CEO Message

ITOCHU will seize upon the changes of this era and turn them into major opportunities by relentlessly practicing our “earn, cut, prevent” principles and accelerating our shift to a market-oriented perspective.

In FYE 2021, despite the obstacles the pandemic imposed on business, ITOCHU achieved its first “triple crown” as a general trading company, ranking No. 1 in terms of market capitalization, share price, and consolidated net profit. In FYE 2022, we will continue to set our sights higher as we steadily achieve goal after goal outlined in the new medium-term management plan “Brand-new Deal 2023![]() ” and resolutely temper overconfidence.

” and resolutely temper overconfidence.

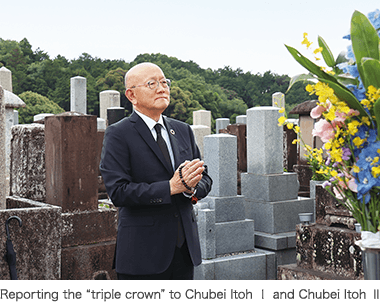

One Day of Celebration

Since becoming president, I have visited the grave of the founder every year to report the Company’s business achievements. This year marked the 11th time I have paid my respects, but the first time I reported that ITOCHU had achieved the “triple crown” in market capitalization, share price, and consolidated net profit for a general trading company. This was the first time since ITOCHU’s founding.

Since surging to the top of the general trading company sector in market capitalization and share price in June 2020, the Company ended FYE 2021 without surrendering that top spot even once. Regarding consolidated net profit, we steadily cleared our initial plan. Leveraging our solid earnings base centered on the nonresource sector, we took the challenge head on and seized the No. 1 spot as a general trading company for the first time in five years. Moreover, ITOCHU’s consolidated net profit has been No. 1 on a cumulative basis since the end of the resource boom in FYE 2016, and during that time ITOCHU was the only one not to go into the red.

We had taken on the general trading companies associated with the former zaibatsu industrial groups before this, but had a history of not quite measuring up. Many of ITOCHU’s former managements and employees withstood hardship as they worked to shore up the Company’s foundations. We all rejoiced at finally achieving the “triple crown.” I have nothing but respect for the Company employees and ITOCHU Group members who gave their all amid adverse business environments.

However, we only celebrated for one day. That was the day we achieved the “triple crown.” I must never forget my self-awareness as a “merchant.” No matter how much the Company’s position rises in the industry, I visit the founder’s grave every year to be reminded of our origins. In his book The Innovator’s Dilemma, American entrepreneur and economist Clayton M. Christensen points out that temporary success can ironically lead to failure. We must always remember that.

We Will Not Tread the Same Paths

What really keeps me on my toes is the fact that, in the past, ITOCHU had a history of repeatedly falling into overconfidence and failure. To achieve “diversification,” we pursued a rapid expansion of the non-textile areas and invested in TOA Oil Co., Ltd. from 1966, which led to a massive loss. I talked about this last year, but there is more to this story. In the 1980s, the accepted practice was that the three general trading companies with the highest sales were eligible to participate in international bids so the companies competed furiously for sales. In FYE 1987, the year after the TOA Oil problem was fully resolved, ITOCHU’s net sales expanded to the top of the general trading companies, and the Company desperately tried to maintain the top sales spot thereafter. As a result, we moved away from the stable business practices we had pursued until that point and, amid the bubble economy, we went all in on real estate excesses, corporate investment funds, and fund trusts.

Although ITOCHU should have learned its lesson from the TOA Oil failure, the Company then became No. 1 without trying to recall those lessons and ended up making the same mistakes. The Company racked up huge losses from the late 1990s into the 2000s, effectively hitching a heavy anchor to its future. During the resources boom at the start of the 2000s, ITOCHU fell behind due to the gap in financial position that had arisen with the general trading companies connected to former

zaibatsu industrial groups. The plans and growth strategies that general trading companies formulate when operating results are strong tend to aim unrealistically high. Accordingly, since achieving the “triple crown,” we are now, more than ever before, committed to resolutely tempering overconfidence.

Our Basic Stance as a “Merchant”

Recently, I have been getting questions about what our next vision is after achieving the “triple crown,” with suggestions that we should set out on a new stage unlike what we have done before. Just because we have achieved the “triple crown” does not mean that we should abandon the way we have done business until now or the direction of our aims.

If Hideki Matsuyama, the first Japanese winner of the Masters Tournament, were asked about his next goal, I suppose he would say that he would continue on the same path and aim to win a second major championship or achieve No. 1 in the world rankings by carrying on with his diligent practice. Switching analogies to baseball, if ITOCHU had been scoring runs with base hits and then suddenly started overswinging to hit home runs, the Company’s form would crumble. Amid the Hanshin Tigers’ rise this year, as a fan I was especially happy to see the promising slugger Teruaki Sato playing. However, even he sometimes goes off the rails. After amazingly hitting three home runs in one game, he struck out five times in a row in another game and humiliatingly tied the previous worst record in pro baseball. ITOCHU will have to diligently maintain its basic stance as a “merchant” by slowly and steadily building up profit and not overextending itself.

Under “Brand-new Deal 2023” (FYE 2022–2024), we set out a goal of achieving consolidated net profit of ¥600.0 billion during the term of the plan. Although COVID-19 vaccinations are proceeding apace around the world and economic activities are gradually returning to normal, it is still tremendously difficult to accurately forecast the new business environment at present. We will therefore need to pay much more careful attention to trends in the commodities market and exchange rates, the protracted U.S.–China trade friction, and various other factors. Accordingly, we will constantly monitor the business environment from an objective and conservative perspective. Of our basic fundamentals of “earn, cut, prevent,” we will especially concentrate on “cut” and “prevent” while maintaining lean management.

Profit Opportunities Are Shifting Downstream

Amid AI, IoT, and other recent rapid advancements in digital technologies, automobile manufacturers, for example, are developing connected cars, EVs, autonomous cruising vehicles, and other technologies. They are also undertaking full-scale development of completely unique technologies, such as creation of practical flying cars. These manufacturers will need to undertake massive capital investment and R&D expenses to secure market share for their new products. However, if their business sectors grow too large, through diversification or other means, investment could become insufficient. Some sectors may be whittled down through selection and concentration. If the manufacturers do not increase their investment efficiency, they will not survive.

General trading companies, on the other hand, differ in focus from manufacturers that create revolutionary technologies and products that can instantly change the world. We evolve from existing trade, and, for example, assert our presence by increasing added value by combining the functions and know-how cultivated in marketing, logistics, and other fields. General trading companies constantly change shape in line with global trends. Rather than focusing on a few specific areas, it is critically important that we extend feelers into a wide range of fields, accumulate expertise in various industries, and change our organization and resource allocation depending on the situation. ITOCHU’s track record of overcoming a multitude of turbulent periods since its founding, as well as its current steady expansion of profit, is a testament to the ability of this kind of general trading company business model to maintain its superiority into the future.

Power is shifting from the supplier side (manufacturers and distributors) to the consumer side, so data accumulated in businesses that engage closely with customers is becoming increasingly important. The value chain is clearly moving in the opposite direction as before. This is the meaning of the phrase “profit opportunities are shifting downstream.” Going forward, as general trading companies transform, the key will be how much we can control the downstream flow of the value chain. ITOCHU, which already has strengths in the non-resource sector, especially the consumer-related sector, intends to polish its existing business model and better leverage its competitive

advantage to continue taking the initiative in the overall value chain.

Ingraining a Market-Oriented Perspective Through Repetition

Going forward, the most important thing to continue leveraging our competitive advantage downstream will be to successfully switch to and ingrain a market-oriented perspective that transforms and improves our existing businesses. Given growing social demands, such as

decarbonization, we will strive to steadily meet significantly changing consumer needs and further expand our business opportunities. It is obvious that this will require a market-oriented perspective.(→ Realizing Business Transformation by Shifting to a Market-Oriented Perspective)

General trading companies, including ITOCHU, have done business from a product-oriented perspective until now, contemplating how to sell the products they handle, within a vertical organization for each product category. It is now becoming more important to analyze consumer

needs using data accumulated from customer contact points, and that kind of product-oriented perspective is quickly falling out of step with the new downstream-focused value chain. Changing a long-held mindset is not easy. In recent years, I have been getting out the word myself by repeatedly mentioning the term “market-oriented perspective” again and again in my messages.

Similar to how we made “earn, cut, prevent” part of our shared internal language, I will continue in this way while providing specific examples until the shift to this crucial perspective is firmly rooted in our employees. I consider this a major responsibility as a senior manager who aims to further expand business into the future while developing human resources.

For FamilyMart, which is positioned as the most important base in ITOCHU’s strategy, the market-oriented perspective has become a keyword too. By leveraging flexibility, convenience stores have become the most evolved form of the retail industry. If they continue pursuing functions suited to people’s lifestyles, they can evolve even more. For example, I heard customers say that last year they stocked up at supermarkets to minimize outside trips, but currently prefer shopping at nearby convenience stores, buying just what they need to get some exercise and change their mood. To meet that kind of change, I immediately indicated the need for a product lineup adjustment. Complicated theories are not useful for a market-oriented perspective. Look at things from the customer’s point of view and seriously think about how you can satisfy the customer. It’s that simple. The 8th Company, which was newly founded to break down product silos, is rooted in a market-oriented perspective and steadily increasing cross-divisional functionality. By drafting and implementing new plans such as digital signage, humanoid AI, and data utilization, it will continue

helping to improve the profitability of FamilyMart.

Keita Ishii, the new President & COO, maintains this kind of market-oriented perspective and can precisely assess and respond to changing situations. He also received a recommendation from the Nomination Committee as a candidate qualified to be in charge of executing the Company’s business. I am looking forward to the results of his skill and strong drive, which has previously built new businesses to meet customer needs, such as developing the environmental businesses of energy storage systems (ESS) and renewable energy. (→ Outside Director Roundtable Discussion)

A Sense of Urgency Kindled in Europe

I want to talk about the European business trip I took around three years ago. I stayed in a hotel in Milan, and when I went to brush my teeth, I realized there was no toothbrush. When I called the front desk, they told me toothbrushes were only provided upon request, not automatically. Around the same time, I was watching news on the hotel TV about how Starbucks was eliminating plastic straws and would switch exclusively to paper. It dawned on me at that time that these trends were emerging in Europe, which is environmentally conscious, but not in Japan, where like-minded companies and individuals remained in the minority. However, I could not shake that palpable recognition from my European business trip. I believed that a much more proactive environmental response was necessary under the upcoming mediumterm management plan, and held many discussions on this topic in preparation. Consequently, without waiting for the public announcement of “Brand-new Deal 2023” scheduled for May, ITOCHU sprinted ahead of others in the industry and, right after the New Year’s holiday, announced a policy to contribute to the environment and help realize decarbonization across society.

First, as a reduction of the Company’s owned assets with significant GHG emissions, we decided to go beyond our existing policy of not acquiring new thermal coal interests and will instead withdraw from all thermal coal interests during the period of the new medium-term management plan. To get a running start, in April we completed the sale of our interests in the Drummond mine in Colombia, which accounts for 80% of our thermal coal interests. I believe this clearly demonstrates ITOCHU’s commitment and reliability.

(→ Business Expansion in Accordance with a Decarbonized Society)

Moreover, the non-resource sector is the Group’s strong suit and holds an array of new business shoots that are now bursting forth. These will directly lead to reductions in global GHG emissions and also provide immediate potential to turn a profit. We intend to aggressively pursue these with the greatest possible speed. A primary example of these promising shoots is the ESS-related business where we can expand the value chain and reliably count on future profit contributions.

Soy meat, which is currently garnering global attention, holds such potential as well. Low-fat, high-protein soy meat is a super food that can help solve future foodrelated challenges. Compared to conventional beef and other meat, it greatly reduces water use and GHG emissions during production and soy meat is already being offered by many food vendors as a processed product. The Group’s FUJI OIL CO., LTD. boasts around 50% share of Japan’s market for soy meat materials (granulated soy protein), and demand for this product is expected to grow even more going forward. Another shoot is the joint plant established by ITOCHU with the major Finland-based forest industry Metsa Group. Together, we manufacture cellulose fiber from wood that cannot be used for pulp. With the focus on low environmental impact and sustainable natural materials, inquiries are increasing from famous European and U.S. brands (such a Burberry, Zara, and the Kering group, which owns Gucci and Balenciaga) which actively work to protect the environment. The ITOCHU Group will continue working to harness its comprehensive strength and expertise to robustly support the trend of switching to socially demanded low environmental impact products and materials.

Keeping an eye on the post-pandemic world even amid the pandemic, our policy is to continue further solidifying our earnings base centered on the stable non-resource sector.

Sampo-yoshi Capitalism

To date, shareholder capitalism, which states that companies belong to shareholders, has been the dominant ideology. But recently, stakeholder capitalism is becoming more mainstream in the belief that the scope should be broadened to include not just shareholders but also society as a whole, customers, employees, and others. Sampo-yoshi capitalism outlined in “Brand-new Deal 2023” makes it clear that ITOCHU, which outlines “Sampo-yoshi” in its corporate mission, heads in the same direction as all its stakeholders and shares the fruit of its labor over the long term.(→ CAO Interview)

If companies aim to realize a sustainable society, an obvious prerequisite is that the companies themselves must remain sustainable. This has to be implemented by upper management. I believe it is important to promote balanced business strategies that do not benefit only specific stakeholders but rather consider the perspectives of all stakeholders.

That, however, should not suggest that we do not value our investors and shareholders before or now. The executive officers of ITOCHU hold many more shares than those of other general trading companies, and nearly 100% of its employees are enrolled in the Employee Shareholding Association. Since announcing a progressive dividend policy in FYE 2016, executives and employees share the same perspective as investors and shareholders, and we have steadily increased dividends. As can be inferred from the fact that a large number of companies in FYE 2021 decreased or forewent dividends, under a dividend policy that only focuses on the dividend payout ratio, it is possible that if there is a temporary decrease in profit, the dividend amount may decrease and betray investor and shareholder expectations. Accordingly, under this especially unclear business environment at present, I considered it appropriate as a senior manager to continue stably and steadily raising progressive dividends as before. However, in response to the market expectations, we are considering the announcement of a dividend increase for FYE 2022 based on the first-half results and the higher dividend payout ratio during “Brand-new Deal 2023.”(→ CFO Interview)

Taking into account the abnormal surge in resource prices and the significant progress made in the first quarter, many people are expecting profit to exceed ¥600.0 billion in FYE 2022. Keeping an eye on the post-pandemic world even amid the pandemic, our policy is to continue further solidifying our earnings base centered on the stable non-resource sector. To this end, ITOCHU will steadfastly and thoroughly practice its “earn, cut, prevent” principles and accelerate its shift to a market-oriented perspective in order to continue evolving as it uses well-grounded management to implement Sampo-yoshi capitalism.