Our Business Model, as Seen Through Business Development

By utilizing financial and non-financial capital, focusing on fields where we can demonstrate strengths, and creating multifaceted, linked businesses, we strive to enhance earning power of trade and business investment.

Going forward, we will sustain value creation by maximizing synergies and upgrading our businesses through business transformation that begins in downstream areas and is driven by market-oriented perspectives, while thoroughly instilling the “earn, cut, prevent” principles.

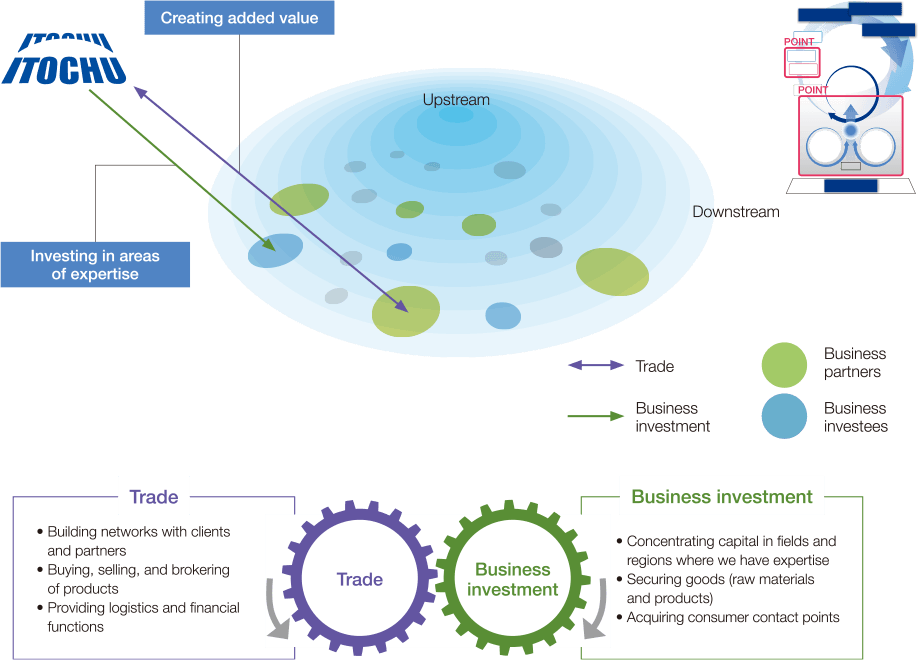

STEP 1: Forming Domains Through Trade and Business Investment

We utilize our accumulated financial and non-financial capital to develop businesses through trade and business investment. By leveraging our business know-how and client and partner assets, we expand trade by creating added value and invest in fields where we have knowledge and can control risk. Our goal is to increase our earning power of trade and business investment. To this end, we upgrade business management by instilling our fundamental “earn, cut, prevent” principles and restructuring businesses, while creating multifaceted, linked businesses through new trades and synergies.

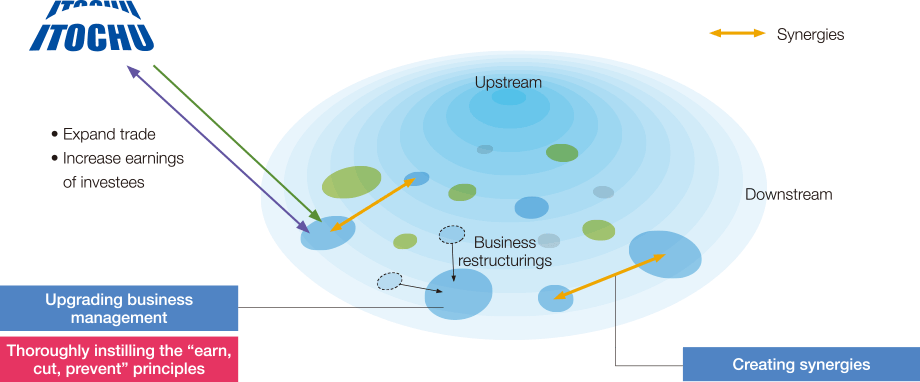

STEP 2: Expanding Multifaceted, Linked Businesses to Increase Earnings from Trade and Business Investment

Our goal is to increase our earning power of trade and business investment. To this end, we upgrade business management by instilling our fundamental “earn, cut, prevent” principles and restructuring businesses, while creating multifaceted, linked businesses through new trades and synergies.

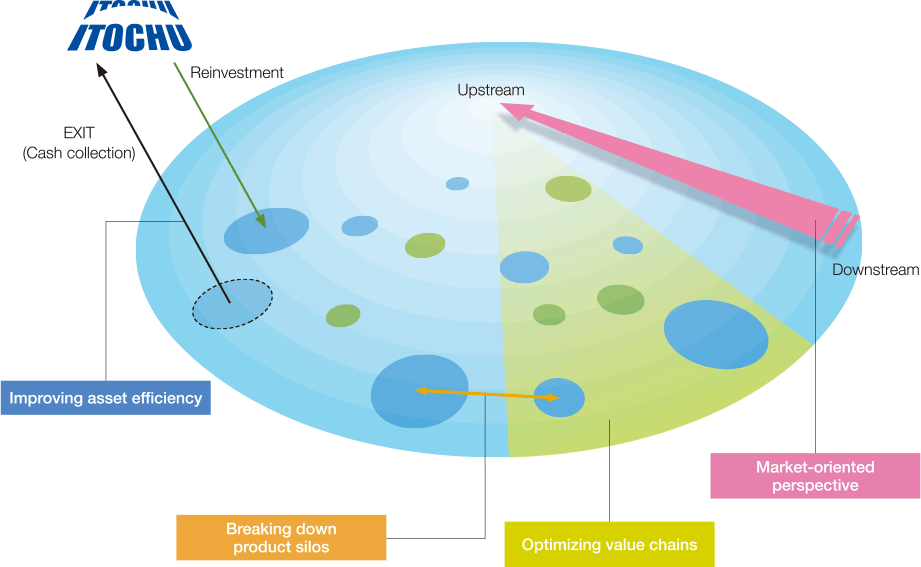

STEP 3: Sustaining Value Creation by Upgrading Multifaceted, Linked Businesses

We will upgrade businesses to respond to consumers’ and social needs by shifting to a downstream-centered market-oriented perspective and by increasing collaboration among Division Companies to break down product silos. Also, we will further improve asset efficiency through asset replacement, optimization of value chains by utilizing data and new technologies, and pursuit of business management efficiency.

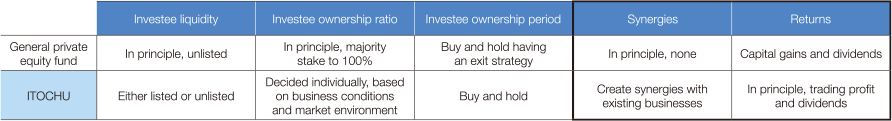

How ITOCHU Differs from a General Private Equity Fund

As we consider business investment to be a powerful tool, our business model is often compared to that of a private equity fund. There are certain similar aspects, such as the desire to contribute proactively to investees’ management and maximize the corporate value of investees. However, the differences are that we focus on generating synergies with existing businesses and enjoy returns centered on trading profits and dividends.

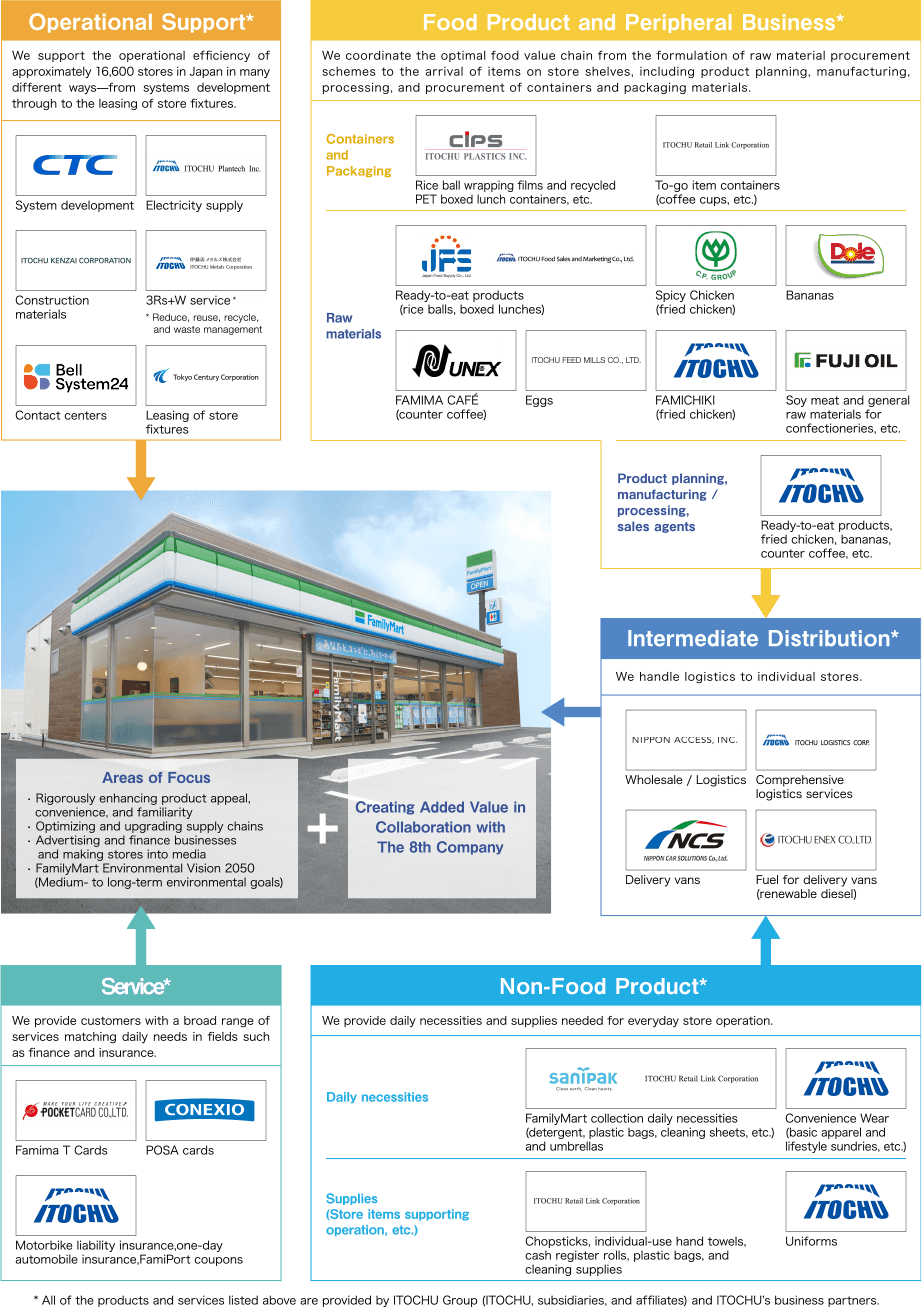

Business Development Example: Our FamilyMart-Centered Convenience Store Business

In its convenience store business, ITOCHU and its Group companies are collaborating to build and improve the value chain, stretching from downstream through to upstream operations. To grow the value of the Group’s convenience store business, which is centered on FamilyMart, we are creating synergies that transcend Division Companies’ boundaries. Specifically, while The 8th Company is acting as a hub, we not only strengthen the food value chain but also focus on such diverse areas as daily necessities, financial services, systems development, and construction materials.