CFO Interview

While keeping an eye on the unclear business environment, this year we will lay out thorough preparations with an awareness of the new growth stage.

Tsuyoshi Hachimura

Member of the Board, Executive Vice President, CFO

Q1. What is your overall assessment of the FYE 2021 financial and capital strategies?

A1. We were able to steadfastly keep our financial and capital positions even amid an unprecedented business environment.

The business environment in FYE 2021 was exceptionally tough due to the COVID-19 pandemic, but I believe that overall we prevailed. By steadfastly keeping our financial and capital positions, we were able to achieve results that led to the “triple crown” for a general trading company.

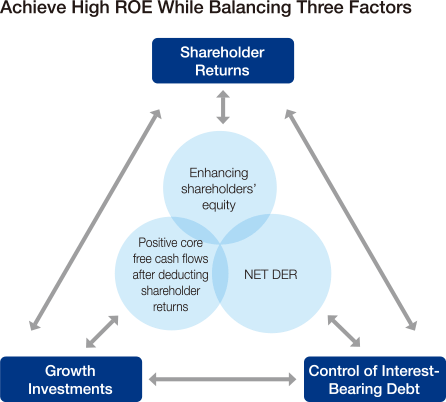

Since becoming CFO in FYE 2016, I have committed to the “Policy to achieve high ROE while balancing three factors (growth investments, shareholder returns, and control of interest-bearing debt)” and continued implementing unified balance sheet control. In FYE 2021 too, we conducted major investments (around ¥520.0 billion) in tandem with the privatization of FamilyMart, which will contribute to the Group’s further growth, while also maintaining a “financial position appropriate for A ratings” even amid an unprecedented business environment.

It can be seen through the fact that, for example, the shareholder equity ratio, which demonstrates the soundness of our finances, rose 2.2 points at the end of FYE 2021 (29.7%) year on year. Also, net debt-to-shareholders' equity ratio (NET DER) (0.78 times) came close to our record level achieved March 31, 2020 while conducting a large-scale investment.

In addition, core profit totaled approximately ¥452.5 billion, including the negative impact of approximately ¥56.0 billion from the pandemic. This was far above our initial plan of ¥400.0 billion. If the pandemic effects had been insignificant, core profit would have exceeded ¥500.0 billion. I believe we were able to maintain stable earning power at roughly the same level as before the pandemic.

Furthermore, core operating cash flows amounted to approximately ¥574.0 billion, the second highest on record, trailing only the previous fiscal year. This was a testament to the strong resilience of our cash-generating power to economic volatility.

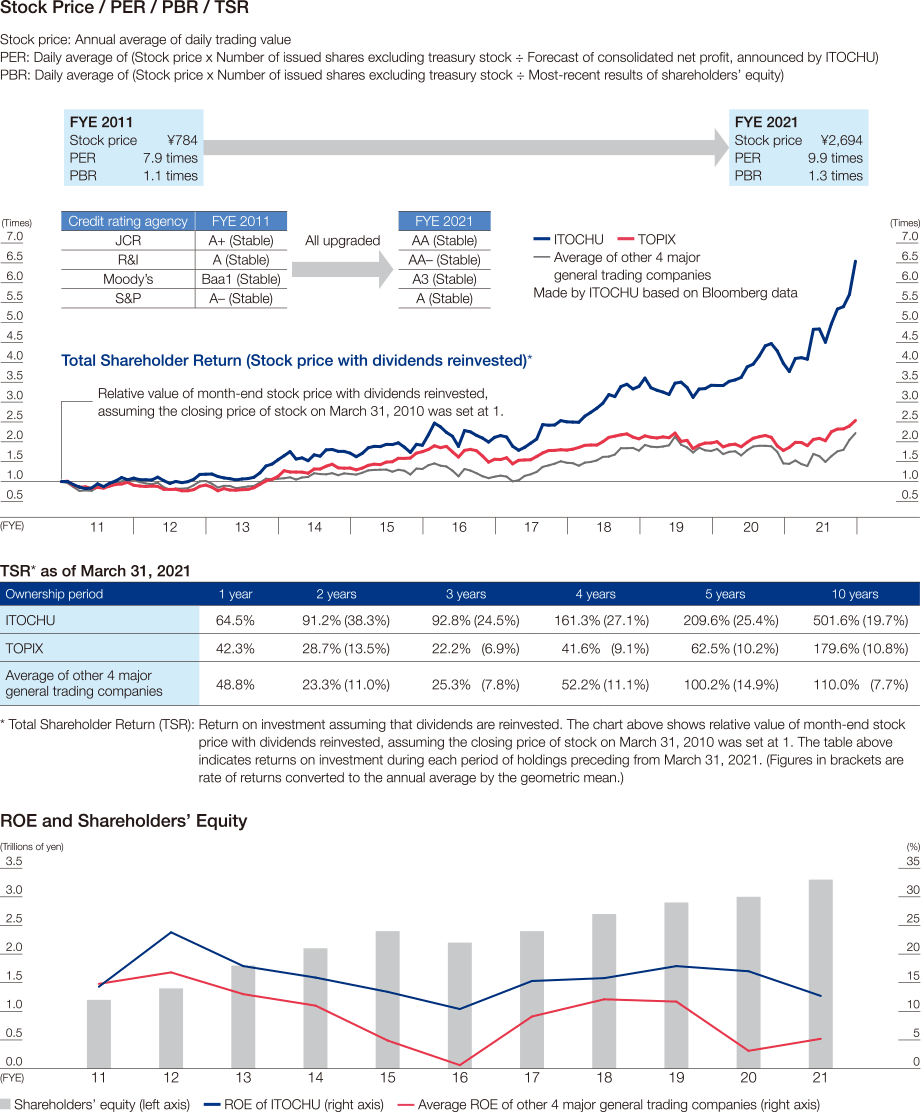

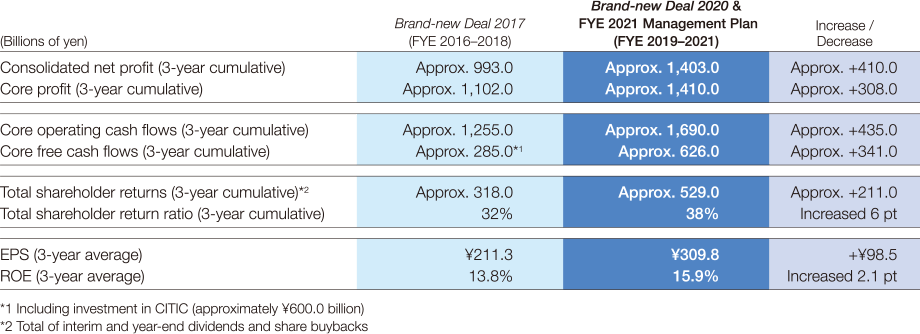

The following chart zooms out to a wider timeframe, comparing present achievements with the past three-year KPIs from “Brand-new Deal 2017” to see how much they have improved.

Both earning power, which is represented by consolidated net profit and core profit, and cash-generating power, which is represented by core operating cash flows, improved tremendously. I want everyone to understand that this was achieved by harnessing the strengths of our earnings base, centered on the non-resource sector. In addition, regarding total shareholder returns, we were able to keep core free cash flows after deducting shareholder returns in the black and, by tapping into our stable cash-generating power, we were able to achieve shareholder returns and a total shareholder return ratio exceeding those under “Brand-new Deal 2017.”

On the other hand, for investments, we have avoided buying high, which leads to the accumulation of goodwill, and strived to focus primarily on the sectors and regions where we have expertise. We also conducted large-scale investments by accumulating surplus funds each fiscal year. By implementing these controls and reducing unnecessary interest-bearing debt, our financial soundness has been lifted even higher.

We steadily enhanced ROE and EPS (Consolidated net profit per share), which are the special focus points of the Company, by carrying out our financial and capital strategies to balance three factors. As a result of the positive feedback from investors and shareholders, the Company’s share price in FYE 2021 rose to a record high 33 times.

Q2. Can you elaborate on the key points of the financial and capital strategies under “Brand-new Deal 2023”?

A2. The main point is that we will unwaveringly carry out our existing policies.

Although COVID-19 vaccinations are proceeding apace around the world and expectation for economic recovery is increasing, concerns about the re-spread of infection and uncertainty about the business environment after the pandemic cannot be dispelled. Moreover, we need to look more closely at the risk of plummeting resource prices that have remained historically high, geopolitical risks (such as the protracted U.S.–China trade friction), and the debate over tax increases in response to expanding government expenditures in addition to the trends in interest rates, exchange rates, and the stock market going forward.

Although COVID-19 vaccinations are proceeding apace around the world and expectation for economic recovery is increasing, concerns about the re-spread of infection and uncertainty about the business environment after the pandemic cannot be dispelled. Moreover, we need to look more closely at the risk of plummeting resource prices that have remained historically high, geopolitical risks (such as the protracted U.S.–China trade friction), and the debate over tax increases in response to expanding government expenditures in addition to the trends in interest rates, exchange rates, and the stock market going forward.

In addition, the recent trend of responding to the SDGs, especially given accelerating climate change, creates major business opportunities. However, manufacturing businesses with high GHG emissions and companies with a high ratio of stranded assets assume that additional costs will be factored in such as those for withdrawing from businesses, product obsolescence, and restructuring. It is possible that the unclear business environment will become protracted.

Amid this environment, management needs to be balanced and not overly biased toward any particular direction. Under “Brand-new Deal 2023,” we will continue to balance three factors, maintain highly efficient management (high ROE), and achieve sustainable growth in EPS. In short, there is no change in our existing financial and capital strategies.

As an additional key point, I would like to elaborate on the termination of share buybacks announced in June 2021. This has drawn many questions from the market. ROE and EPS are especially important to ITOCHU. I am sure you already understand our policy of aiming to enhance ROE and EPS fundamentally by expanding sustainable profit. In FYE 2022, there are contributions from expanded profit in the non-resource sector and rising resource prices, and profit is expected to significantly rise year on year. On the other hand, because uncertainty in the business environment in FYE 2023 and beyond cannot be discounted, we decided that it would be appropriate to fully reset the announced share buybacks and prepare for FYE 2023 and beyond. ITOCHU has carried out active and continuous share buybacks after carefully assessing future cash allocation. We will make no changes to this basic policy going forward.

Q3. What is your policy on cash allocation under “Brand-new Deal 2023”?

A3. Within the amount of surplus funds, we will continue considering how to best balance growth investments with shareholder returns, etc.

If yearly average core operating cash flows are ¥600.0 billion, surplus funds for each year under “Brand-new Deal 2023” will average ¥250.0–300.0 billion, which excludes capital expenditure of around ¥150.0–200.0 billion that is consistently incurred every year and shareholder returns of around ¥150.0 billion (assuming ¥100/share multiplied by around 1.5 billion eligible shares). These surplus funds could be used for additional shareholder returns or net investments after considering cash-in from the exits of existing investments. Going forward, within the amount of surplus funds, we will continue to balance allocation for conducting growth investments and expanding shareholders’ equity as a risk buffer, as well as providing additional shareholder returns.

Regarding dividends per share (DPS), during the period of “Brand-new Deal 2023,” we will continue our progressive dividend policy to steadily increase dividends as announced in FYE 2016. FYE 2022, the first year of the plan, will start with a minimum DPS of ¥94, which is ¥6 higher than the previous year’s dividend of ¥88. Moreover, we have announced our intention to aim for ¥100 during the period of the plan. However, we plan to announce a revised shareholder returns policy, in light of the closer consideration of market expectations we received through follow-up dialogue with investors and shareholders after the announcement of the plan.

Under “Brand-new Deal 2023,” ITOCHU’s policy is to continue searching for prime investment projects, while being aware of the Company’s cost of capital of 8%, as the Company strives to move from its initial plan of ¥530.0 billion in core profit in FYE 2022 toward ¥600.0 billion. In FYE 2021, regarding existing investments, we conducted evaluations using stricter criteria than ever and cleared up concerns about the future. We also revised internal investment criteria in line with present conditions, such as increasing the variety of hurdle rates for each industry (by country) from around 40 industries to around 70 industries.

(→ Business Investment![]() )

)

It is significant that at ITOCHU the CFO has served as chair of the Investment Consultative Committee for four years in a row. In FYE 2022, I again want to lead constructive discussions that assess the business environment from a consistently objective and conservative perspective.

Q4. Are there any measures that help reduce the cost of capital?

A4. I think it is important to continue fostering highly trustworthy dialogue.

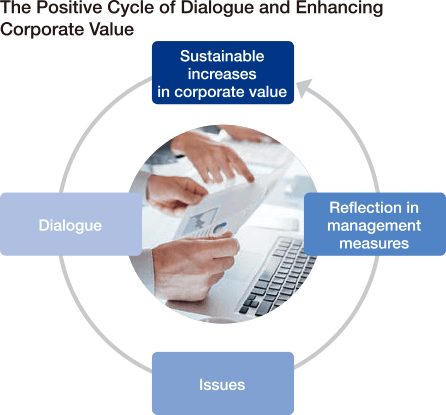

I think that proactively promoting investor relations activities leads to a reduction in the cost of capital. Even amid the unusual pandemic environment, I took the lead in holding dialogues, expanding these both qualitatively and quantitatively to better enable all stakeholders, especially investors and shareholders, to further understand and evaluate the Company’s strategies and policies. As one of the leading general trading companies, ITOCHU engages in highly trustworthy dialogue to better ascertain market expectations. We continue to make timely and appropriate disclosures, and these steps lead to further reductions in the cost of capital.

I think that proactively promoting investor relations activities leads to a reduction in the cost of capital. Even amid the unusual pandemic environment, I took the lead in holding dialogues, expanding these both qualitatively and quantitatively to better enable all stakeholders, especially investors and shareholders, to further understand and evaluate the Company’s strategies and policies. As one of the leading general trading companies, ITOCHU engages in highly trustworthy dialogue to better ascertain market expectations. We continue to make timely and appropriate disclosures, and these steps lead to further reductions in the cost of capital.

From an ESG perspective, we are also taking steps. Based on the recent trend of increased environmental awareness, ITOCHU became the first general trading company to publicly issue SDG bonds (U.S. dollar-denominated senior unsecured bonds). These bonds were issued in March 2021 to promote the use of energy storage systems and renewable energy, such as solar power and wind power, and procure certified coffee beans, etc. The purpose is to further enhance initiatives for the SDGs, and I believe the bond market also recognized the Company’s genuine commitment through these initiatives. Going forward, by steadily implementing initiatives that are aware of market needs, we will continue working hard to enhance sustained corporate value.