SPECIAL FEATURE:— Examples of Areas with High Growth Potential —

Expanding Collaboration with Leading Domestic Companies by Leveraging “Trust and Credibility”

By expanding collaborations with leading domestic companies and generating synergies, we are capturing new growth opportunities through the expansion of our business domains and achieving grow earnings.

By expanding collaborations with leading domestic companies and generating synergies, we are capturing new growth opportunities through the expansion of our business domains and achieving grow earnings.

Under our Management Policy, “The Brand-new Deal,” ITOCHU has adopted the principle of “No growth without investments,” striving to enhance performance through proactive growth investments. In addition to expanding investments in areas where we possess expertise, we have also increased cases of expanding our business domains through collaboration with leading domestic companies. Growth investments leveraging the “trust and credibility” we have cultivated over the time have broadened our business potential.

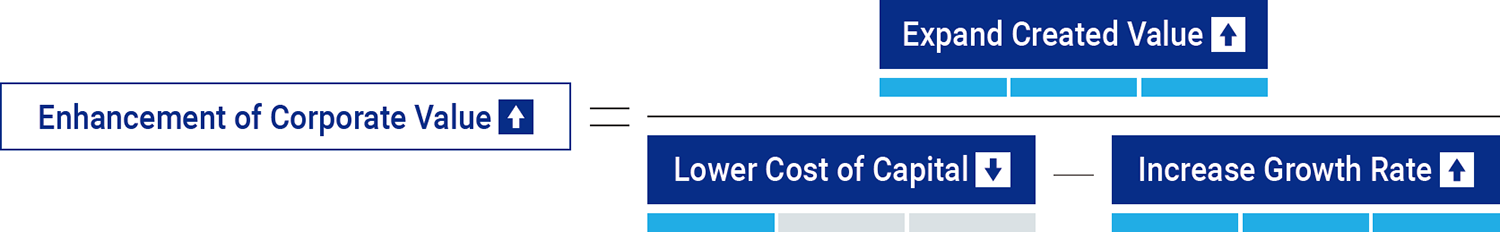

Diverse Collaboration with Domestic Manufacturers Originating from Investment in Hitachi Construction Machinery

In August 2022, we executed an investment in Hitachi Construction Machinery Co., Ltd. through a special purpose company jointly established with Japan Industrial Partners, Inc. Behind this investment, there were two key developments for Hitachi Construction Machinery Co., Ltd.: one was the independent business development in the North American market following the dissolution of its long-standing alliance with Deere & Company in the U.S. at the end of February 2022; the other was Hitachi, Ltd.’s efforts in response to the dissolution of its parent-subsidiary listing. We have built a relationship of mutual trust with Hitachi Construction Machinery Co., Ltd. as business partners since the 1990s through trade and joint ventures in Indonesia and elsewhere. Furthermore, our expertise gained through finance operations in North America with Isuzu Motors Limited, as well as the sales channels of MULTIQUIP Inc., a U.S. company specializing in compact construction equipment, were highly valued. As a result, we were selected as the optimal partner for a capital alliance with Hitachi Construction Machinery Co., Ltd., particularly in the North American market, where nearly 90% of construction machinery purchasers utilize financing. The presence of a competitive captive finance company is therefore essential to success in this market. Leveraging the know-how we have accumulated over the years in North American construction machinery and finance businesses, we have established a local finance company in collaboration with Hitachi Construction Machinery Co., Ltd. and Tokyo Century Corporation. By providing services that meet local needs, such as prompt credit screening and flexible payment options, the company achieved profitability in its first year of operation in FYE 2024.

These collaborative achievements with Hitachi Construction Machinery Co., Ltd. have served as significant momentum for securing investment opportunities with other leading companies. In April 2025, we acquired shares in Kawasaki Motors, Ltd. through a capital and business alliance, launching and promoting a joint retail finance business in the motorcycle and power sports* sector to further expand Kawasaki Motors, Ltd.’s presence in the North American market. (→ Capital and Business Alliance with Kawasaki Motors, Ltd.)![]() Furthermore, in May 2025, aiming to resolve the parent-subsidiary listing of Toyota Industries Corporation, we acquired shares in AICHI CORPORATION, a leading manufacturer of aerial work platforms. This will enable us to create new revenue opportunities by strengthening our value chain in the domestic market, including financing, after-sales service, and used car sales, as well as to achieve growth by developing overseas markets. In this way, the “chain of trust” cultivated through collaboration with Hitachi Construction Machinery Co., Ltd. continues to drive new investment opportunities and the expansion of the Machinery Company’s business domains.

Furthermore, in May 2025, aiming to resolve the parent-subsidiary listing of Toyota Industries Corporation, we acquired shares in AICHI CORPORATION, a leading manufacturer of aerial work platforms. This will enable us to create new revenue opportunities by strengthening our value chain in the domestic market, including financing, after-sales service, and used car sales, as well as to achieve growth by developing overseas markets. In this way, the “chain of trust” cultivated through collaboration with Hitachi Construction Machinery Co., Ltd. continues to drive new investment opportunities and the expansion of the Machinery Company’s business domains.

* Power sports vehicles refer to motorcycles, off-road four-wheelers vehicles, jet skis, and other vehicles equipped with engines or motors for outdoor recreational activities.

Expanding Infrastructure Business Addressing Social Issues by Enhancing Construction and Building Materials Alliance

We have been strengthening alliances in the construction and building materials sectors in recent years with the aim of reinforcing our value chain and expanding our business into the infrastructure domain. A symbolic example of this strategy is our capital and business alliance with Nishimatsu Construction Co., Ltd. (Nishimatsu Construction), in which we began investing in 2021. At that time, Nishimatsu Construction was seeking to stabilize its management in response to changes in its business environment, including the need to address activist shareholders, and requested our participation as a capital partner. As we aimed to complement and strengthen our entire value chain—from building materials manufacturing and distribution to real estate development, management, and operation—through strategic business investments, we viewed this alliance with Nishimatsu Construction —a leading Japanese contractor with robust execution capabilities and a proven record of joint real estate development with our Company—as an important opportunity to further strengthen and complement our value chain. Since our initial investment, we have realized a variety of synergies, including additional joint real estate development projects, collaboration in the procurement of construction materials and equipment through our Group companies, and cooperation in the renewable energy business. To further accelerate our partnership, we increased our equity share in May 2025, making Nishimatsu Construction an equity-method affiliate.

In addition, our construction and building materials alliances include Oriental Shiraishi Corporation, one of Japan’s leading bridge manufacturers, with whom we entered into a capital and business alliance in May 2023, and Iwano Bussan Co., Ltd., a company with a long-standing track record in civil engineering materials trading in eastern Japan, which became a wholly owned subsidiary of our Group company, ITOCHU KENZAI CORPORATION, in April 2025. Through alliances with Oriental Shiraishi Corporation—a pioneer in the infrastructure maintenance market such as expressway renovations— Iwano Bussan Co., Ltd.—with its long history as a civil engineering materials trading company in eastern Japan—and Nishimatsu Construction—with advanced civil engineering capabilities— we are contributing to meeting social needs driven by government policies for national resilience, including the renewal of aging social infrastructure and disaster prevention and mitigation. In addition, in this domain, we expect further synergies through cooperation with PASCO Corporation, in which the ICT & Financial Business Company has invested. By utilizing geospatial information, we aim to advance infrastructure monitoring and the maintenance and management of urban infrastructure through horizontal collaboration. Going forward, we will continue to work closely with a diverse range of partners to address social challenges and further enhance our corporate value.

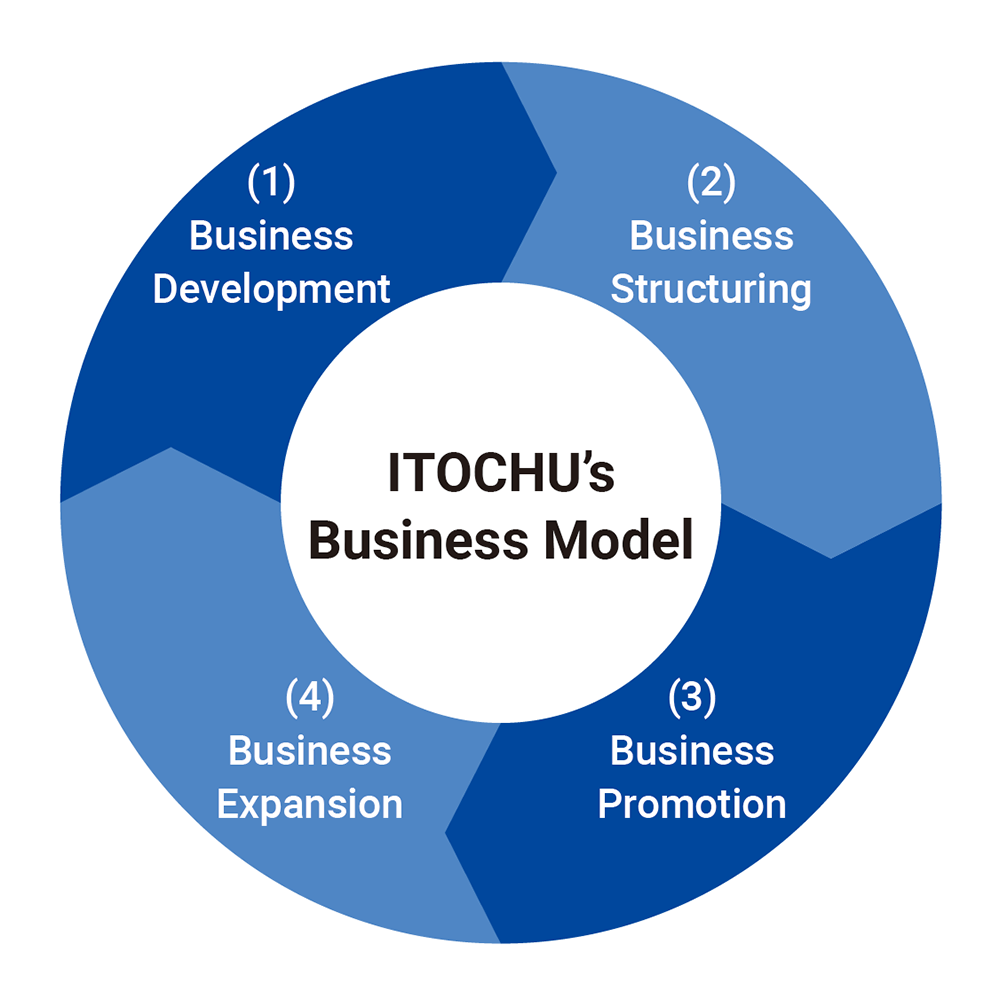

Supporting Problem-Solving as a Business Model and Expanding Our Business Domains

These initiatives have in common the fact that, at a time when industries and companies are going through periods of major change or facing challenges, ITOCHU is proactively working closely with its partner companies to address their management challenges and stepping in to create multifaceted value, such as by participating in management and launching new businesses.

This strategy is founded on a wealth of experience and know-how accumulated over the years through our business model. For example, in 2003 ITOCHU invested in YANASE & CO., LTD., supporting the company through its management crisis caused by deteriorating business conditions since the bubble economy and worsening terms with major business partners, thereby enabling YANASE & CO., LTD. to grow and for ITOCHU to expand into the automotive distribution domain. Our investment in Prima Meat Packers, Ltd. in the same year was aimed at supporting the Company’s business turnaround and further strengthening our partnership, as Prima Meat Packers, Ltd. had entered a period of poor performance despite our longstanding collaborative relationship. With respect to NIPPON ACCESS INC., of which we gradually increased our equity share following a capital and business alliance in 2001, we expanded into the food wholesale network in response to a request from the Snow Brand group, its then parent company. This also contributed to strengthening our food distribution business and further reinforced our robust value chain with FamilyMart.

It could be said that we have been able to balance helping leading companies solve their problems with strategically expanding our own value chain. Going forward, we will continue to work with leading partner companies in each industry to create value, enhance the reproducibility of our approach, and expand our business domains, thereby achieving sustainable growth in corporate value.