ITOCHU Announces Capital and Business Alliance with Netstars

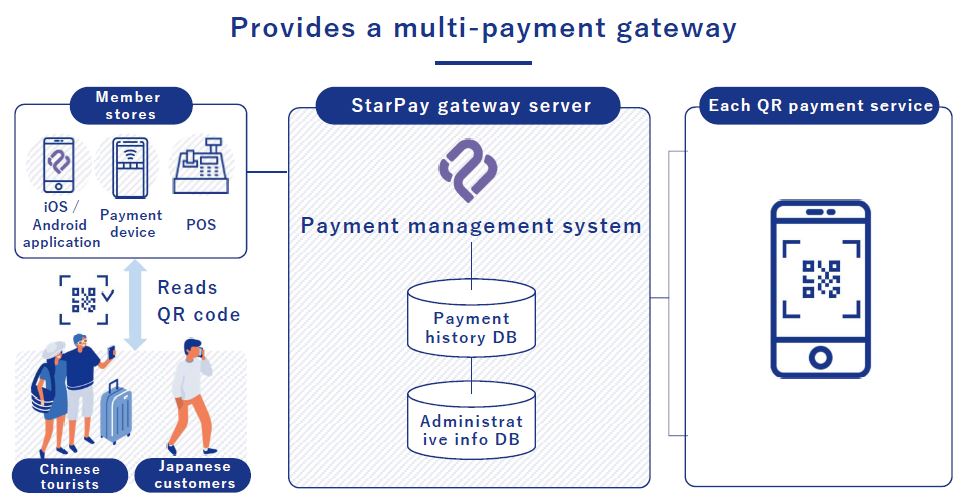

Overseas and domestic expansion of “StarPay,” a service which enables retailers to install multiple QR code payment systems collectively

November 21, 2019

ITOCHU Corporation (headquartered in Minato-ku, Tokyo; Yoshihisa Suzuki, President & COO; hereinafter “ITOCHU”) announced today that it has formed a capital and business alliance with Netstars Co., Ltd. (Tsuyoshi Ri, Representative Director & President; headquartered in Chuo-ku, Tokyo; hereinafter “Netstars”). Netstars has developed StarPay, a service which consolidates every major QR code payment system for installation in any store, and ITOCHU will expand this service to retailers in Japan and overseas.

The market for QR code-based payment has seen sharp growth in recent years, centered on greater China. Mobile phone-based payment in China exceeded approximately 620 trillion yen in 2016, with most of that attributable to QR code payment systems such as WeChat Pay and Alipay. Even outside of greater China, QR code payment is becoming more prevalent due to the low front-end costs and the entry of local payment processing providers. In ASEAN, for example, cashless payments have grown to encompass around 10% of all payments.*1

It is said that domestic QR code payments in Japan will reach 600 billion yen this fiscal year and the 8 trillion-yen level*2 by FY2023, due to an increase in foreign visitors to Japan and the entry of domestic QR code payment processing providers. This has led experts to predict that demand for multiple QR code payment options will continue to increase among retailers in all fields.

In 2014, Netstars became the first Japanese company to conclude a licensing agent agreement with Tencent for WeChat Pay, entering Japan’s QR code payment market early on. Since then, Netstars has begun its StarPay service, which enables retailers to process payment for multiple QR code payment systems using a single application. Netstars now handles more than 20 domestic and overseas QR code payment brands including LINE Pay and Alipay—the most of any companies in Japan. Retail stores, food and drink establishments, drug stores, airports, and many other retailers have now introduced QR code-based payment systems. This number has reached over 120,000 retailers as of October 2019 and is expected to continue growing rapidly.

Under this capital and business alliance, ITOCHU will use its domestic network to support the further spread of StarPay within Japan’s retail sector. ITOCHU will also use its overseas network to promote StarPay’s expansion into regions anticipated to introduce multiple QR code payment systems, such as ASEAN, Europe, South America, and the Middle East.

This alliance aligns with ITOCHU’s aim to improve the value of its consumer-related value chains, as part of the business reinvention named in the Company’s medium-term management plan “Brand New Deal 2020.” ITOCHU will use this alliance to help expand cashless payment markets worldwide and, within its consumer-related operations, work to create and expand new businesses with a market-oriented perspective.

- *1Prepared by Roland Berger, based on information from Euromonitor

- *2JMA Research Institute, Inc.

|

|

|

|

|