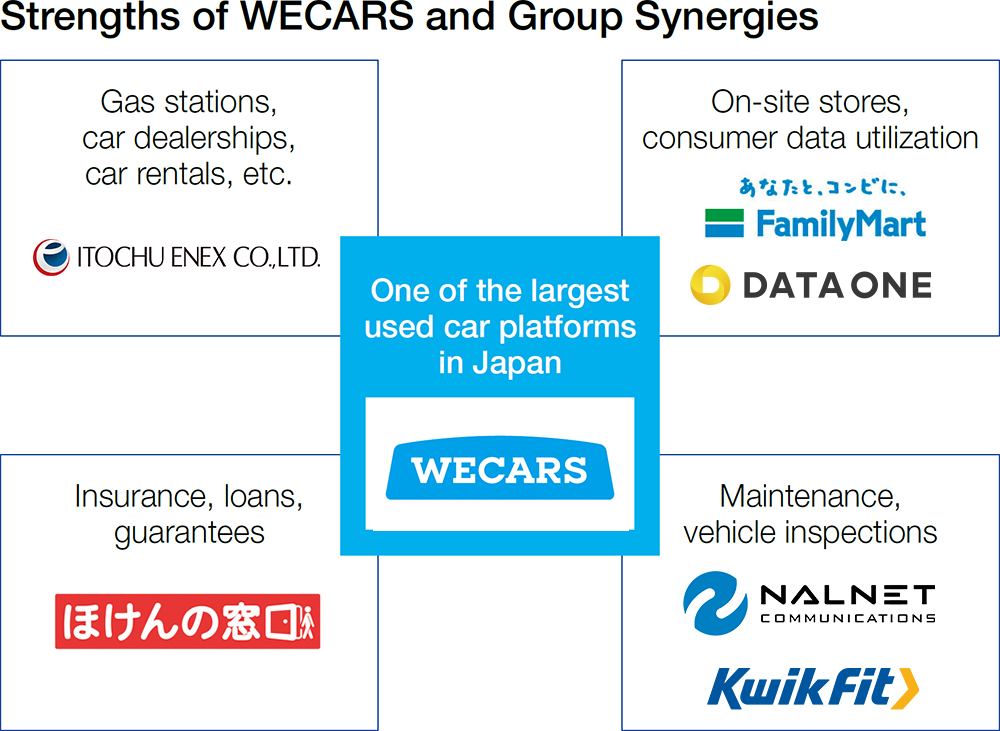

To rebuild the business, we will promote hands-on management by fully leveraging the know-how accumulated in ITOCHU through various revitalization projects in Japan and abroad, as well as dispatching experienced personnel from management to the front lines. WECARS Co., Ltd.’s strength lies in its extensive network of around 250 stores nationwide, making it one of the largest used car platforms in Japan. Additionally, we will leverage the frontline capabilities ITOCHU ENEX CO., LTD. has cultivated in the automotive dealer and rental car businesses, and providing highly transparent and convenient insurance services utilizing HOKEN NO MADOGUCHI GROUP INC. By harnessing the comprehensive capabilities of the Group, which excels in downstream fields, we aim to evolve the business with a market-oriented perspective.

While we anticipate that it will take some time to rebuild this business, we will leverage the Group’s comprehensive capabilities to tackle the reconstruction diligently and steadily, ultimately aiming to restore our position as the No. 1 player in the used car industry.

Toward the Rebuilding of WECARS

In rebuilding WECARS Co., Ltd., the top priorities are reforming the corporate culture and ensuring thorough compliance. I have been involved in numerous turnaround projects, including with Kwik-Fit, a leading tire retailer in the United Kingdom. Although the industries differ, the approach to engaging with a company facing challenges remains the same. I believe that both the strengths and weaknesses of the management are fully reflected on the front lines. It is important to immerse ourselves at the front lines and steadily establish mechanisms for improvement. Employees dispatched from the ITOCHU Group will primarily be responsible for revising the operation flows to ensure compliance on the front lines. At Kwik-Fit, I built a culture that emphasized a customer-first perspective. Similarly, at WECARS Co., Ltd., I will consistently communicate the importance of providing value to customers. We are also considering introducing a new human resource system that incorporates customer satisfaction and other KPIs, rather than focusing solely on sales and other numerical targets. By thoroughly reforming the corporate culture and ensuring strict compliance, we aim to make customers feel that the company has changed and garner their support. If we can achieve this, we believe that sales will naturally return. WECARS Co., Ltd. is starting from a place of lost trust. By actively incorporating customer feedback and employee voices from the front lines, and leveraging the know-how of the ITOCHU Group, the entire organization will drive these reforms forward.

President and Chief Executive Officer, WECARS Co., Ltd.

Shinjiro Tanaka

Mr. Tanaka joined ITOCHU in 1985. Since around 2010, he led the turnaround of MATER-HALCO, Inc., the largest fence manufacturer and wholesaler in the United States. From 2019, he served as CEO of European Tyre Enterprise Limited, which operates Kwik-Fit, the largest tire retailer in the United Kingdom. He has held his current position since May 2024.

06:Clean-Tech Business with Swift and Steady Execution

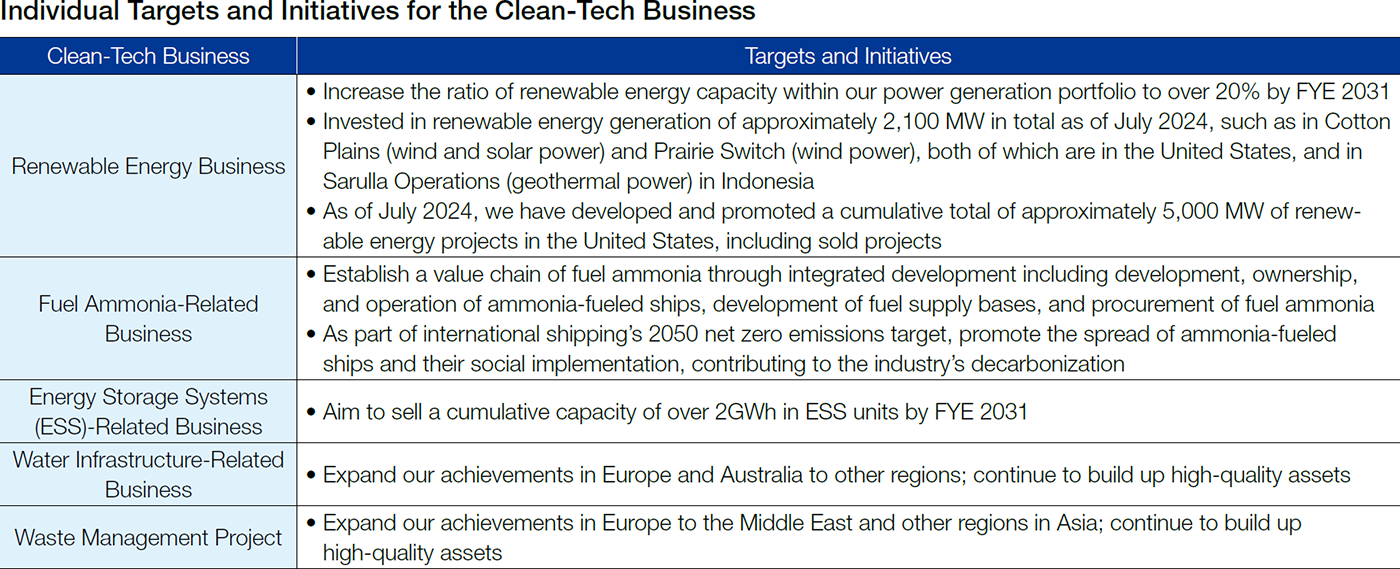

ITOCHU views climate change and other environmental risks as opportunities. We are engaged in clean-tech businesses that simultaneously pursue economic value as well as environmental and social value by expanding our operations through our “earn” principle while addressing societal demands and industry challenges. By setting individual targets and advancing climate change initiatives with swift and steady execution, we will steadily accumulate GHG avoided emissions.

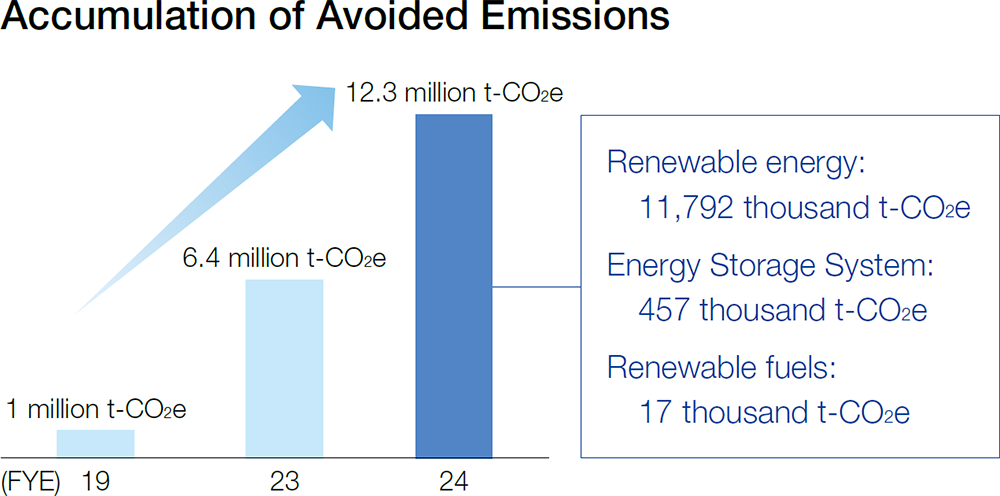

Avoided emissions are quantifications of the GHG emissions reductions that can be realized in the value chain by replacing existing (baseline) products and services with new products and services. In FYE 2024, our avoided emissions reached 12.3 million t-CO2e through the expansion of renewable energy businesses centered on the power generation business. We aim to create a volume of avoided emissions that exceeds our GHG emissions by 2040.

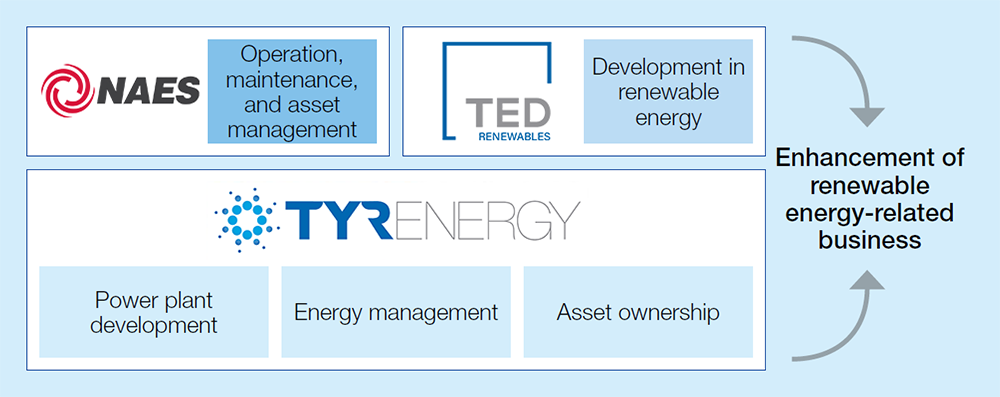

Expanding the Renewable Energy Business in North America

Our subsidiary, Tyr Energy, Inc. (based in the U.S.) established Tyr Energy Development Renewables, LLC (TED) in 2022, a company dedicated to renewable energy development. As of July 2024, TED and Tyr Energy, Inc. have developed over 30 solar power plants totaling around 5,000 MW (equivalent to five nuclear power plants), including sold projects. TED has built a development platform that completes a series of operations in-house, including land acquisition, obtaining various permits and approvals, power grid connection, negotiating and concluding power purchase agreements, selecting and negotiating with major equipment and construction contractors, and arranging financing. In February 2024, TED completed development of three projects with a total generating capacity of 333 MW (equivalent to around 72,000 standard U.S. households) and an expected annual CO2 reduction of around 600,000 tons. Moreover, our subsidiary NAES Corporation, also based in the U.S., is one of the world’s largest independent power plant operations and maintenance service providers, offering asset management and operations and maintenance services for around 1,400 renewable energy sites, including 2,000 MW of solar power plants and 1,100 MW of wind power plants. Furthermore, in 2023 we launched a fund targeting renewable energy development assets in North America and plan to engage in projects worth up to US$2 billion through this fund.

By leveraging the know-how cultivated through various power generation projects and expanding the scope of our business by enhancing diversified functions and services, we aim to capture the high growth rate of the North American renewable energy market, while contributing to the realization of a decarbonized and sustainable local society.