Environmental Management

Policy and Basic Concept

ITOCHU strives to make initiatives to conserve the global environment to be a top management priority for us. This is under recognition that the business activities we perform in Japan and overseas (e.g., the provision of various products and services, the development of resources, and business investment) are closely connected to global environmental problems. Therefore, we established the Global Environment Department (current Sustainability Management Division) in 1990 ahead of other trading companies. We are ensuring compatibility of both offense and defense — offense to promote environment conserving businesses and defense to take a precautionary approach to environmental and social risks — based on our environmental policy. The aim of this is to fulfill our corporate mission of Sampo-yoshi. We are also engaged in global corporate management and activities with a constant awareness of global environmental problems.

We reorganized and integrated our conventional environmental management structure into a structure to promote sustainability in line with the revision of our Environmental Policy in April 2018. We have built and are maintaining and operating an efficient environmental management system (EMS) in accordance with the ISO 14001 standards. The interrelated global environmental problems must be addressed from a comprehensive perspective to solve them. Through the EMS, we comprehensively identify various environmental and social issues and risks at each phase of our business. We strive to avoid trade-offs whereby resolving one problem creates other problems and instead promote “trade-on” business development characteristic of a general trading company—pursuing solutions that deliver multiple, mutually reinforcing benefits across complex, interrelated issues. Over the medium- to long-term, we expect these initiatives to help lower our cost of capital and expand investment by strengthening stakeholders’ trust and credibility, thereby contributing to the sustainable enhancement of corporate value.

Refer to: The ITOCHU Group Environmental Policy

Structures and Systems

ITOCHU recognizes that our business activities can have an impact on the global environment and society and so are looking to take a precautionary approach to environmental and social risks. To that end, we have built a sustainability management system including EMS to assess in advance the impact in regard to new investments in particular together with the products we handle. Under this system we formulate targets every year for items related to environmental and social risks, environment conserving businesses, saving energy, saving resources, greenhouse gas (GHG) emissions reduction and other climate change related risks. We then assess and analyze the progress, and we move through the PDCA cycle to reliably achieve our targets.

Refer to: ITOCHU’s Sustainability Promotion Structure

External Audits

ITOCHU undergoes an ISO 14001 certification review every year by the BSI Group Japan K.K. We underwent the re-certification audit recently in December 2024. The latest registration certificate is valid until December 23, 2027.

ISO 14001 Certification of the ITOCHU Group

ITOCHU was the first trading company to acquire ISO 14001 certification in 1997 and is working to continuously improve its sustainability promotion system.

- ISO 14001 certified sites: ITOCHU Corporation, ITOCHU Automobile Corporation, ITOCHU Metals Corporation, ITOCHU Taiwan Corporation

- Percentage of ISO 14001 certified sites: 93%

- Scope of registration: Business activities of a general trading company to invest and provide goods and services

Internal Audits

ITOCHU conducts internal sustainability audits every year based on ISO 14001. In conjunction with the re-certification audit for ISO 14001, we have planned to conduct both internal and external audits for all 49 departments. Members of the Sustainability Management Division constitute the audit team and conduct the audits with emphasis on compliance. The implementation of internal sustainability audits over half a year leads to a precautionary approach to environmental and social risks.

Initiatives

Assessment of Sustainability Risk in Products ITOCHU Handles

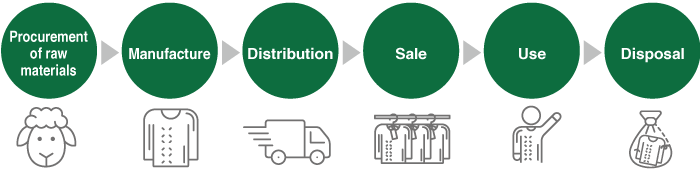

ITOCHU deals in a wide variety of products on a global scale. Therefore, we believe it is important that we assess the impact on the global environment of each product, our environmental related laws and regulation compliance situation, and our relationships with stakeholders. Accordingly, we conduct our own sustainability impact assessments on all our products. The assessment is based on LCA* analysis methods to investigate the environmental and social impacts of the product, from the procurement of raw materials to the manufacturing process, use and disposal of the product. We evaluate climate change risks such as tropical rainforest deforestation, desertification, and global warming, as well as the dependence and impact on biodiversity, and the impact on the human body and local communities in both normal and emergency situations. If the results of the assessment of our newly handling products indicate that there is a significant environmental or social impact, the product in question will be registered as a priority management target, and various regulations, procedure manuals, and specific operational personnel training are individually formulated and implemented, and monitored during the annual cycle of the EMS.

- Life Cycle Assessment (LCA): This is the technique to assess the impact of one product on the environment in all stages of its lifecycle — from raw materials to manufacture, transportation, use, and disposal or reuse.

Investigations into the Actual Conditions in Group Companies

ITOCHU has continued to visit and investigate Group companies having relatively high environmental impacts since 2001. The aim of this is to prevent environmental pollution by these Group companies. We have investigated a total of 301 offices over the past 24 years up to the end of FYE 2025. We assess companies in these investigations by investigating their factory and warehouse facilities, their situation of drainage to rivers, and their compliance with environmental laws and regulations, in addition to holding an engagement interview with their management regarding their response toward environmental challenges, including climate change.

Sustainability Risk Assessments on New Investment Projects

ITOCHU assesses the social and environmental impact of its business investment projects and the governance status of the investment targets in advance using the “ESG Checklist for Investments”. This checklist consists of checkpoints on climate change, pollution prevention and resource circulation, water resources, natural capital and biodiversity, including elements from the seven core subjects of ISO 26000, the international standard for organizational social responsibility. For projects that require expert knowledge, we make request to external experts to conduct investigations in advance. The investment project is then only undertaken upon confirming that there are no problems in the results of those investigations.

Environmental Education and Awareness

ITOCHU provides various educational programs to encourage employees to conduct environmental conservation activities. In addition, we hold environmental laws and regulations seminars and global environmental problem awareness seminars for Group employees. Through these initiatives, we are striving to improve environmental awareness over the entire ITOCHU Group.

Regular Training for Outside Directors

In order to promote Outside Directors’ and Outside Audit & Supervisory Board Members’ understanding of risk management and other ITOCHU Group initiatives, Outside Directors and Outside Audit & Supervisory Board Members have regular meetings with the Chairman & CEO and the President & COO; Outside Directors have regular liaison meetings with full-time Audit & Supervisory Board Members; and internal auditing units meet regularly with Outside Directors to report on their activities. Outside Directors and Outside Audit & Supervisory Board Members also meet regularly on an individual basis with Division Company Presidents and Officers in charge of overseeing head office functions to constantly improve their knowledge and understanding. We hold information sessions for Outside Directors and Outside Audit & Supervisory Board Members to provide opportunities to deepen their understanding of environmental, social, compliance, and various other risks (climate change, water quality, forest commodities management, human rights and occupational safety and health) as well as the related risk management systems. Outside Directors and Outside Audit & Supervisory Board Members also receive pre-briefings before meetings of the Board of Directors, with explanations of individual investment matters that includes not only the investment details but also risk analysis and response; in so doing, we work to ensure that they enter meetings of the Board of Directors with a full understanding of the relevant risks.

Seminars and Training Sessions

We proactively hold seminars and training sessions. The aim of these is to thoroughly inform ITOCHU Group employees about environmental related law and regulation requirements and to raise their compliance and environmental awareness.

Inquiries from Inside and Outside the Company and Our Response to Them (FYE 2025)

| Inquiries from outside parties |

|

| Requests for submission of ISO 14001 certification copy | 37 |

| Serious environmental accidents, troubles, lawsuits or penalties in our company | 0 |

Sustainable Finance

In March 2021, ITOCHU became the first general trading company to have decided to issue US 500 million dollars Senior Unsecured Bonds due 2026 to raise funds for projects that contribute to SDGs (the “SDGs Bonds”). To issue the SDGs Bonds, we have established the SDGs Bond Framework in alignment with the Green Bond Principles, 2018, the Social Bond Principles, 2020 and the Sustainability Bond Guidelines, 2018 as administered by ICMA (the International Capital Market Association). And it has obtained an external evaluation (second party opinion) from Vigeo Eiris for the conformity of our Framework with principles such as the Sustainability Bond Guidelines.

In September 2023, we entered into a green loan financing agreement with Sumitomo Mitsui Trust Bank, Limited, and in December 2024, with The Bank of Fukuoka, Ltd. The Green Loan will be used for eligible projects (renewable energy power generation, waste treatment and power generation, and circular economy-related).

Refer to: Sustainable Finance