ITOCHU Announces a Capital and Business Alliance with Kawasaki Motors and the Establishment of a Finance Business Company in North America

November 8, 2024

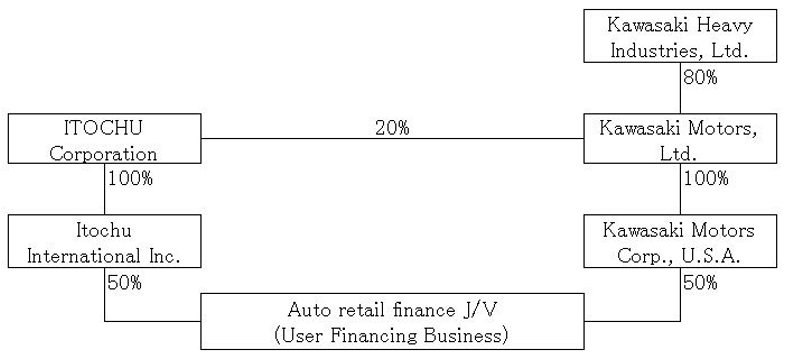

ITOCHU Corporation (headquartered in Minato-ku, Tokyo; Keita Ishii, President & COO; hereinafter “ITOCHU”) announced today that ITOCHU concluded an agreement concerning a business alliance (hereinafter the “Business Alliance”) with Kawasaki Motors, Ltd. (Head Office: Akashi-shi, Hyogo; Hiroshi Ito, President and Chief Executive Officer; hereinafter “Kawasaki Motors”), a subsidiary of Kawasaki Heavy Industries, Ltd. (Head Office: Minato-ku, Tokyo; Yasuhiko Hashimoto, President and Chief Executive Officer; hereinafter “Kawasaki Heavy Industries”), agreeing that ITOCHU will acquire 20% of the equity securities of Kawasaki Motors by third-party allocation (hereinafter the “Stock Acquisition”). It was simultaneously announced that ITOCHU and Kawasaki Motors plan to establish a joint venture intended to be a sales financing business (hereinafter the “User Financing Business”) in the United States through their subsidiaries in the country.

|

|

Background of the market

At nearly 15 billion dollars, the US powersport*1 market is the largest in the world. The demand for powersport products is growing radically with the increased interest in outdoor leisure activities during the COVID-19 pandemic. The current situation has enabled the market to perform steadily. Boasting industry-leading competitiveness and the largest share of the US motorcycle market, Kawasaki Motors is planning to introduce many new appealing products that satisfy the diverse needs of customers leveraging the brand awareness that has been cultivated in the motorcycle business. They intend to further expand their sales in the four-wheel off-road vehicle market.

Objectives and details of the collaboration

ITOCHU and Kawasaki Motors previously had a collaborative relationship in the initial stages of their overseas expansion in and after the 1960s with ITOCHU engaged in exports and acting as a sales agency in Europe. The two companies reached an agreement on the Stock Acquisition and the Business Alliance as medium- and long-term partners based on ITOCHU's alignment with the growth strategies stated in Kawasaki Motors's Group Vision 2030.

The product unit price of four-wheel off-road vehicles tends to be high, so for these vehicles in particular there is strong demand for long-term installment payments arranged at the time of purchase. For this reason, it is necessary to offer a speedy credit review process to dealers and customers and a highly competitive menu of financing products independent of the fluctuation of the business. The two companies are planning to establish a joint venture that is intended to be the User Financing Business in the United States an area where significant synergy can be expected between the companies.

The companies are considering personnel exchanges and the utilization of the global bases of ITOCHU to globally expand sales of powersport products, not just motorcycles, in the future. To be specific, the wide-ranging Business Alliance will be promoted in the powersport market where demand is expected to expand globally, not just in North America, including in emerging markets such as the CIS, the Middle and Near East, Africa, and Latin America where ITOCHU has gained deep knowledge through its automobile business as well as in India and East Asia where the demand for motorcycles is expected to continue to grow.

ITOCHU and Kawasaki Motors will continue to accelerate their business alliance. As a medium- and long-term business partner, ITOCHU will commit to contributing to the realization of the growth strategies in Kawasaki Motors's Group Vision 2030. ITOCHU will also work to increase the corporate value of the two companies, establishing a concrete collaborative structure in the future and developing the sustainable competitiveness of their businesses.

ITOCHU has put forth a new management policy "The Brand-new Deal: Profit opportunities are shifting downstream" and will promote investment in growth and the expansion of business, beginning with downstream businesses closer to consumers, using its upstream and midstream assets and the expertise it has cultivated over the more than 160 years since its foundation.

- *1: Vehicles equipped with engines and motors for outdoor activities, such as motorcycles, snowmobiles and four-wheel off-road vehicles (all-terrain vehicles such as ATVs and SxSs)

Collaboration scheme

|

|

About Kawasaki Motors

With a view toward working for the happiness and joy of all those whose lives Kawasaki touches as its corporate mission, Kawasaki Motors was established when the Motorcycle and Engine Division split from Kawasaki Heavy Industries on October 1, 2021. Since its entry into the motorcycle market in developed countries in the 1960s, Kawasaki Motors has maintained and preserved the traditions it has established over many years. Globally, awareness of the Kawasaki brand is high. Today, based on growth strategies with a goal of achieving sales revenues of one trillion yen in its Group Vision 2030 established in 2020, Kawasaki Motors its bolstering its powersport product portfolio, which includes four-wheel off-road vehicles and personal watercraft (PWCs)*2 in addition to motorcycles.

- *2: JetSki, a popular name for personal watercraft, is a trade name held by Kawasaki Motors.

About Kawasaki Motors

| Company name | Kawasaki Motors, Ltd. |

|---|---|

| Representative | Hiroshi Ito, President and Chief Executive Officer |

| Headquarters | 1-1 Kawasaki-cho, Akashi-shi, Hyogo |

| Established | 2021 |

| URL | Kawasaki Motors, Ltd. (global-kawasaki-motors.com) |

Outline of the Third-Party Allotment

| Payment date | April 2025 (planned) *3 |

|---|---|

| Number of subscribed shares | 4,000 shares of the common stock of Kawasaki Motors |

| Underwritten price (paid-in amount) | 20 million yen per share |

| Paid-in amount | 80 billion yen |

| Method of offering (scheduled allottee) | Method of allocation to third party (ITOCHU) |

| Change in stock ownership ratio | Before allotment: 0.0% → After allotment: 20.0% |

- *3: The acquisition of stock by ITOCHU is subject to the acquisition of licenses and approvals from the relevant authorities.

Outline of the Joint Venture

The joint venture will be operated in a way such that ITOCHU will be responsible for the general management of the joint venture, the proposal of financial products and the construction of a credit examination system maximally leveraging the knowledge and expertise it has obtained through past investment projects*4 to further strengthen the customer base for sales activities while cooperatively supporting marketing. The joint venture will further enhance the products and services of Kawasaki Motors and enhance the value chain in the United States by providing quality financial services from a market-oriented perspective while introducing new appealing products.

| Company name | TBD |

|---|---|

| Headquarters | Foothill Ranch, California |

| Representative | TBD |

| Business description | The User Financing Business for powersport products handled by Kawasaki Motors |

| Capital | TBD |

| Commencement of business | April 2025 (planned) *5 |

| Shareholders (percentage of voting rights) | ITOCHU International Inc. (50%) Kawasaki Motors Corp., U.S.A. (50%) |

-

*4: A recent similar investment project ITOCHU Announces Establishment of Joint Venture to Finance Construction Machinery in North America (November 21, 2022)

https://www.itochu.co.jp/en/news/press/2022/221121.html - *5: Subject to acquisition of the licenses and approvals from relevant authorities necessary for the establishment of the business.