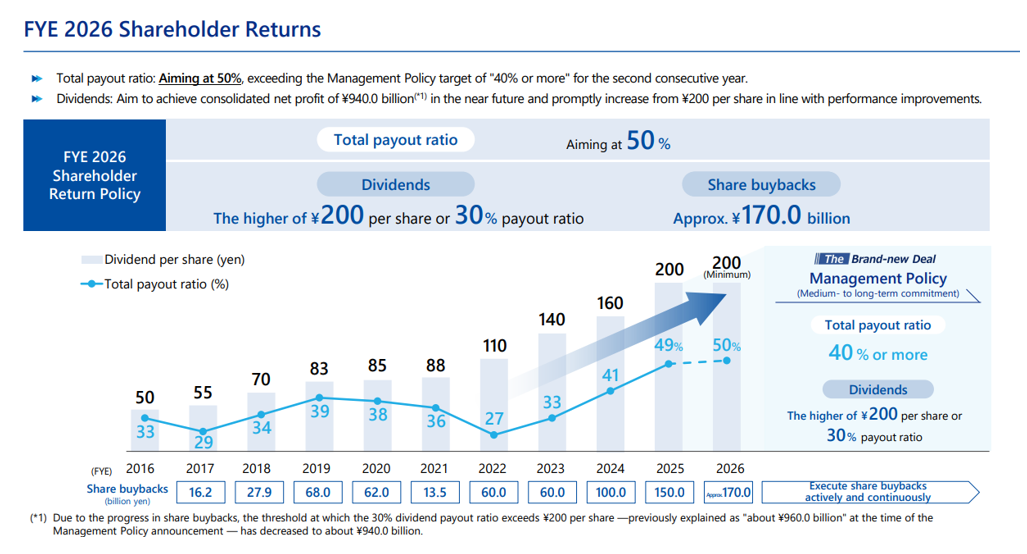

Dividend and Share Buybacks

Shareholder Returns Policy

FY 2025 Shareholder Return Policy

- Total payout ratio Aiming at 50%

- ¥210 per share (pre-split basis)

- Share buybacks ¥150.0 billion or more

Dividend Information

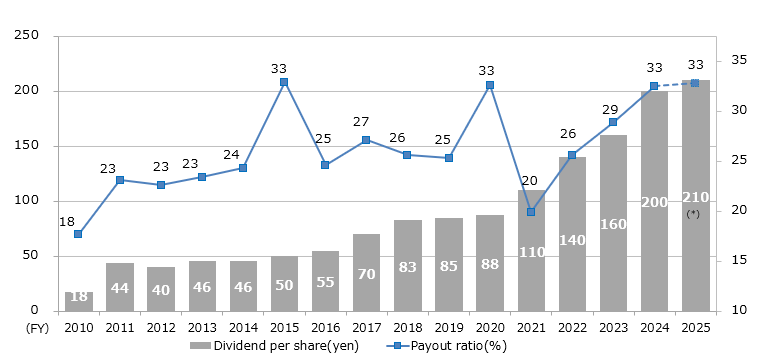

ITOCHU intends to pay a full-year dividend of ¥210.0 per share, comprising an interim dividend of ¥100.0 per share and a year-end dividend of ¥110.0 per share for FY 2025, which corresponds to ¥22.0 per share after the share split.

| Fiscal Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (Forecast) |

|---|---|---|---|---|---|---|---|---|

| Interim |

¥37.0 |

¥42.5 |

¥44.0 |

¥47.0 |

¥65.0 |

¥80.0 |

¥100.0 |

¥100.0 |

| Year-end |

¥46.0 |

¥42.5 |

¥44.0 |

¥63.0 |

¥75.0 |

¥80.0 |

¥100.0 |

¥22.0 |

| (Annual Total) |

¥83.0 |

¥85.0 |

¥88.0 |

¥110.0 |

¥140.0 |

¥160.0 |

¥200.0 |

- |

*Each share of common stock owned by shareholders listed or recorded in the register of shareholders on the record date of December 31, 2025 will be split into five shares. Since this date falls on a non-business day of the shareholder register administrator, the actual record date will be December 30, 2025.

Dividend per share and Payout ratio are as follows.

(*) Pre-split basis.

Share Buybacks

| Buyback period | Method of acquisition | Total number of shares repurchased | Total amount *1 |

|---|---|---|---|

|

to December 31, 2025 |

|

28,000,000 shares |

¥150.0 billion |

|

to January 14, 2025 |

|

19,895,800 shares |

¥150.0 billion |

|

to February 29, 2024 |

|

12,095,000 shares |

¥75.0 billion |

|

to September 30, 2023 |

|

4,459,000 shares |

¥25.0 billion |

|

to March 31, 2023 |

(b) Purchase on the TSE |

6,169,600 shares |

¥25.0 billion |

|

to January 31, 2023 |

|

8,611,700 shares |

¥35.0 billion |

|

to March 24, 2022 |

|

15,757,200 shares |

¥60.0 billion |

|

to June 11, 2021 |

|

5,213,100 shares |

¥13.5 billion |

|

to June 11, 2020 |

|

-*2 |

-*2 |

|

to June 3, 2019 |

|

50,256,100 shares |

¥100.0 billion |

|

January 4, 2019 |

(b) Purchase on the TSE |

15,097,200 shares |

¥30.0 billion |

|

|

|

17,120,000 shares |

¥27.9 billion |

|

|

|

12,000,000 shares |

¥16.2 billion |

|

to December 12, 2014 |

|

78,000,000 shares |

¥100.7 billion |

*1 Rounded off amount.

*2 There was no share buybacks during the period.

Payout ratio (forecast)

* Dividend per Share FY 2025: ¥210.0 (pre-split basis)