CFO Interview

We will continue to drive the sustainable enhancement of our corporate value under our new Management Policy by pursuing globally competitive efficiency and maintaining a consistent financial policy.

Member of the Board,

Executive Vice President, CFO

Tsuyoshi Hachimura

One year has passed since the announcement of the Management Policy “The Brand-new Deal.” How do you reflect on this past year?

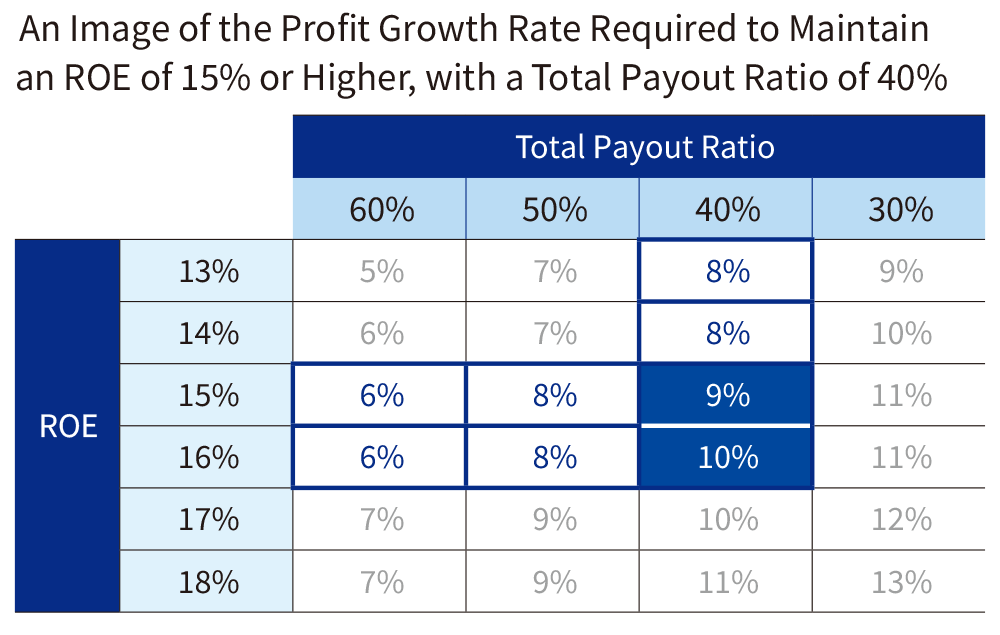

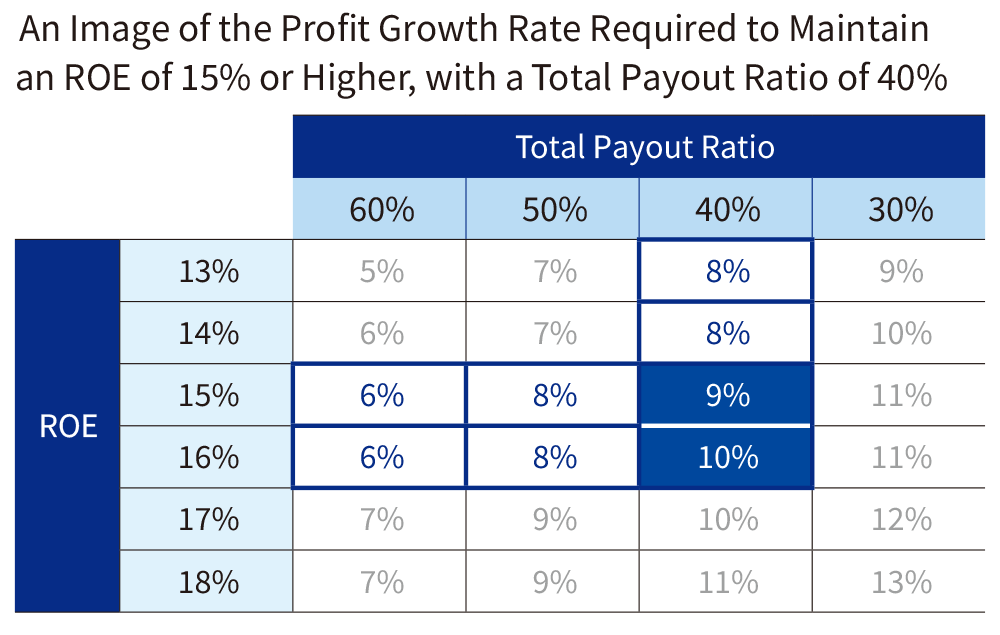

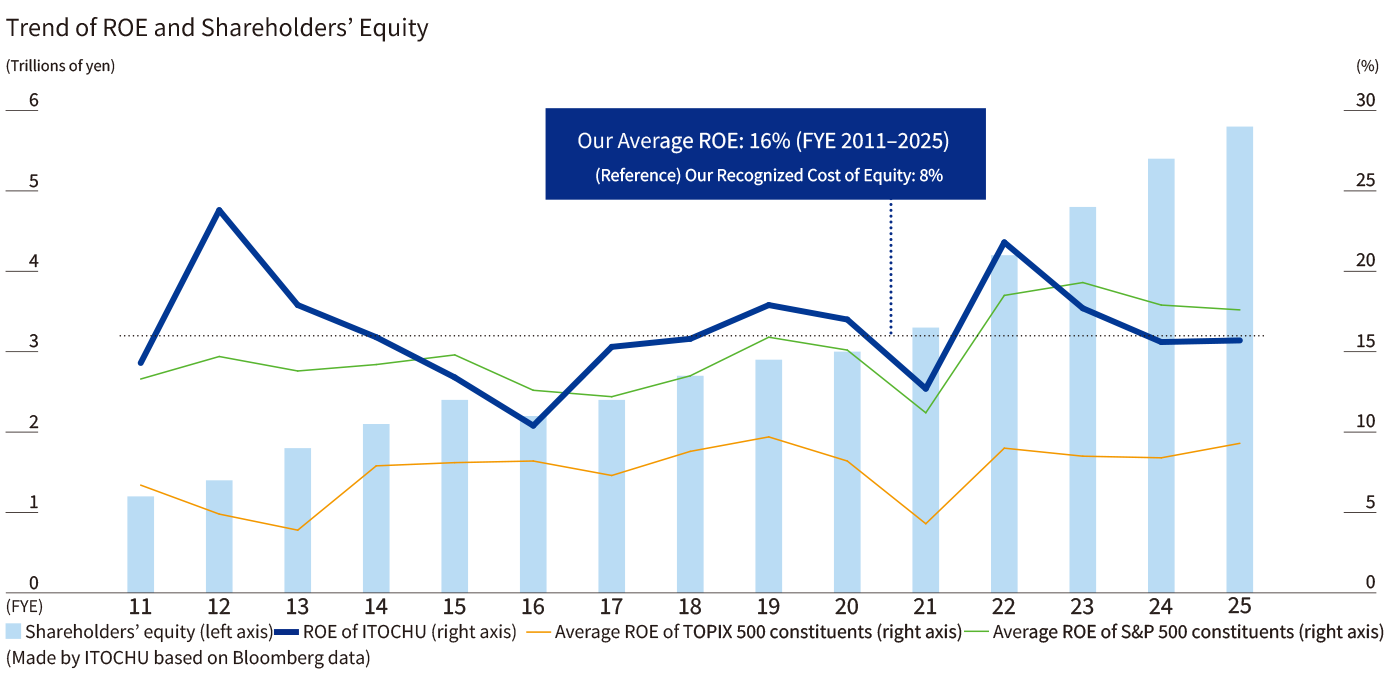

Following the disclosure of our business results and management plan in early May 2025, I have had numerous opportunities to engage in dialogue with a wide range of institutional investors and analysts as the head of investor relations, as I do every year. Through these dialogues, I was able to further explain the financial logic behind our Management Policy “The Brand-new Deal,” and I feel these dialogues helped deepen their understanding. This Management Policy was developed through repeated discussions among the management team, based on dialogues with shareholders and investors—grounded in my 10 years of experience as CFO. This policy reflects our commitment to highly efficient management, which is one of our strengths, based on our solid track record of realizing steady growth over the long term and an appropriate shareholder return policy. In essence, this represents a roadmap for enhancing corporate value, guided by the “financial matrix” that, starting from a total payout ratio of 40% or more, if we can achieve profit growth of about 10% based on our past track record, we can sustainably deliver a globally competitive ROE of 15% or higher. Many institutional investors, both in Japan and overseas, have commented that this matrix of total payout ratio, ROE, and profit growth rate is simple, clear, and easy to understand. As CFO, I believe it is my mission to provide the market with clear and logical explanations, even when discussing long-term perspectives, supported by quantitative information.

Reflecting on FYE 2025, the first year under the Management Policy “The Brand-new Deal,” we achieved record-high consolidated net profit of ¥880.3 billion, which increased by approximately 10% compared to the previous fiscal year, and maintained a high ROE level of approximately 16%. Consequently, we have achieved a 13% CAGR in profit growth since FYE 2011. In terms of growth investments, we decided to execute approximately ¥1 trillion in investments, including projects scheduled for execution in FYE 2026. Specifically, we accumulated high-quality investments that are characteristic of ITOCHU, such as the privatizations of DESCENTE LTD. and C.I. TAKIRON Corporation, as well as the iron ore business in Brazil, which is expected to contribute steady profits. Regarding shareholder returns, we achieved a total payout ratio of approximately 50%, exceeding the level set in our long-term Management Policy. We paid an annual dividend of ¥200 per share (an increase of ¥40) and executed ¥150 billion of share buybacks. However, challenges remain. As I stated in my own words since announcing the FYE 2025 3rd quarter business results, core profit fell short of market expectations due to the decline in resource prices, delays in the turnaround of certain businesses, and the impact of delays in the timing of profit contributions from new investments. While extraordinary gains, such as the revaluation gain resulting from the conversion of DESCENTE LTD. into a consolidated subsidiary, and steady progress in PMI*1 at non-resource businesses such as CTC and DAIKEN CORPORATION, enabled us to achieve our initial consolidated net profit plan, it is a fact that core profit fell short of our initial plan. I am aware that this has caused concern among some investors, and management shares a strong sense of urgency regarding this issue. In particular, for the underperforming businesses, we are engaging in more in-depth discussions on what kind of turnaround measures should be implemented, and the extent to which our hands-on management approach, which is our strength, can be effective. I strongly believe that steadily accumulating core profit to achieve profit growth is essential to meet investor expectations.

*1 PMI: Post-Merger Integration

How will you continue to achieve profit growth in the uncertain business environment?

I have been busier than usual in preparing the management plan for FYE 2026. We are at a time of significant change in the business environment. Since President Trump’s inauguration, the business environment, including tariff policy, has been changing day by day. I recognize that the business environment is highly uncertain, with the World Bank and the Bank of Japan also lowering their economic outlooks. It is precisely in times like these that management must remain calm and rigorously assess the situation. For our management plan for FYE 2026, rather than taking the conventional approach of treating recession risk as a Companywide buffer, we have presented a plan that starts from a solid, achievable level of core profit. From there, we incorporate recession risks by segment and aim to achieve the plan through profit contributions from organic growth and new investments. Regarding the recession risk, we determined that the broader economic slowdown due to the deterioration in sentiment would have a greater impact than the direct impact of tariffs. Based on the fact that core profit in FYE 2021, when economic activity stagnated due to the COVID-19 pandemic, fell 6.8%, and considering that the situation would not be as severe as a global shutdown of economic activity, we incorporated an assumption of approximately 5% impact on core profit.

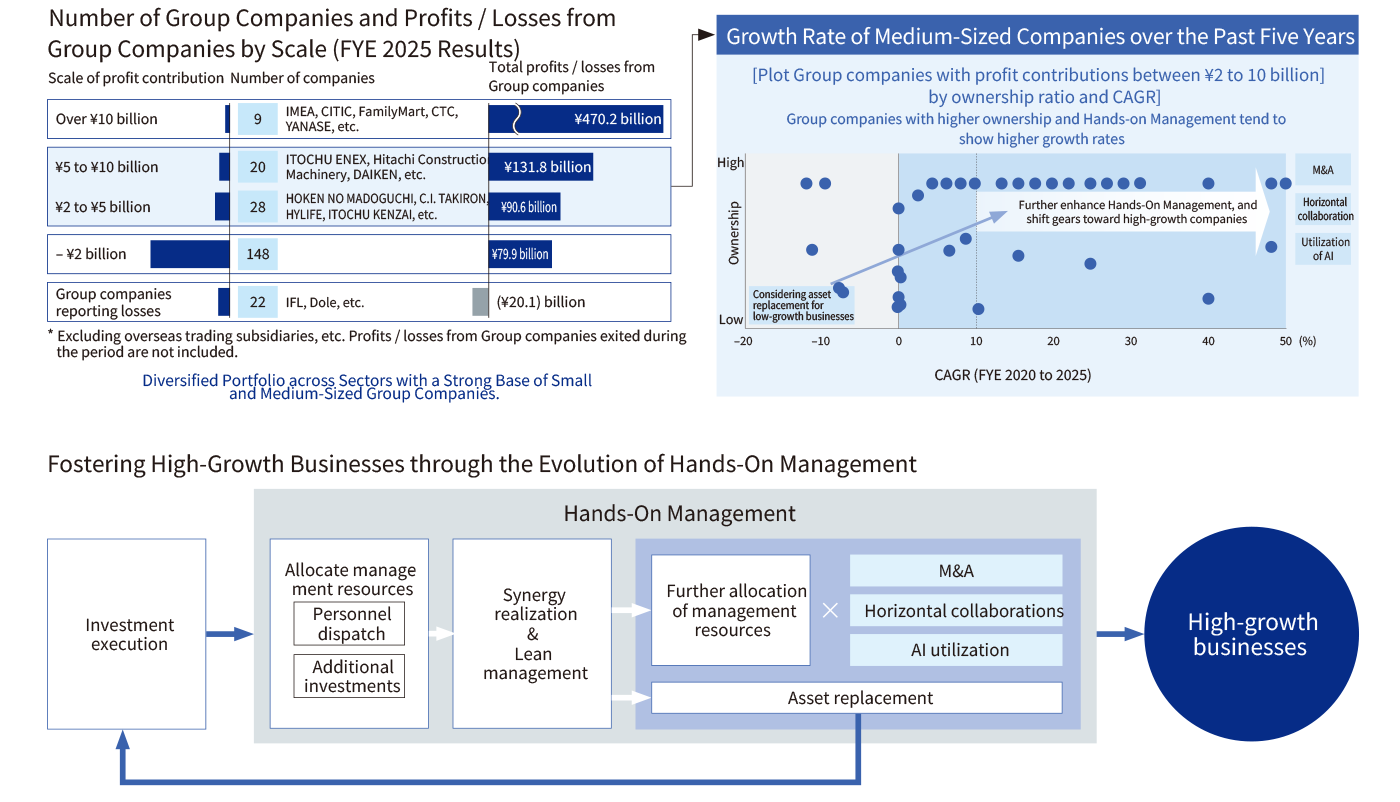

In this challenging environment, the key question is how we intend to drive growth in core profit—our top priority. The critical point lies in how we evolve our unique strength: hands-on management. By organizing and analyzing data such as profit contribution, ownership, and growth rate for each group company, we can identify the distinctive characteristics of our group. In FYE 2025, we had 148 small-scale Group companies with profit contributions of ¥2 billion or less, around 50 medium-sized Group companies contributing ¥2–10 billion, and nine Group companies (including IMEA, FamilyMart, and CTC) contributing over ¥10 billion. Our earnings base, which is highly resilient to economic fluctuations and supports our sustainable growth, is made up of a wide range of Group companies diversified across different areas, rather than relying solely on large-scale Group companies.

For small-scale Group companies with profit contributions of ¥2 billion or less, while their value is not limited to their absolute profit contribution, they play a key role in supporting our extensive domestic network in the consumer sector, such as Textile, Food, and General Products & Realty, and this leads to an advantage in the information we can reach. Even if the profit generated is not large, an increase of ¥100 million for a Group company with net profit of ¥1 billion, or tens of millions for a Group company with net profit of ¥100–200 million, represents a significant growth rate. Accumulating these profit increases across multiple companies is also essential for overall growth. Smaller Group companies, in fact, tend to benefit more visibly from our hands-on approach. By dispatching our employees and alumni to support them, we aim to drive steady growth through management improvement — focusing especially on the “Cut” and “Prevent” aspects of our “Earn, Cut, Prevent” principles.

I believe the key focus should be on the Group of medium-sized Group companies with profit contributions of ¥2–10 billion. This group is characterized by its breadth and diversity across a wide range of business fields. Analysis of growth rates over the past five years shows that medium-sized Group companies with established business foundations and hands-on management have tended to achieve higher growth. There is no doubt that our growth to date has been supported by our hands-on management, in which we proactively allocate management resources to investees, realize synergies, and implement lean management. Through these efforts, we have nurtured our core businesses and driven sustainable growth. However, it is not simply a matter of increasing our ownership by injecting additional capital or dispatching personnel without careful consideration. It is essential to assess the situation of each Group company and develop the optimal strategy to accelerate their growth, whether that means allocating additional resources through a hands-on approach, maintaining the current level of involvement, or shifting to a hands-off strategy that leverages external capital or business restructuring. It is essential to further evolve our existing hands-on management by strengthening our earning power through combining M&A by Group companies, horizontal collaboration within the Group, the AI utilization, and rapid asset replacement. For example, we view M&A by existing Group companies as one way to pursue relatively low-risk investments aimed at expanding into adjacent domains or fields where we have expertise. In FYE 2025, several Group companies including ITOCHU KENZAI CORPORATION, ITOCHU CHEMICAL FRONTIER Corporation, ITOCHU Retail Link Corporation, and a subsidiary of C.I. TAKIRON Corporation have initiated their own M&As as a means of driving business expansion. While large-scale, inorganic strategic investments are sometimes important, we believe there is still a lot of room for growth in our neighboring domains where risk can be more carefully managed. By combining these initiatives, we will steadily work to further raise our core profit base.

From the perspective of asset efficiency, regardless of company size, we conduct comprehensive quantitative and qualitative periodic reviews of all business investments to determine whether they are generating returns that exceed the cost of capital. For any businesses identified as low-efficiency, irrespective of their scale, we promptly reconsider our holding policy, including the possibility of swift asset replacements. At the ALM Committee*2 which I chair, we receive reports on key management indicator analysis every year, conducted for each Division Company. In addition to our ongoing analysis of asset efficiency and improvement measures, we conducted in-depth analysis and discussions on the theme of “enhancing hands-on management” for this year. I have instructed each Group company to promptly implement the measures discussed at the committee, and I will closely monitor their progress.(→ Portfolio Management)![]()

*2 ALM Committee: Asset Liability Management Committee

What are the key points of the FYE 2026 management plan, and what are your thoughts behind this plan?

As I explained at the beginning, the Management Policy “The Brand-new Deal” includes a financial strategy that takes into account the matrix of profit growth rate, shareholder returns, and ROE. There is no change in this mindset. Under the Management Policy of “Grow earnings: No growth without investments,” we will continue to steadily accumulate high-quality growth investments that contribute to profit growth, aiming for 10% growth from a medium- to long-term perspective. Regarding shareholder returns, we have maintained a total payout ratio of 50% for the second consecutive fiscal year to meet market expectations. Regarding dividends, on which we have received a variety of opinions, the annual dividend per share is initially set at ¥200, which is the same amount as for FYE 2025. We aim to increase dividends at an early stage as profit accumulates going forward. Our approach to shareholder returns remains adaptable, reflecting the ongoing dialogue with the market.

The premise for this cash allocation is our financial policy, in which we aim to maintain a solid financial foundation based on balancing three factors (growth investments, shareholder returns, and interest-bearing debt control) that I am particularly committed to as CFO. For FYE 2026, we are planning ¥1 trillion in growth investments and a 50% total payout ratio, and expect approximately ¥300 billion in cash inflows from asset replacements, including approximately ¥170 billion*3 from the sale of C.P. Pokphand Co. Ltd. in April 2025. We will continue to maintain NET DER at less than 0.6 times.(→ Financial Strategy)![]()

Recently, I held a regular meeting with Mr. Greg Abel, the next CEO of Berkshire Hathaway Inc., one of our major shareholders. Since Berkshire Hathaway Inc.’s investment in the five general trading companies, I am the only member of management who has consistently served as their point of contact. These dialogues with investors, are valuable opportunities to reflect on the importance of meeting market expectations and building strong, unwavering relationships of trust.

We are targeting consolidated net profit of ¥900 billion, a record-high for the second consecutive year in FYE 2026. It is an extremely important year in aiming for a return to the Triple Crown among general trading companies in consolidated net profit, ROE, and market capitalization. I understand market expectations and have incorporated them into our management. I believe I fully understand the expectations now being placed on our Company. I remain committed to fulfilling my responsibilities as CFO, one by one, in order to sustainably enhance our corporate value.

*3 Realized a cash inflow of approximately ¥190 billion in the 1st quarter of FYE 2026. Tax payment of this transaction, totaling approximately ¥20 billion, is expected in FYE 2027.

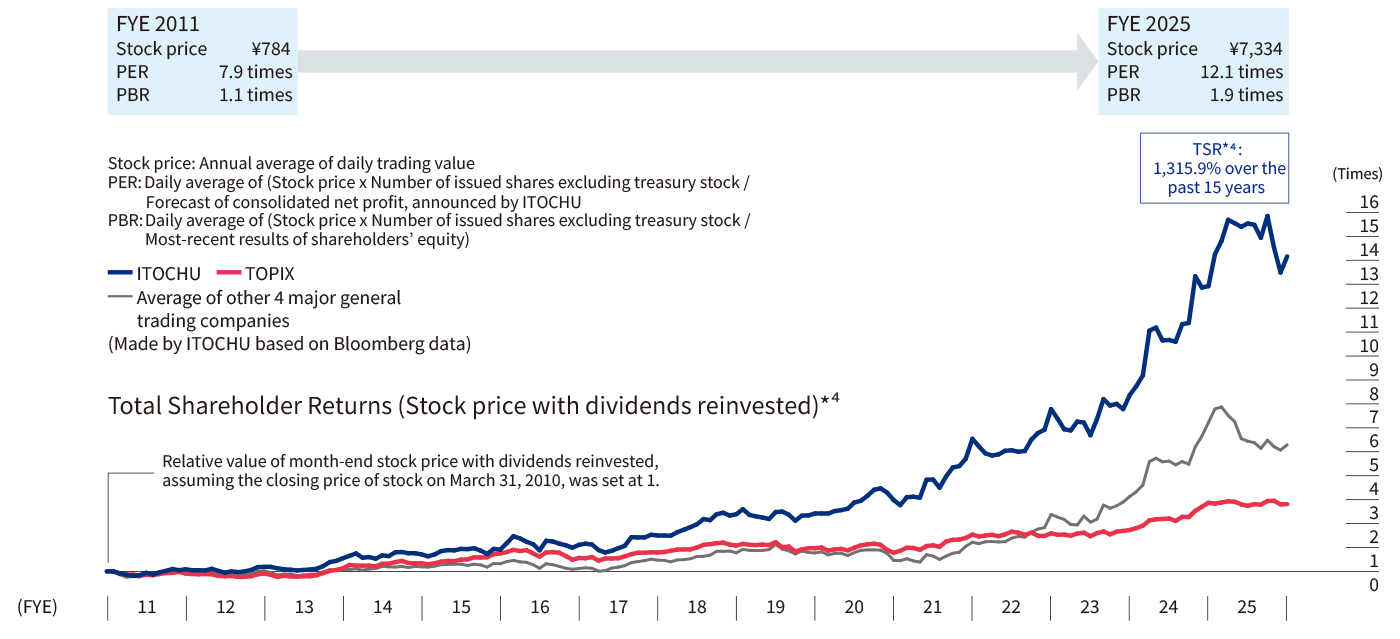

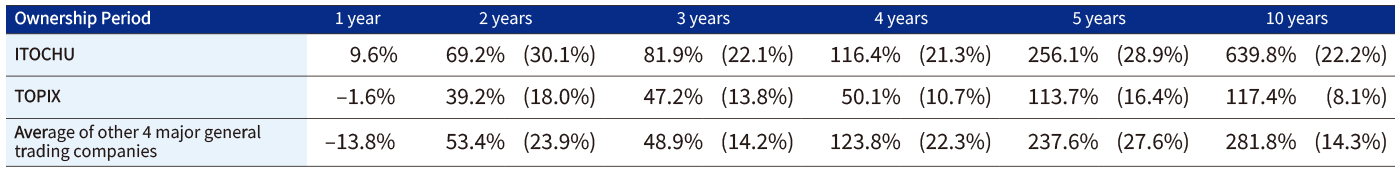

Trends of Stock Price / PER / PBR / TSR*4

TSR*4 as of March 31, 2025

*4 Total Shareholder Returns (TSR): Returns on investment assuming that dividends are reinvested. The chart above shows relative value of month-end stock price with dividends reinvested, assuming the closing price of stock on March 31, 2010, was set at 1. The table above indicates returns on investment during each period of holdings preceding from March 31, 2025. (Figures in brackets are rate of returns converted to the annual average by the geometric mean.)