Corporate Governance

We are establishing a governance system that strengthens our earning power by promoting appropriate risk-taking through the continuous enhancement of the effectiveness of the Board of Directors.

We are establishing a governance system that strengthens our earning power by promoting appropriate risk-taking through the continuous enhancement of the effectiveness of the Board of Directors.

Corporate Governance System

POINT Establishment and Enhancement of a Governance System Focused on Substantive Effectiveness

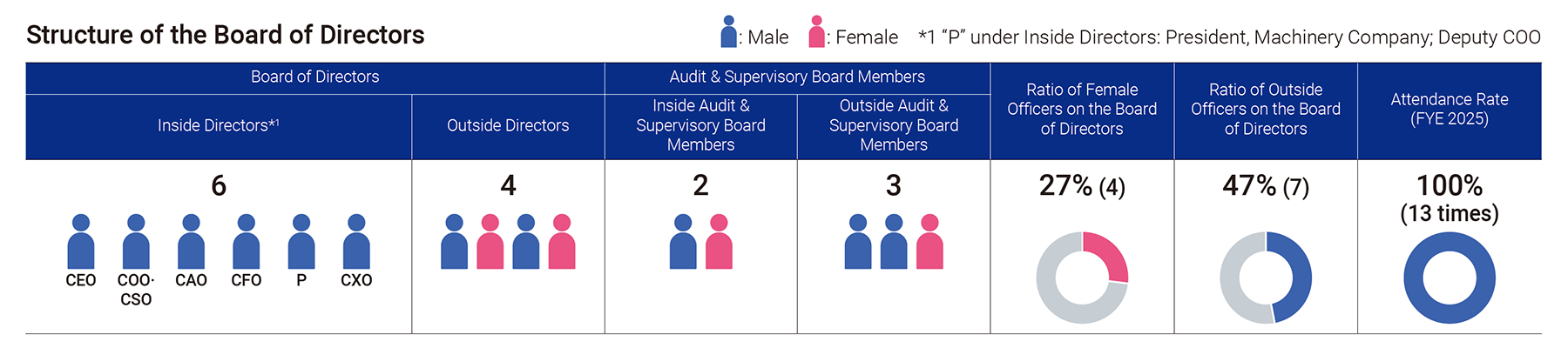

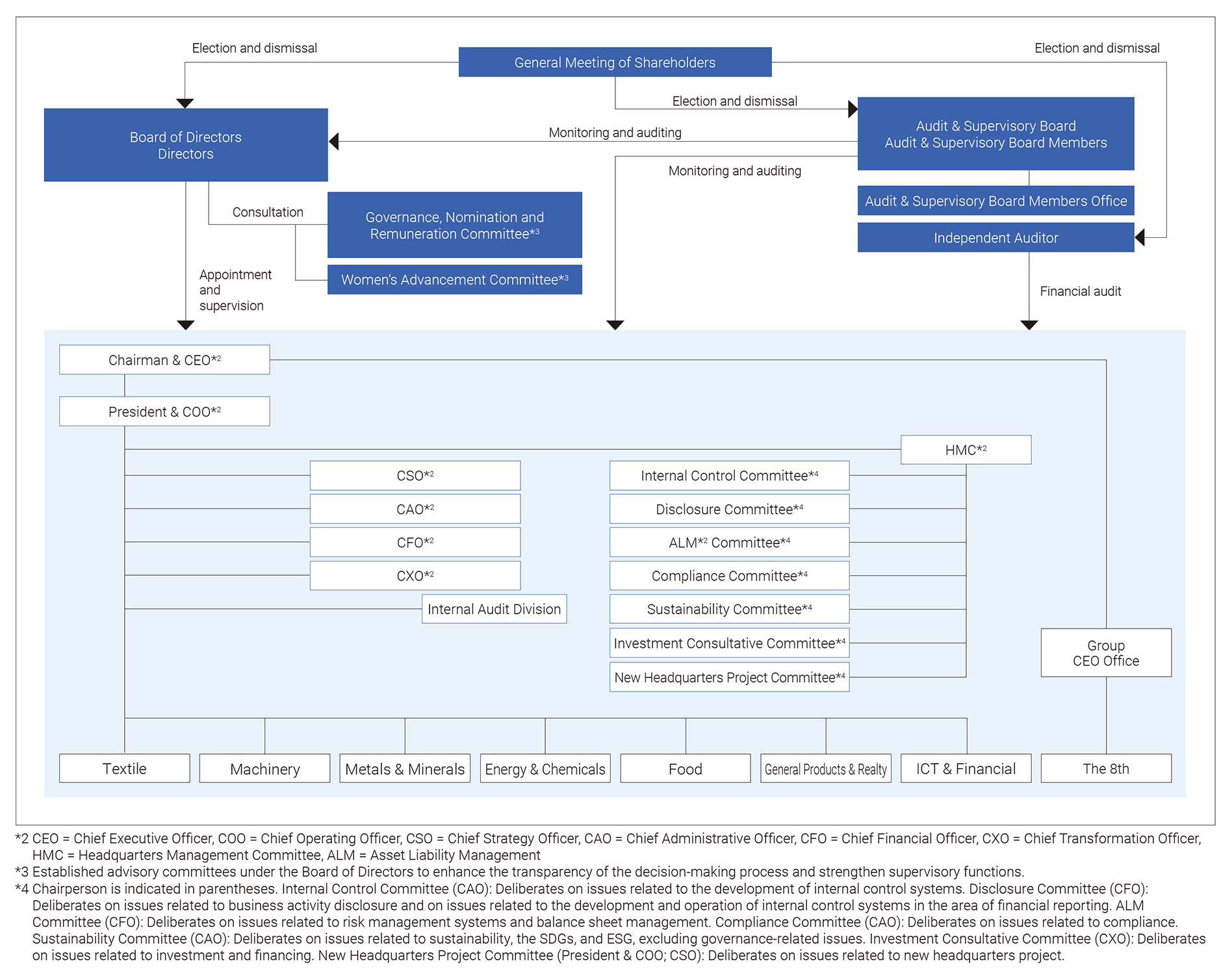

As a corporation with the Audit & Supervisory Board (Kansayaku secchi kaisha), ITOCHU has adopted a governance system centered on the Board of Directors, where Outside Directors account for at least one-third of members. The system also includes advisory committees to the Board of Directors, with more than half of the members being Outside Directors, and an Audit & Supervisory Board, at least half of which is composed of Outside Audit & Supervisory Board Members. Through a well-developed system for the provision of information and provision of support to outside officers, the Board has established effective ways to ensure that the supervision of business execution is appropriate from outside perspectives, which is to say from the perspectives of the public and general shareholders. Taking into account the Corporate Governance Code and feedback from the market, we are committed to continually reinforcing a governance system that prioritizes substantive effectiveness.

Overview of Corporate Governance and Internal Control System

(As of July 1, 2025)

Evaluation of the Effectiveness of the Board of Directors

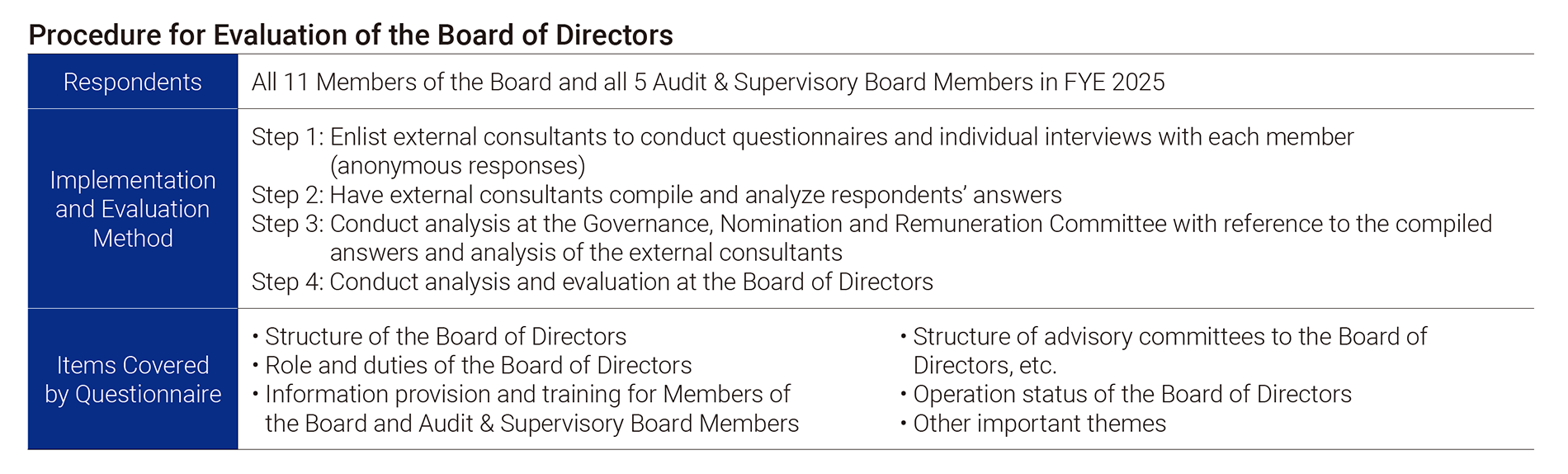

We appoint external consultants to ensure objectivity and conduct an annual evaluation of the effectiveness of the Board of Directors. We formulate and implement specific measures to address issues identified in previous evaluations, and by repeatedly evaluating the formulated measures and identifying new issues, we are able to continuously maintain and improve the effectiveness of the Board of Directors.

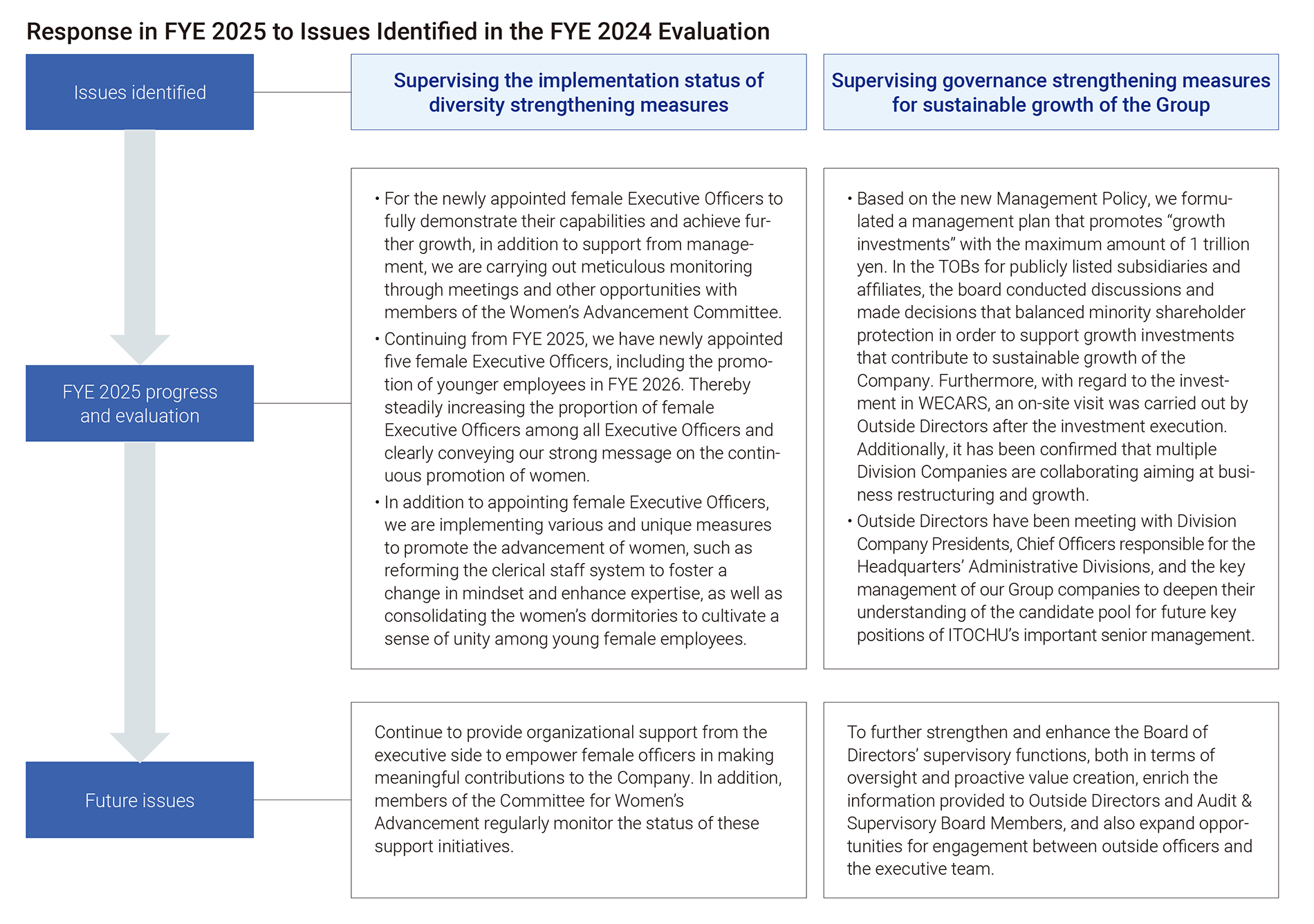

In the FYE 2025 evaluation, the quantitative evaluation score reached a new record high, and we confirmed high effectiveness in all six evaluation themes. Qualitative issues that should be addressed in the medium- to long-term include “supervising the implementation status of diversity strengthening measures and discussions aimed at further advancement” and “supervising governance strengthening measures for sustainable growth of the Group,” and we have recognized that the Board of Directors should continue to take further steps, as in previous years.

In addition, we are continuously taking measures to improve the operation of the Board of Directors beyond the issues identified, such as changing the operation method to reflect the opinions of Outside Directors on the frequency and themes of business execution status reports. Regarding the evaluation of the effectiveness of the Board of Directors, we will not limit ourselves at a formal evaluation, but will steadily make detailed improvements to achieve an improvement in effectiveness that is unique to our Company.